Copyright scmp

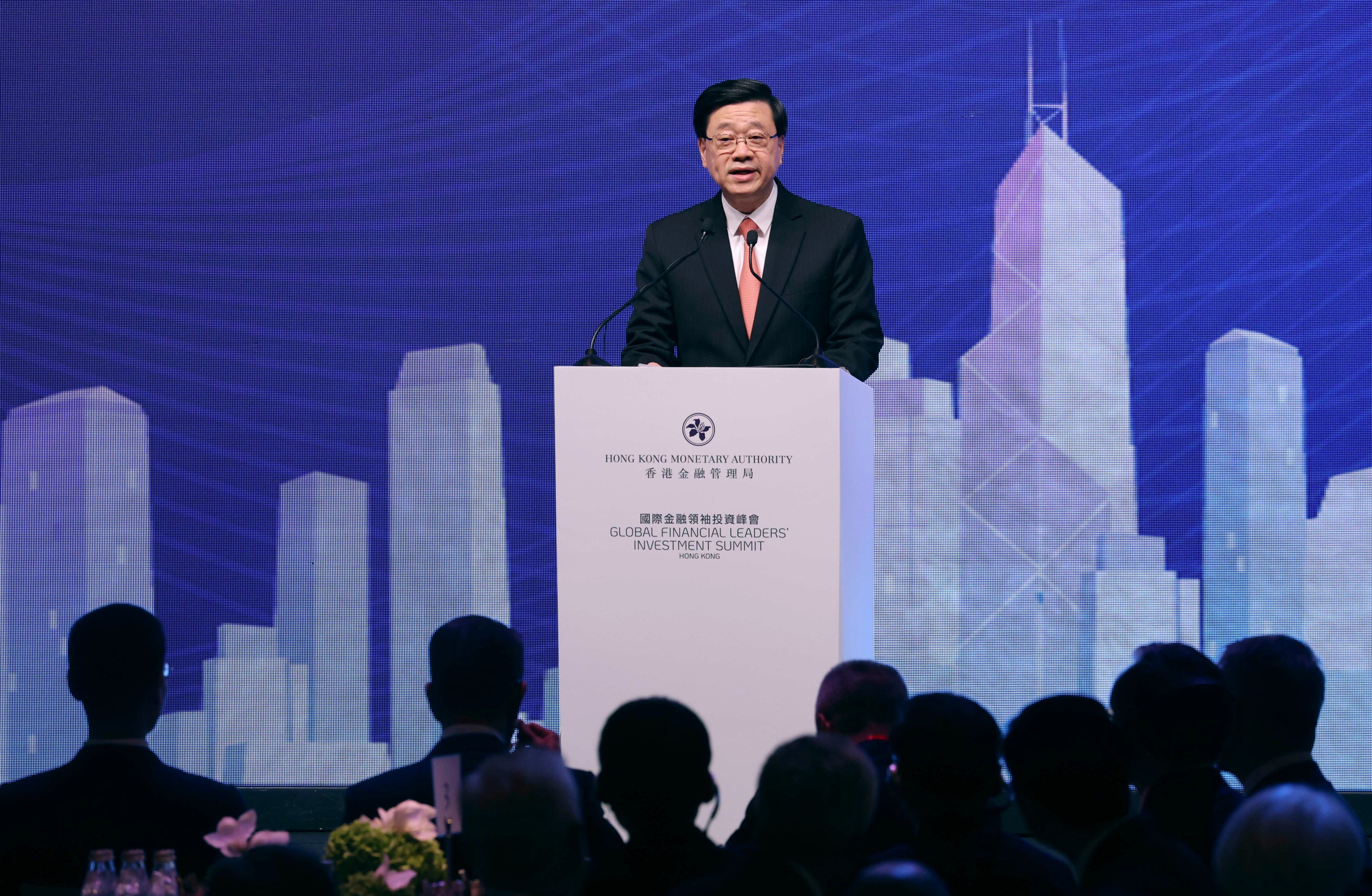

Hong Kong’s leader has called on global investors seeking to diversify their assets and minimise risk to come to the city as it offers stability and certainty despite the market volatility brought by geopolitical tensions. Chief Executive John Lee Ka-chiu said on Tuesday that the “one country, two systems” principle had enabled businesses in the city to reach out to the world while maintaining “unparalleled” access to China. “We offer certainty and clarity, along with confidence and opportunity, to global investors and businesses seeking to diversify their assets and minimise risks,” Lee said in a keynote speech at this year’s Global Financial Leaders’ Summit, themed “Trekking Through Shifting Terrain”. Pointing to the geopolitical uncertainty and market volatility that financial leaders are currently facing, Lee told the audience that Hong Kong’s vibrant financial market and diversified fintech achievements allowed it to offer investors the safe haven they needed. He noted that Hong Kong’s stock market had soared more than 30 per cent year to date, while average daily turnover had exceeded US$32 billion, nearly double that of last year. The city also ranks the world’s first initial public market fundraising market thanks to the 80 IPOs recorded in the first 10 months of this year, he added. Lee pointed to the road map for the development of fixed income and currency markets published in September, which is designed to attract primary market issuance, boost secondary market liquidity, expand the city’s offshore renminbi business, and develop next-generation infrastructure. “It will offer global investors more choices, as they seek to allocate assets and help companies raise funds multiple times,” he said. The city leader stressed that Hong Kong was built on outreach and pursuing international partnerships and mutual opportunities. “Our unique ‘one country, two systems’ framework makes this possible, enabling Hong Kong to reach out to a world of prospects, while maintaining unparalleled access to China, our country,” he said. He referenced the Apec summit he attended in South Korea last week, where he spoke with world leaders to advance open trade and multilateralism. He also mentioned the China International Expo he is set to attend in Shanghai on Wednesday, where 380 Hong Kong companies will promote their products and services. Welcoming the Asian Infrastructure Investment Bank’s announcement to set up an office in Hong Kong, Lee vowed to leverage the city’s vibrant capital markets, world-class professional services, and diversified product offerings in project financing, bond issuance, and investment management. “They are shining examples of how both the principle and Hong Kong help connect the world with the Chinese market,” Lee said. The fourth Global Financial Leaders’ Investment Summit – held by the Hong Kong Monetary Authority – will run for three days till Wednesday, drawing around 300 global financial heads, including more than 100 group chairmen and CEOs to the city.