Semiconductor industry leaders are warning the Trump administration that a proposed tightening of visa rules risks shrinking a vital talent pool and undermining efforts to expand chip manufacturing in the U.S.

More than two dozen semiconductor executives — including two unnamed CEOs — have objected to a Department of Homeland Security plan to put stricter limits on the F-1 student visas that serve as a critical pipeline to the tech workforce. Their mostly anonymous comments, ahead of a formal rule-making, joined a total of more than 17,000 submissions from across academia.

In commentary filed with the government, chip executives questioned the move. “I am deeply troubled,” one unidentified CEO wrote. “The global race for chip supremacy is intensifying, and these restrictions risk ceding ground to nations with more welcoming immigration policies.”

Changes proposed in August to student visas pose an added challenge to the chip industry as it grapples with a separate Trump administration decision to charge $100,000 for most new H-1B visa applications. While semiconductor makers have stayed largely silent over the new six-figure H-1B payments, several major companies face the prospect of millions in added fees for skilled-worker visas.

Taken together, the visa changes highlight growing tension between President Donald Trump’s immigration crackdown and his goal of boosting domestic production of semiconductors and other advanced goods to stay ahead of China. An immigration raid last month on a Hyundai Motor Co.-LG Energy Solution Ltd. battery plant being built in Georgia further illustrated the challenge in relying on foreign-born talent to jump-start new factories.

White House spokeswoman Taylor Rogers declined to comment on the student visa changes but said the H1-B policy puts American workers first “by discouraging companies from spamming the system and driving down wages,” while giving certainty to US businesses that want to hire high-skilled foreign workers. Homeland Security didn’t respond to a request for comment.

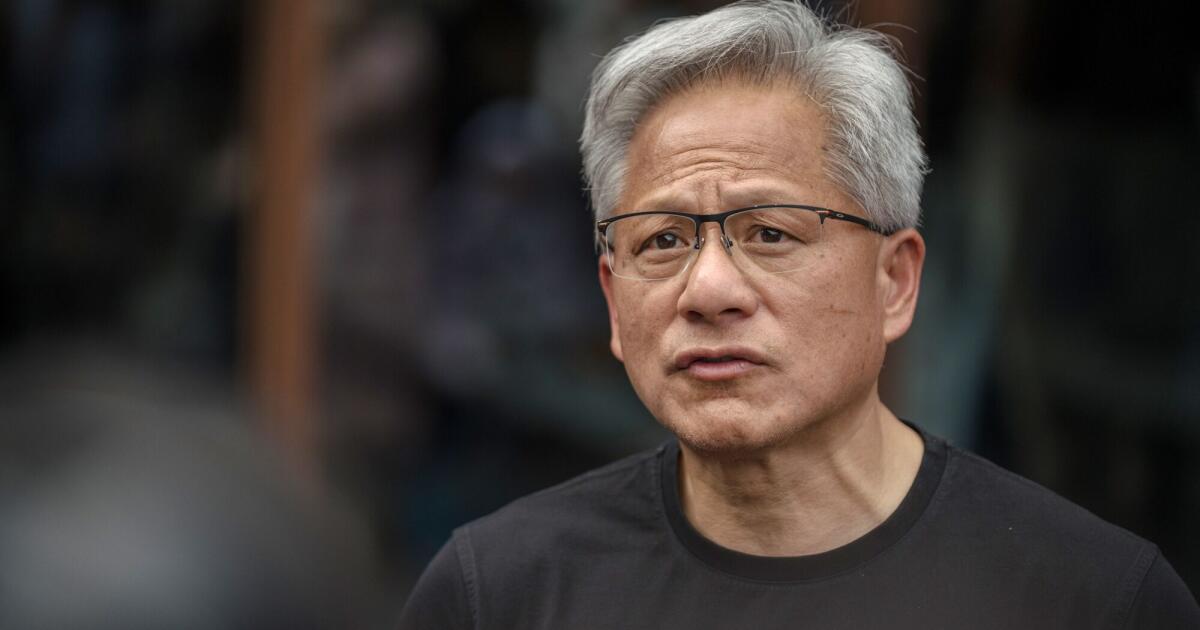

Days after the H-1B changes were announced, Nvidia Chief Executive Officer Jensen Huang stressed immigration’s role as a source of talent but stopped short of criticizing US policy. “We want all the brightest minds to come to the United States,” Huang told CNBC. “Immigration is really important to our company, and it’s really important to our nation’s future.” An Nvidia spokesperson declined to comment further.

