Copyright internewscast

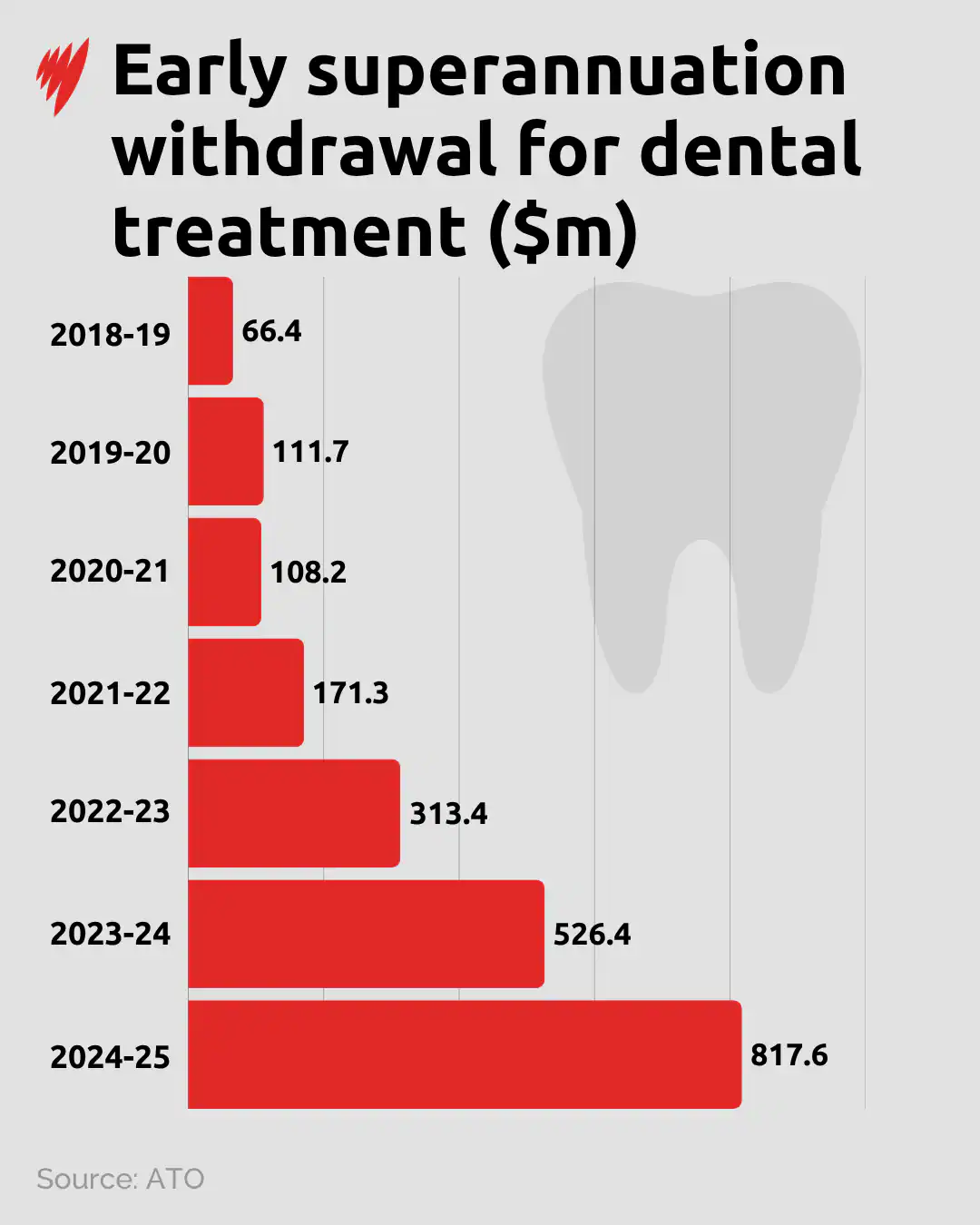

Melinda Amourous paid tens of thousands of dollars for dental work that was never completed. Source: Supplied “They basically talked me into having a matching smile,” she told SBS News. “I think they aimed to take advantage of desperate people.” Supercare — which operated five clinics in Sydney, the Central Coast and Newcastle — connected her with an early release agent, which helped her withdraw $48,000 from her super to pay for the procedure. She said she was guided through the process, which involved having a GP sign off on the treatment and the lodging of paperwork with the ATO. “It was a really easy process,” she said. “I was just so busy jumping up and down thinking: ‘oh awesome, I could finally get my teeth done’.” Within weeks, the money had landed in her account, which she then transferred to Supercare as an upfront payment. Melinda Amourous had to use superglue to hold in her broken dentures. Source: Supplied She described experiencing excruciating pain during a four-and-a-half-hour procedure — conducted under local anaesthetic — to remove her teeth. The clinic went into voluntary administration earlier this year and Amourous has been left with incomplete work and bleeding gums. She was also forced to superglue her broken dentures and has to remove them whenever she eats. Hundreds of patients left out of pocket Amourous is far from alone. According to an administrator’s report to creditors, cited by the ABC, 441 patients paid more than $2.1 million for treatment that was never delivered. Among them was Peter Hazell, from Musswellbrook in NSW, who also came across Supercare through a Facebook advertisement. “[The ad] said: ‘get the smile you want,” he said. Hazell withdrew nearly $83,000 from his superannuation to pay for a full set of implant teeth. Peter Hazell was left without teeth after Supercare went into voluntary administration. Source: Supplied He said he accepted an offer to have dentures instead, with the rest of the money refunded in weekly $10,000 instalments. But before the procedure could be completed, the clinic had shut its doors. “I got no dentures, no teeth, and no money,” he said. SBS News made several attempts to contact Supercare but the phone numbers for the business and owner, Syma Usman, were disconnected. Positive experience for others Not all those who withdraw from their super come to regret it, with the