By Contributor,Hq Portfolio,Trefis Team

Copyright forbes

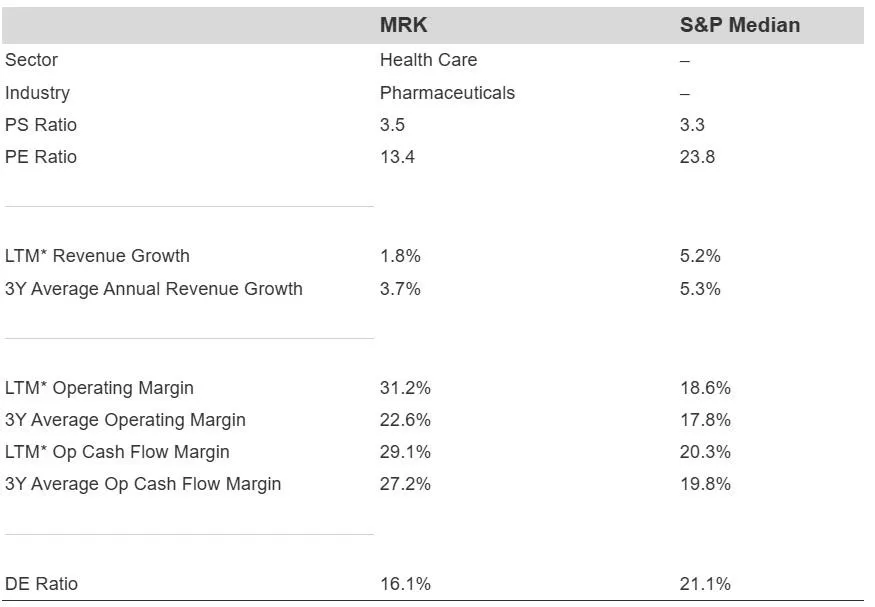

Merck (MRK) stock merits your attention. Why? Because it offers monopoly-like high margins at a discounted price. Here are some statistics.

Revenue Growth: Merck experienced growth of 1.8% LTM and 3.7% over the last 3 years on average.

Recent Profitability: Approximately 29.1% operating cash flow margin and 31.2% operating margin LTM.

Long-Term Profitability: About 27.2% operating cash flow margin and 22.6% operating margin for the last 3 years on average.

Available At Discount: At a P/S multiple of 3.5, MRK stock is currently offered at a 22% discount compared to 1 year ago.

While revenue growth is good, this is not a growth perspective. Pricing power and high margins yield consistent, predictable profits and cash flows, reducing risk and permitting reinvestment of capital. The market tends to reward this.

As a brief background, Merck develops pharmaceutical products for human health across various therapeutic areas and also creates veterinary pharmaceuticals, vaccines, and health management solutions for animal welfare.

Merck fundamentals compared with S&P medians

*LTM: Last Twelve Months

But do these figures convey the entire narrative? Read Buy or Sell MRK Stock to assess whether Merck continues to have a competitive advantage that withstands scrutiny.

Investing in a single stock can be precarious, but a significantly diversified strategy we employ with Trefis High Quality Portfolio offers substantial value. Trefis collaborates with Empirical Asset Management – a wealth manager based in Boston – whose asset allocation strategies achieved positive results during the 2008-09 period when the S&P fell over 40%. Empirical has integrated the Trefis HQ Portfolio into this asset allocation framework to deliver superior returns to clients with minimized risk in comparison to the benchmark index, providing a steadier investment experience, as demonstrated by HQ Portfolio performance metrics.

MORE FOR YOU

Stocks Like These Can Outperform. Here Is Data

This is our selection process: We focus on stocks over $10 billion in market capitalization, filtering for those with high CFO (cash flow from operations) margins or operating margins. We also restrict our focus to stocks that have significantly decreased in value over the past year.

Here are the statistics for stocks chosen using this strategy since 12/31/2016.

Average 12-month forward returns of close to 19%

12-month win rate (percentage of selections that yield positive returns) of around 72%

But Consider The Risk

However, MRK is not shielded from significant declines. It dropped approximately 38% during the Dot-Com Bubble and suffered a 63% decline in the Global Financial Crisis. Smaller disturbances like those in 2018 and the inflation spike still caused a drop of 18% to 20%. Even the Covid market crash cut nearly 27% from its peak. Strong fundamentals are important, but when panic sets in, MRK is not exempt from substantial pullbacks.

The Trefis High Quality (HQ) Portfolio, consisting of 30 stocks, has demonstrated a record of comfortably outperforming its benchmark, which includes all three indices – the S&P 500, S&P mid-cap, and Russell 2000. What accounts for this? As a group, HQ Portfolio stocks have delivered stronger returns with reduced risk compared to the benchmark index; offering a smoother investment experience, as evidenced by HQ Portfolio performance metrics.

Editorial StandardsReprints & Permissions