Copyright bizwatchnigeria

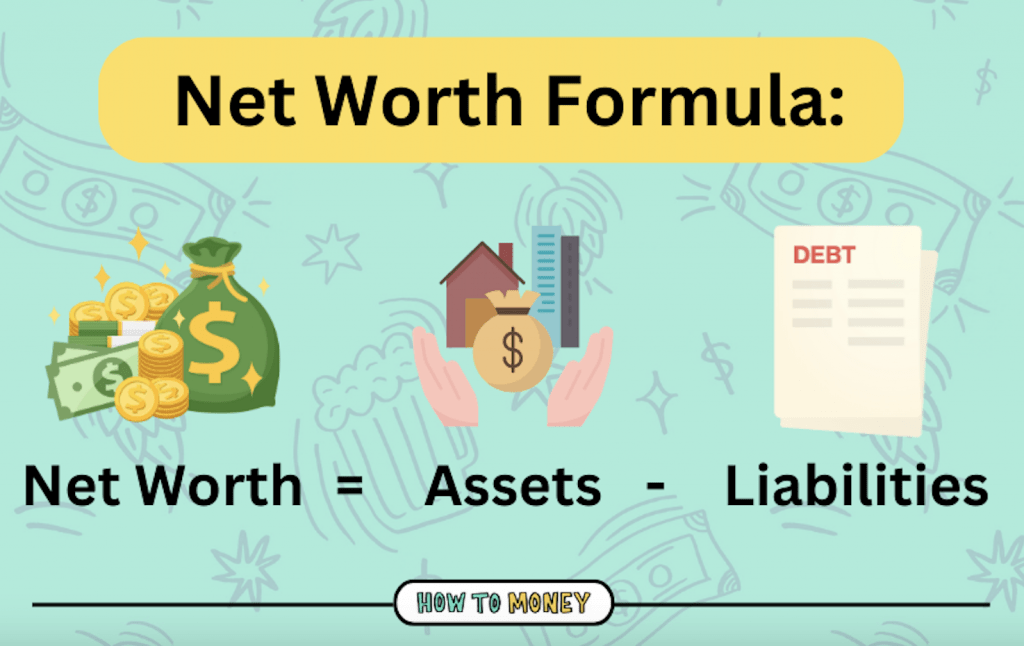

You probably know how much is sitting in your bank account right now. But do you know your net worth? For many Nigerians juggling rent, side hustles, loan apps, and the occasional “urgent 2k” request, calculating net worth feels like something only Dangote, Davido, or Tony Elumelu should bother about. But here’s the truth — your net worth isn’t about being rich; it’s about knowing where you stand. When you know your net worth, money stops feeling like a mystery. It becomes something you can control, plan, and grow. And that’s where true financial confidence begins. So, What Exactly Is Net Worth? Let’s keep it simple. Your net worth = what you own – what you owe. In everyday terms, if you sold everything you own today — your car, phone, land, savings, even that side business — and used the money to pay off every debt and bill you owe, what’s left is your net worth. Here’s a quick example. Suppose you have: ₦4 million in savings, A car worth ₦3 million, Investments of ₦2 million. That’s ₦9 million in total assets. But if you also owe ₦2 million in loans and ₦1 million in rent arrears, your liabilities are ₦3 million. So, ₦9 million (assets) minus ₦3 million (liabilities) = ₦6 million net worth. And you know what’s interesting? Earning more money doesn’t automatically mean having a higher net worth. Take Chioma and Tunde for instance: Chioma earns ₦800k a month but owes ₦3m in debt. Tunde earns ₦400k, owns a small car and some land in Ibadan, and has zero debt. Tunde’s net worth is higher — even though he earns less. Because wealth isn’t about how much you make; it’s about how much you keep and grow. How To Calculate Your Net Worth (Without Stress) You don’t need a finance degree or an accountant. Just honesty, a notepad, and maybe your calculator app. Step 1: List your assets.These are things you own that have value: Cash (bank accounts, PiggyVest, Kuda, OPay, PalmPay) Investments (mutual funds, real estate, stocks, crypto, or your small business) Valuables (car, land, jewellery, gadgets with resale value) Step 2: List your liabilities.These are the things you owe: Loans (salary advances, student loans, loan apps, cooperative loans) Outstanding bills or rent “Buy Now Pay Later” balances Step 3: Subtract liabilities from assets.That’s it — your net worth. You can jot it down in a notebook, or better yet, use Google Sheets or Notion to track it. Some people even review it quarterly like a financial health check. Why Your Net Worth Matters More Than You Think Think of your net worth as your financial GPS. It tells you exactly where you are — and whether you’re moving forward, stuck in traffic, or sliding backward financially. Here’s why it matters: It gives you a complete picture, not just your account balance. It helps you set achievable goals — like buying a house or clearing debt. It keeps you honest. Numbers don’t lie. It shows you when to invest, when to save, and when to pause spending. When you know your net worth, you’re no longer guessing your way through money decisions. You’re working with facts. Growing Your Net Worth (Even on a Nigerian Salary) Let’s be real. It’s tough to “save and invest” when food, fuel, and rent keep rising faster than your income. But the goal isn’t perfection — it’s progress. Here are small, steady ways to build your net worth: Save consistentlyEven if it’s ₦10k a month. Automate it using apps like Cowrywise or PiggyVest so you don’t have to think about it. It adds up quicker than you’d imagine. Reduce debtStart with the high-interest ones — loan apps, salary advances, and credit purchases. Pay off the small ones first for motivation. Invest wiselyPut money in low-risk options like mutual funds, treasury bills, or real estate cooperatives. Avoid “double your money in 2 weeks” schemes. Platforms like Bamboo, Risevest, and Ladda can help you invest safely. Diversify your incomeYou can only cut expenses so much. Extra income — from freelancing, tutoring, or selling products online — can push your finances forward faster than cutting back ever will. Common Mistakes Nigerians Make When Calculating Net Worth It’s easy to get it wrong. Here are a few traps to avoid: Counting your iPhone or designer shoes as assets. (They lose value fast.) Ignoring debts — especially “small” loans you plan to pay later. Comparing your finances to people on Instagram. (Half of them are broke with aesthetics.) Forgetting to update your net worth yearly. Net worth isn’t a one-time project; it’s a living number that changes with your financial journey. When Your Net Worth Is Negative — Don’t Panic Many young Nigerians start with negative net worth, especially if you’ve got student loans, credit debt, or unpaid bills. It’s not the end of the road; it’s just a starting point. Here’s a simple fix: List every debt you owe (and their interest rates). Focus on clearing the ones that stress you the most. Start saving — even small amounts — while you pay off debts. Small wins compound over time. That’s how financial recovery works — slowly, but surely. The Bottom Line: Know Your Worth, Then Grow It Your net worth tells your financial truth. It’s a snapshot of your past decisions, your present habits, and your future possibilities. When you track it, you start to see patterns — where your money goes, what drains you, and what builds you. You make better financial choices not from pressure, but from clarity. Because when you know your worth, you stop guessing and start growing.