By Bhawana Gariya

Copyright republicworld

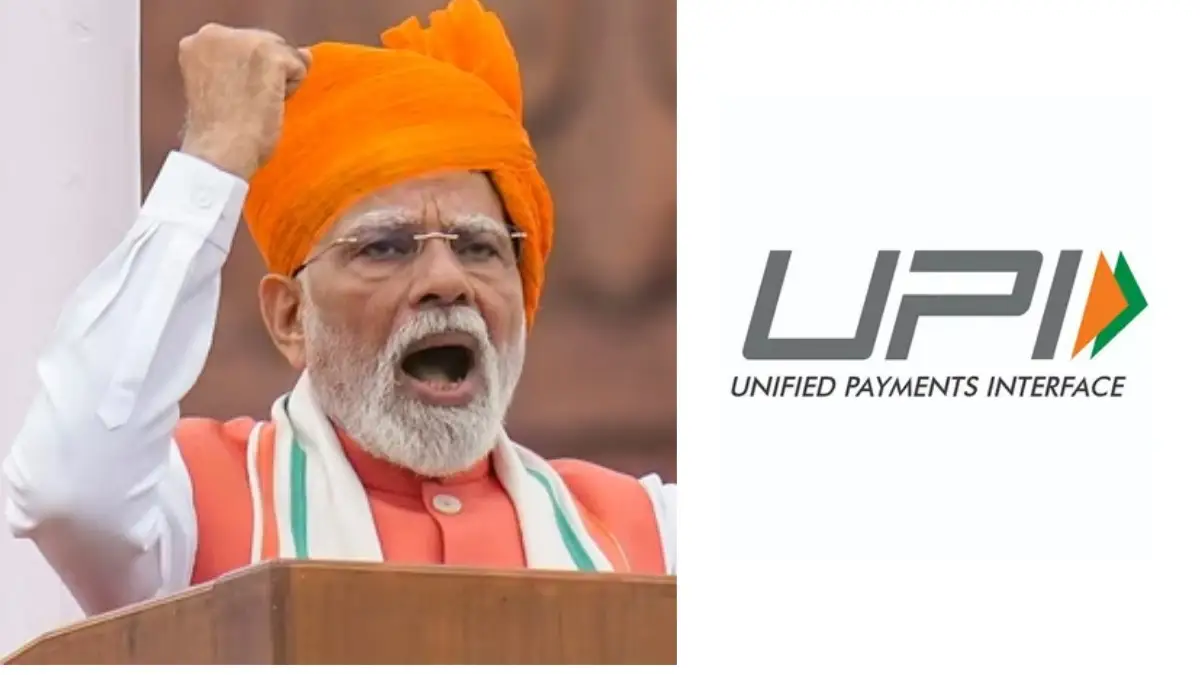

New Delhi: Prime Minister Narendra Modi’s proactive “fintech diplomacy” is rapidly expanding the global reach of India’s Unified Payments Interface (UPI), a system that has not only transformed financial transactions within the country but is now solidifying India’s position as a leader in digital public infrastructure.In an increasingly interconnected world, economic power is no longer solely measured by traditional metrics. Fintech, particularly digital payment systems, has emerged as a crucial tool for both domestic convenience and international influence.Over the past few years, PM Modi’s diplomatic engagements have consistently featured discussions around technology transfer and digital cooperation, with UPI often taking center stage. This strategic push has seen UPI establish connections or initiate partnerships with seven countries, offering a glimpse into the future of cross-border payments.This strategic drive was particularly evident during PM Modi’s recent five-nation tour, where UPI was one of the central themes of discussion. During his visit, Trinidad and Tobago became the first Caribbean nation to adopt UPI, while a delegation from Argentina is expected to visit India to further discuss the system. In a landmark development, Namibia has become the first country where NPCI has entered a licensing agreement with a central bank for the deployment of UPI for real-time payments.UPI’s journey from a domestic marvel to an international aspiration began with its unparalleled success within India. Launched in 2016, it quickly became a ubiquitous payment method, lauded for its simplicity, interoperability, and real-time transaction capabilities. With hundreds of millions of users and billions of transactions monthly, its robust architecture and user-friendly interface presented an attractive model for nations looking to modernize their own payment systems.Recognizing this potential, Prime Minister Modi and his government have actively championed the global adoption of UPI. This “fintech diplomacy” involves a multi-pronged approach:While the exact nature of integration varies from country to country, ranging from direct linkage to white-label solutions, the momentum is undeniable. Here’s a look at the seven nations where UPI’s global journey is taking shape:PM Modi’s aggressive push for UPI’s global acceptance holds several strategic implications. It paves the way for a more integrated global digital economy, fostering smoother cross-border trade, tourism, and remittances. This successful export of UPI demonstrates India’s technological prowess and enhances its soft power, positioning it as a leader in digital public goods. By offering a low-cost, real-time payment solution, UPI’s global expansion can significantly reduce the costs associated with international transactions, benefiting individuals and businesses alike. For developing nations, adopting UPI-like systems can accelerate financial inclusion by providing an accessible and efficient digital payment infrastructure. Furthermore, as countries seek alternatives to traditional, often SWIFT-dependent, payment systems, UPI presents a viable and independent framework, which could be particularly appealing to nations wary of relying on Western-controlled financial intermediaries.While the journey has been impressive, challenges remain. These include navigating diverse regulatory frameworks, ensuring cybersecurity, and building interoperability with varying local payment systems. However, the modular and open-source nature of UPI’s architecture offers flexibility in adaptation.As PM Modi continues his global engagements, the list of countries exploring or adopting UPI is expected to grow. India’s fintech diplomacy is not just about exporting a payment system; it’s about sharing a vision for a digitally empowered and interconnected world. The success of UPI on the global stage will undoubtedly be a testament to India’s innovative spirit and its commitment to shaping the future of global finance.