Copyright birminghammail

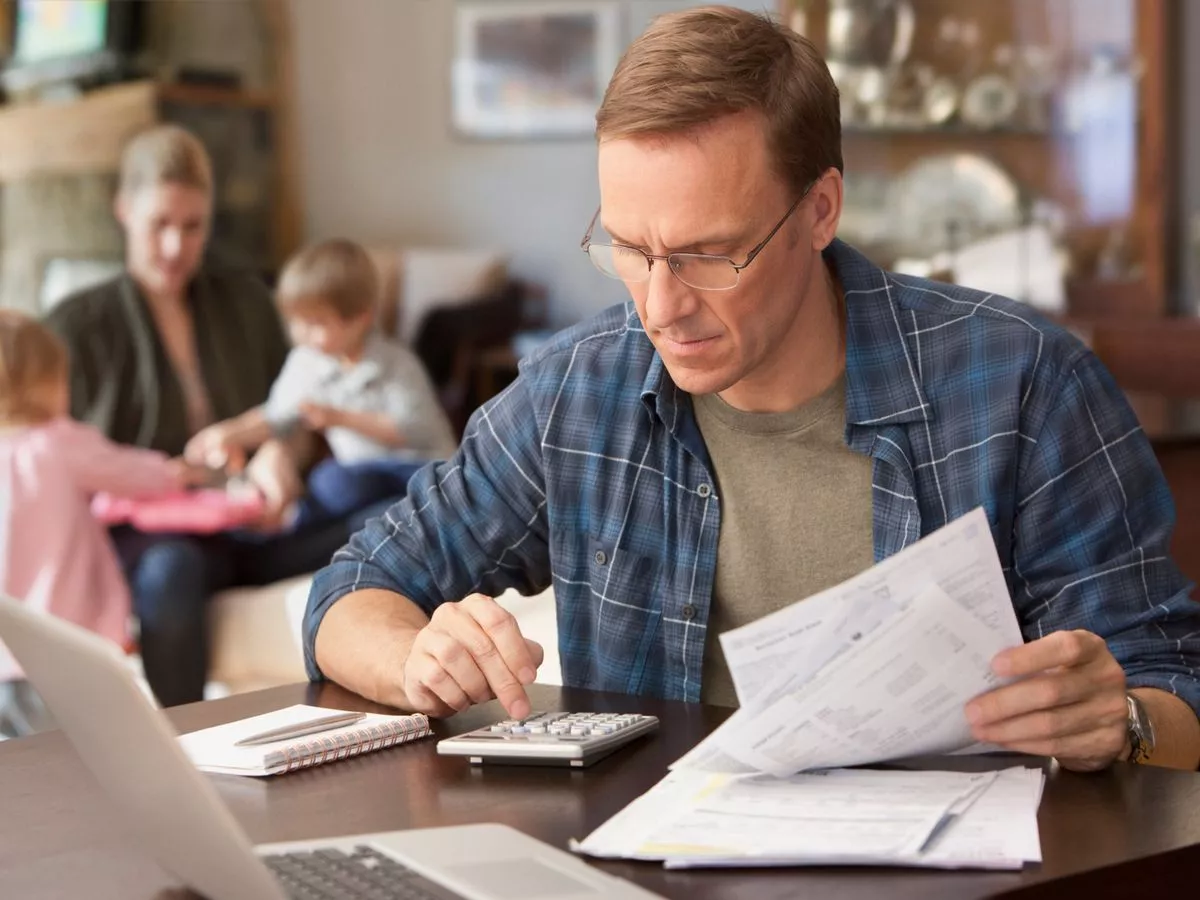

For the first time, thousands of families who rely on Child Benefit will now have the option to pay the high income tax charge through their tax code. Child Benefit is worth £26.05 a week for the first child and £17.25 for any subsequent children, reports Express.co.uk. This benefit is awarded if you are responsible for a child - however if you or your partner earn a high income, you may have to repay some of this benefit. READ MORE: Martin Lewis poses two scenarios over 'major VAT changes on energy bills' Get breaking news on BirminghamLive WhatsApp , click the link to join If either of you earns over £60,000 , you have to repay 1% of your Child Benefit for every £200 earned over £60,000. This is known as the High Income Child Benefit Charge. Once your earnings surpass £80,000 , you must repay 100% of your Child Benefit. Typically, the high income charge is paid through self-assessment, however now there's an option to pay it via your PAYE tax code. This means HMRC will adjust your tax code and the charge will be taken from your salary. This service can be used if you're employed and don't need to file a self-assessment return for any other reason. You have until 31 January 2026 to opt in for the latest 2024/25 tax year, which ended on 5 April 2025. You can still choose to pay the high income charge through self-assessment if you prefer. However, if you usually have to file a self-assessment, then you won't be able to use the new PAYE option. If you're a high-income household, you can claim Child Benefit without receiving the payments. National Insurance credits, which contribute towards your state pension, would still be received, but the charge wouldn't need to be paid. Child Benefit is claimed by over seven million families. It can be claimed if you're responsible for a child under 16, or under 20 if they are still in approved education or training. This could include A-Levels, NVQs or even home education, but it does not cover university or BTEC qualifications. The child typically needs to live with you, or you must contribute at least the same amount as Child Benefit towards their care, for you to claim the payments. If you've fostered a child and the local council isn't contributing towards their accommodation or maintenance, or if you've adopted your child, you can claim Child Benefit. You may also be eligible if you're caring for a child for a friend or relative. There's no limit to how many children you can claim Child Benefit for, but if two people care for a child, only one person can claim Child Benefit. Exchequer Secretary Dan Tomlinson stated: "We're modernising HMRC to make tax simpler. "Tens of thousands of parents will no longer have to go through the extra effort of filing a tax return as this new simple and straightforward system takes the stress out of paying the High Income Child Benefit Charge (HICBIC). He added: "If they sign-up they will then be issued with a new tax code which will reflect their HICBC deduction. "Any fluctuations in income and Child Benefit entitlement will be reflected in-year in their tax code."