By Contributor,Piotr Swat,Trefis Team

Copyright forbes

POLAND – 2025/08/30: In this photo illustration, a SoundHound AI company logo is seen displayed on a smartphone screen. (Photo Illustration by Piotr Swat/SOPA Images/LightRocket via Getty Images)

SOPA Images/LightRocket via Getty Images

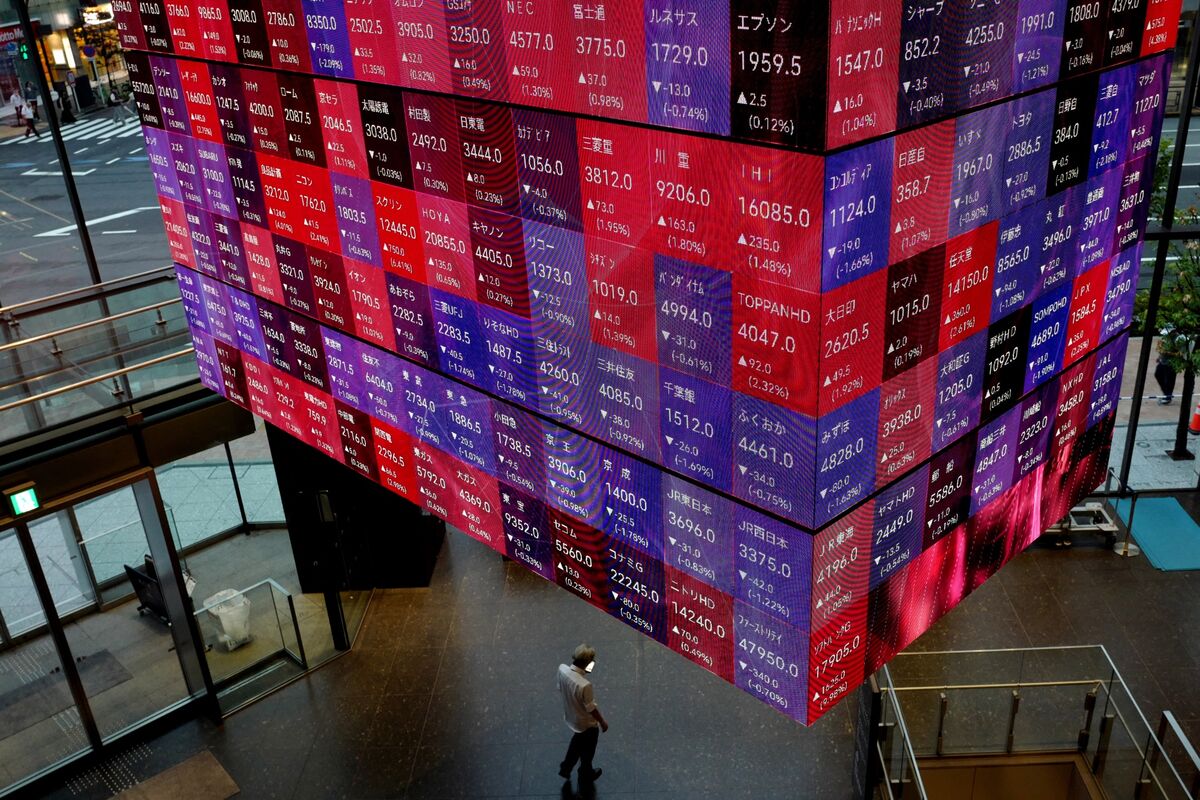

SoundHound AI (NASDAQ: SOUN), a voice AI platform that allows businesses to provide conversational AI experiences, has witnessed a 280% increase in its stock over the past year. What’s the reason for this? It’s a combination of AI excitement and momentum. First, there’s the wider trend of AI voice technology that has captured Wall Street’s interest. Second, the company has been revealing partnerships and integrations that sound compelling – extending its voice AI into automotive, restaurant, and customer service industries. Third, the surge in generative AI has led investors to believe that voice interfaces may become the next major advancement.

