By Shishir Sinha

Copyright thehindubusinessline

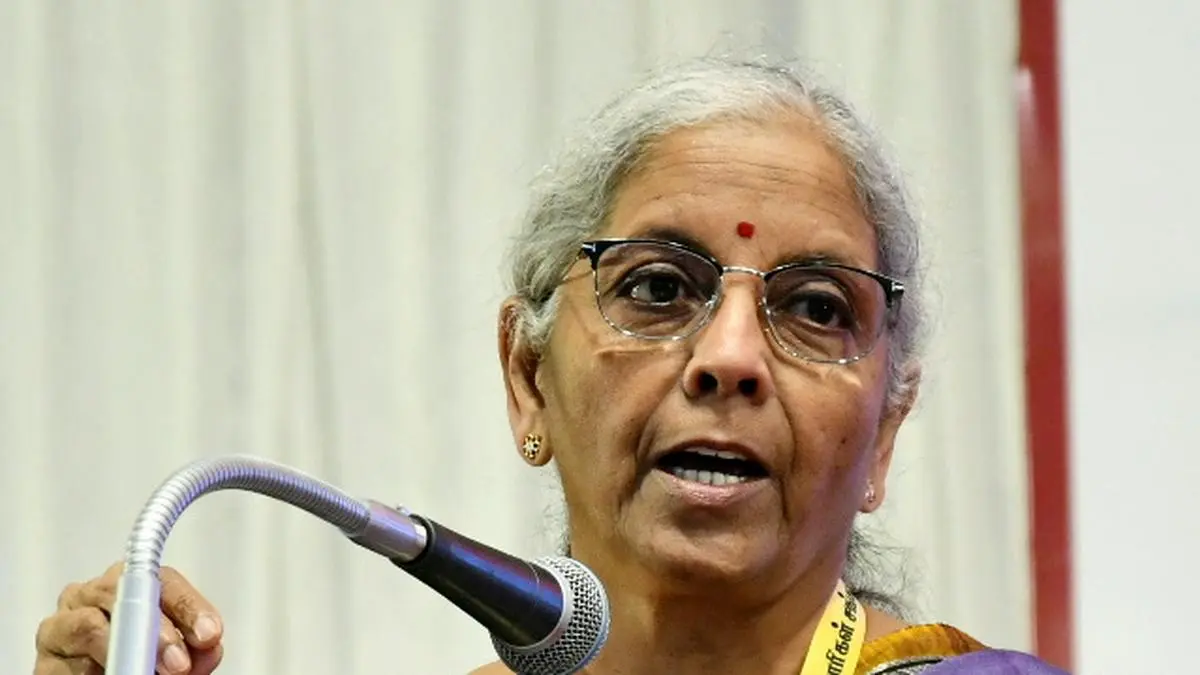

GST Appellate Tribunal (GSTAT) will usher into an era of ‘One Nation, One Forum for Fairness and Certainty’, Finance Minister Nirmala Sitharaman said on Wednesday

Formally launching GSTAT, the Minister said that the tribunal itself has passed through multiple stages of evolution.

“What began in 2017 as ‘One Nation, One Tax, One Market’ now evolves into ‘One Nation, One Forum for Fairness and Certainty’,” she said. Further, she expressed confidence that the forum will become a true symbol of justice for taxpayers, a pillar of trust for businesses, and a catalyst for India’s continued economic growth.

Taking cue from Prime Minister Narendra Modi’s call of ‘Nagarik Devo Bhavah’, Sitharaman set the clear focus for GSTAT. This includes jargon-free decisions in plain language, simplified formats and checklists, digital-by-default filings and virtual hearings, and time standards for listing, hearing and pronouncement.

Legal frictions

“The outcome we seek is straightforward: reduced legal frictions, greater simplicity, and delays in litigation addressed proactively, so cash flows move faster, MSMEs and exporters invest with confidence and citizens feel the benefits of the system,” she said

After a long wait, GSTAT will start accepting appeals by the end of this month. Hearings will begin by the end of December, as recommended by the GST Council. Additionally, GSTAT will double up as National Appellate Authority for Advance Ruling.

GSTAT has been constituted under Section 109 of the Central Goods and Services Tax Act, 2017, which provides for its constitution as the second appellate authority within the GST framework. While the original adjudication and the first appeal happens through individual officers under the Act, the second appeal — against the orders of the first appellate authorities under the Central as well as State tax administration — lies with the GSTAT.

The GSTAT has been given the responsibility to hear appeals under all the four GST laws passed by Central as well as State officers.

Therefore, this is the first forum at which the adjudication process converges under all GST laws and across all tax administrations. In its meeting on September 3, the Council recommended June as the cut-off date for filing backlog appeals.

Under section 112(1) of the CGST Act, the orders issued under section 107 or section 108 of the CGST Act or SGST Act or the UTGST Act may be appealed to the GSTAT, within three months from the date of the order.

According to officials, a date is imperative to be notified to serve as a limitation for filing of the legacy appeals otherwise, the appeals would get restricted only to those taxpayers who received the order within last three months..

Pending cases

Commenting on operationalisation of the tribunal, Saurabh Agarwal, Tax Partner at EY India, said that the onus is now on businesses to proactively review their pending cases and prepare their appeals to be filed before the March 31, 2026, deadline.

This is a crucial window of opportunity to clear the backlogs and ensure that the appeals are not time-barred.

“The successful operation of these tribunals will unlock capital, provide certainty, and ultimately, reinforce India‘s commitment to ease of doing business on the global stage,” he said.

Published on September 24, 2025