scheme allowing treatment for those who would otherwise be unable to afford it. Damian Cody withdrew $6,000 from his super for dental treatment and has no regrets. Source: SBS News “It felt like when you get something stuck in your teeth, I was hyper aware of that, I was worried about my tooth totally breaking apart because I heard all the horror stories,” he told SBS News. He was quoted about $6,000 for dental crowns and fillings, and learnt about early release of super during the COVID-19 pandemic when temporary access for financial hardship was made available. He said his dentist recommended an early super release agent, but it was easy to prepare and submit the application himself. The dental work was completed over several sessions, and he no longer feels paranoid about losing his teeth. Growing trend of early super access Such cases reflect a growing trend of Australians using their retirement savings for medical treatment, including dental work. The trend has prompted the ATO and medical regulator, the Australian Health Practitioner Regulation Agency (AHPRA), to issue a joint warning about some practitioners encouraging early super withdrawal for unnecessary or overly expensive dental treatment. “While superannuation can be accessed early under compassionate grounds, this is strictly available in very limited circumstances, including for critical medical and dental procedures,” ATO deputy commissioner Emma Rosenzweig said. AHPRA said it was concerned some practitioners were putting their own financial gain ahead of their patients’ best interests, including by preparing the paperwork required for early super access. “Practitioners are on notice that we will take action to protect the public,” a spokesperson said. Early super users risk ‘massively overpaying’ CEO of Super Consumers Australia, Xavier O’Halloran, told SBS News he had noticed a growth in early super withdrawals since COVID-19. “I think people were kind of alert to the idea that super might be available for other uses, and it’s really driven a huge awareness and uptick,” he said. “[Practitioners] know people can tap into super which … isn’t something they can normally tap into,” he said. “They don’t treat it the same way and so there’s a real threat of massively overpaying for services.” He warned Australians accessing their super early risked being tens of thousands of dollars worse off in retirement as they missed out on compounding interest.