However, here’s the stark reality – the company is currently trading at 55 times trailing revenues. While voice AI appears to have significant upside potential, SOUN has a relatively small revenue base of only $131 million. Naturally, it’s consuming cash – showing a net income margin of -170% and an operating cash flow margin of -83%.

That said, if you desire upward potential with less volatility than owning a single stock like SOUN, consider the High Quality Portfolio. It has significantly outperformed its benchmark—a blend of the S&P 500, Russell, and S&P MidCap indexes—and has yielded returns above 91% since its inception. What accounts for this? As a collective, HQ Portfolio stocks have delivered superior returns with reduced risk compared to the benchmark index; avoiding significant fluctuations, as illustrated in HQ Portfolio performance metrics. Additionally, check out – How Oracle Stock Delivered $163B To Investors

The Fundamental Problem

We concur that SoundHound stock has solid growth potential for the future, and we’ve discussed the upside potential ourselves. But have you considered the downside risks? Think it over logically. The markets won’t continue to move in one direction as we have been witnessing recently, and SoundHound is still quite far from profitability. There are numerous risks that could hinder SoundHound’s stock growth engine, and when difficulties arise, such growth stocks don’t just decline—they get severely hit. This is not mere speculation.

Historical Precedent: The 2022 Massacre

Let’s revisit 2022, when elevated inflation resulted in interest rate increases and the markets plummeted by 25% from their peak. Do you know the extent to which SOUN stock fell? It was an astounding 94% drop from $15 to $1. Consider that for a moment – a 94% loss. This highlights the contrast between speculative stocks and legitimate businesses with actual cash flows.

MORE FOR YOU

The Risk Factors That Could Crush SOUN

Big Tech Competition: SoundHound contends with strong competitors who possess considerably deeper financial resources – Amazon’s Alexa, Google’s Assistant, Apple’s Siri, and Microsoft’s voice AI projects. These industry leaders can sustain losses indefinitely while developing superior technology.

Customer Concentration Risk: With a modest revenue base of $131 million, losing even one or two key clients could adversely affect its growth path and investor confidence.

Cash Burn Reality: With margins at -170% for net income, SOUN is effectively a cash-burning entity, relying on achieving profitability before exhausting its financial resources. Importantly, the company anticipates reaching profitability on an adjusted EBITDA basis by year-end. Review how SoundHound’s financials measure up to its peers.

Market Sentiment Shifts: When risk appetites diminish – and they inevitably will – these momentum-driven AI stocks are often the first to suffer.

Dilution Risk: Companies that burn this much cash frequently resort to equity raises, which dilute the holdings of existing shareholders. It’s a destructive cycle that penalizes initial investors.

What’s the Real Downside Risk?

So, what’s the realistic downside risk for SOUN stock at its current price of $18?

If history serves as a reference, it’s below $2.

Are you ready for that?

This isn’t about inciting fear – it’s simply a reflection of what transpired in 2022. Moreover, the underlying fundamentals haven’t significantly altered. The company continues to consume cash, still racing toward profitability while losing money, and continues to trade based purely on growth expectations and future prospects.

If this level of risk makes you uneasy, you might want to consider the Trefis Reinforced Value (RV) Portfolio, which has surpassed its all-cap benchmark (a mix of the S&P 500, S&P mid-cap, and Russell 2000 benchmark indices) to deliver solid returns for investors. What accounts for this? The rebalanced mix of large-, mid-, and small-cap RV Portfolio stocks offers a flexible strategy to capitalize on favorable market conditions while managing losses when markets decline, as explained in RV Portfolio performance metrics.

The Bottom Line

Understand that the aim of this analysis is to highlight the genuine downside risk associated with SOUN stock. It may or may not occur. Nevertheless, the risk remains significant. When the music stops – investors holding speculative growth stocks may face severe losses. You are not purchasing a stake in a profitable company; rather, you are making a wager on voice AI becoming widespread soon enough for SoundHound to endure the cash burn and compete against technology giants with nearly limitless resources. Ultimately, it hinges on whether you can handle the potential volatility on the downside if things do not unfold as anticipated with SoundHound.

Editorial StandardsReprints & Permissions