Skilled workers and foreign students help fill a widening talent gap in the US tech workforce. Last year, prior to any added immigration hurdles, the Semiconductor Industry Association warned that about 67,000 industry jobs risk going unfilled by 2030, with about 26% of those roles projected to require a master’s or PhD degree.

“Immigration is essential to the long-run success of this industry in the U.S.,” said Adam Ozimek, chief economist at the Economic Innovation Group, a think tank that has proposed a policy of specialized visas for chip industry workers. “There’s a global scarcity of these experts. We are in a global competition to bring in these workers.”

Computer science and electrical engineering graduate programs — popular fields for future semiconductor innovators — enroll some of the highest proportions of international students in the US. According to a 2023 survey by the National Science Foundation, more than three quarters of computer science grad students in the US and more than half of all electrical engineering pupils are foreign students enrolled with visas.

“We are the number one desired location of skilled workers around the world,” Ozimek said. “That is one of our competitive advantages, and we should be taking advantage of it, not eroding it.”

Revisions to the F-1 program would impose a four-year time limit on the visas, which currently let international students remain indefinitely as long as their course of study is active. Students could seek extensions for further studies but would be barred from pursuing a second degree at the same academic level as their previous degree.

Industry leaders find the tighter F-1 student visa rules especially troubling because technology graduate students frequently study for longer than four years and take part in practical training that prepares them for the workforce. The F-1 visa is seen as a crucial stepping stone to the H-1B, but unlike the skilled worker program, student visas are not currently subject to a numerical cap.

Semiconductor sector employees, including chief technology officers and engineers, warned of the fallout in anonymous comments. “This policy would cripple our ability to compete globally,” wrote an unnamed senior director who works for an unidentified AI chipmaker.

For the H-1B visas that can be deployed post-grad, Nvidia and Intel Corp. were among chip companies that added hundreds of new workers through the program this year, according to data from US Citizenship and Immigration Services. Micron Technology Inc. and Qualcomm Inc. also tallied H-1B approvals in the triple digits in 2025. If these companies sought similar numbers of H-1B workers in 2026, fees under the new rules would swell into the tens of millions, before accounting for the costs of applicants who are not approved.

Construction of advanced chip fabrication plants, in particular, relies on foreign expertise. If companies attempt to build a fab with US employees, “their productivity is sometimes orders of magnitude lower than if you allow foreign chip manufacturers to bring workers from abroad,” Ozimek said.

The H-1B proclamation leaves the door open for Homeland Security to exempt companies or industries of “national interest,” but the status of carve-outs remains unclear, as it also says abuses of the visa program have suppressed wages and taken jobs from U.S.-born computer scientists. A White House official highlighted the ability to seek exemptions without addressing whether semiconductor companies are eligible or likely to receive them.

SEMI, a microelectronics industry association, said in a statement on the H-1B changes that it’s “concerned about added strain at a time when the industry faces significant workforce shortages,” and looks forward to working with the Trump administration on policies that meet national security needs while “strengthening the talent base necessary to support companies.”

Trump has acknowledged the difficulty in balancing between fortifying the domestic industry and tightening immigration. Last month, about a week after the raid at the Georgia battery plant, he posted on Truth Social that he does not “want to frighten off or disincentivize” international investment in the US.

In the same post, Trump said he wants foreign companies, including chip firms investing in the US, to “bring their people of expertise for a period of time.” He emphasized that the people should return “back into their land” after transferring their knowledge to US citizens.

Trump may have another chance to weigh in on the student visa policy, with the comment period closed as of Monday. The Department of Homeland Security will consider feedback and decide whether to proceed with the proposal.