Copyright scmp

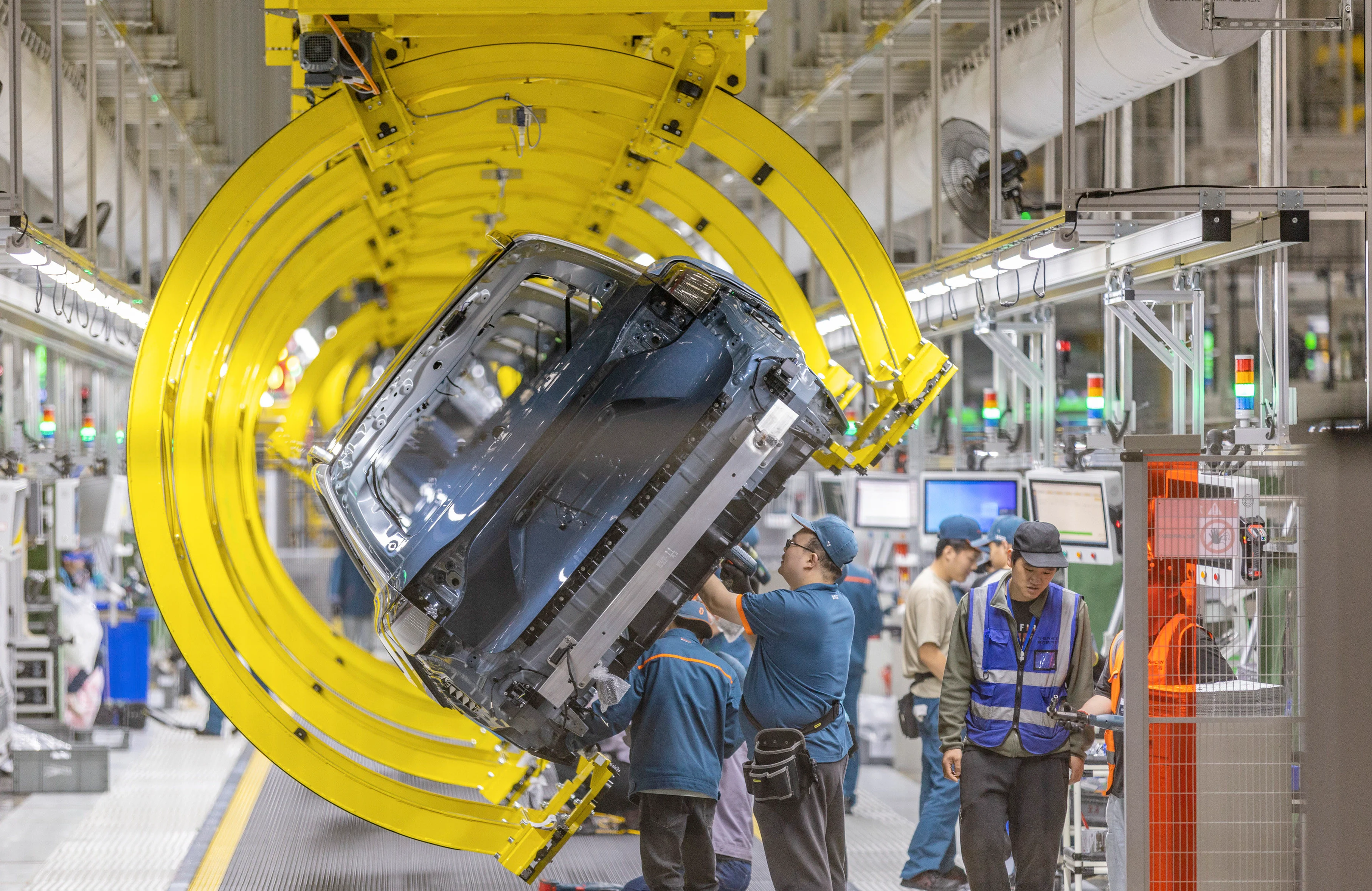

Chinese new energy vehicle maker Seres Group, whose suppliers include Huawei Technologies, filed for an initial public offering (IPO) in Hong Kong on Monday, aiming to raise HK$13.18 billion (US$1.7 billion) amid a wave of long-term global capital flocking to Hong Kong listings. The EV maker plans to sell 100.2 million shares through its secondary listing in Hong Kong, with the offer price capped at HK$131.50 per share. The price determination date was expected to be around November 3, according to its filing with the Hong Kong stock exchange. The stock is expected to debut on November 5. About 10 per cent of the shares will be allocated to the retail tranche, with the remainder designated for institutional investors. Retail investors could subscribe to shares from Monday through October 31, with allocation results to be announced on November 4, according to the expected offering timetable. Seres positions itself as a technology company that develops, manufactures and sells new energy vehicles and their core components. It aimed to build an open ecosystem through long-term partnerships with suppliers, including Huawei and Contemporary Amperex Technology, the world’s largest manufacturer of lithium-ion batteries, the company said. Huawei supplies intelligent cockpit and driving-assistance systems to Seres. The company cautioned that intensifying competition in China’s and global automotive markets could weigh on its business. Seres may issue 15.03 million additional shares in its Hong Kong offering under an overallotment option, which could increase to 17.28 million shares if the offer size adjustment option is fully exercised. Its cornerstone investors include British asset manager Schroders, South Korean investment bank Mirae Asset Securities, Huatai Capital Investment and Zhejiang Sanhua Intelligent Controls. They have committed to buying US$826.47 million worth of shares. Global funds are returning to back mainland Chinese companies’ IPOs in Hong Kong. Singaporean sovereign wealth fund Temasek, UBS Asset Management and BlackRock anchored Sany Heavy Industry’s HK$12.36 billion offering. Connectivity and data transmission device provider CIG Shanghai’s HK$4.62 billion deal attracted global asset manager Baring Asset Management. Both of the companies are expected to debut on Tuesday. Chinese data intelligence software provider Mininglamp Technology’s HK$1.02 billion offering secured investment from GFH Financial Group, an asset manager in the Gulf Cooperation Council region. Seres listed in Shanghai in 2016. Its shares fell 0.49 per cent to 159.22 yuan in the morning trading session on Monday. Founded in 1986 in the southwestern Chinese metropolis of Chongqing, the company started by making springs and shock absorbers before expanding into motorcycle manufacturing. It pivoted to the new energy vehicle sector in 2016. The company, with its core brand Aito, plans to use most of the IPO proceeds to fund technological research and development as well as expand its international market presence. The company’s production facilities have an annual capacity of about 600,000 units. While most sales are currently in mainland China, it has expanded to Europe, the Middle East, the Americas and Africa. Its net profits rebounded to 5.9 billion yuan (US$829 million) last year from a net loss of 2.4 billion yuan in 2023. Seres is one of three Chinese EV makers that are profitable, alongside BYD, the world’s largest EV manufacturer, and Li Auto, Tesla’s closest rival on the mainland. China International Capital Corporation and China Galaxy International are joint sponsors of the deal.