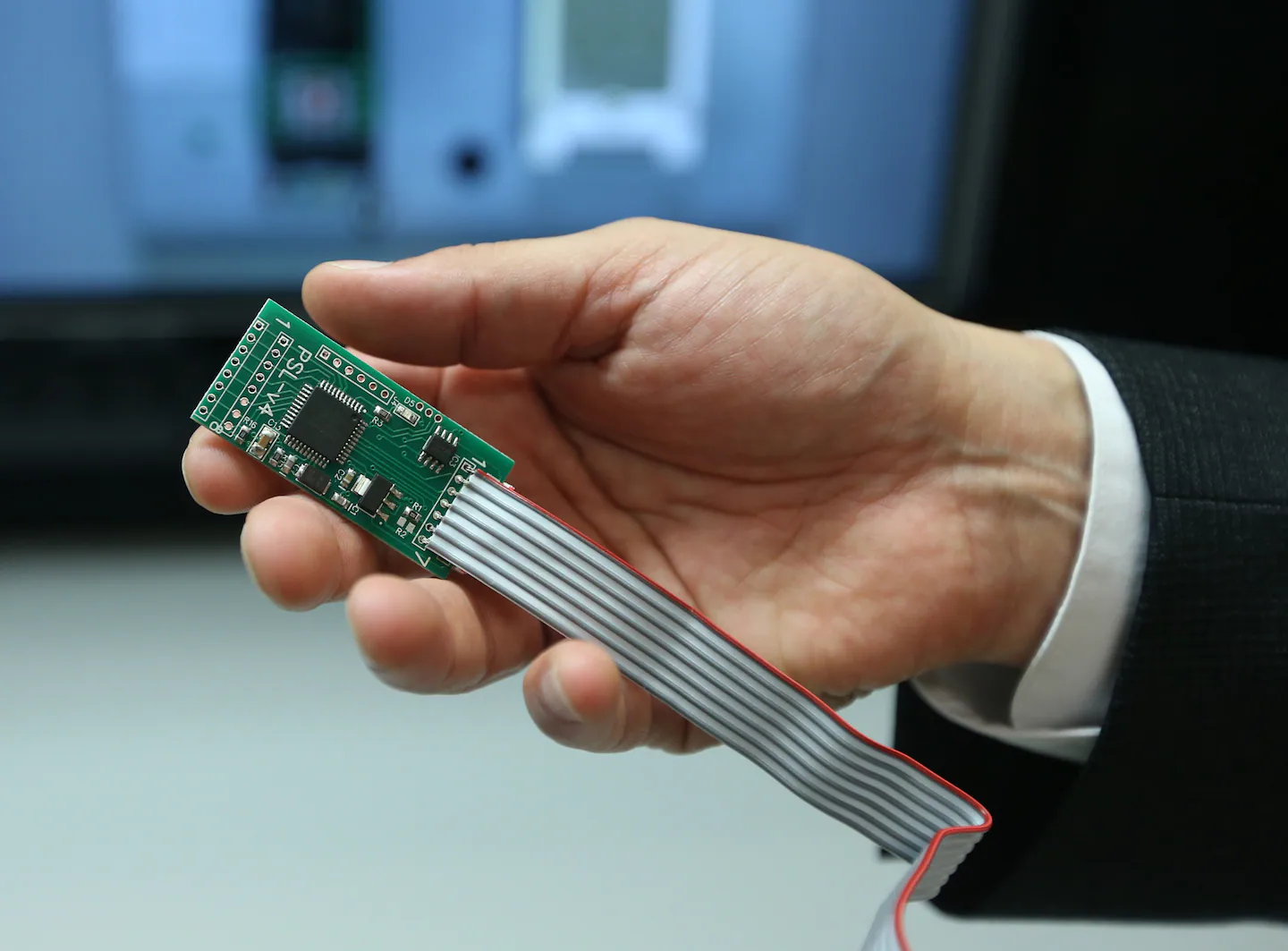

During a three-day crackdown on electronic food stamp fraud in the Greater Boston area, investigators confiscated 17 illegal card skimming devices from businesses this week, the U.S. Secret Service said Friday.

The seizure of the devices prevented an estimated fraud loss of $16.7 million to the government, and an overall loss to businesses and operations of more than $334 million, the Secret Service said in a statement.

The three day sweep, conducted Tuesday through Thursday, at 700 businesses, specifically was aimed at combatting illegal payment card skimming and Electronic Benefit Transfer fraud, the statement said.

Investigators have noted a nationwide uptick in skimming targeted at EBT cards, the Secret Service said.

“EBT fraud targets the nation’s most vulnerable communities,“ the statement said. ”Each month, money is deposited into government assistance accounts intended to help families pay for food and other basic items. This enables criminals who steal card information to time their fraudulent withdrawals and purchases around the monthly deposits.”

Twelve teams of Secret Service analysts partnered with local and state law enforcement agencies to search for and remove skimming devices from ATMS, gas pumps, cash registers, and other point of sale terminals, officials said.

Advertisement

Skimming devices use technology to essentially clone debit, credit, and EBT card information onto fraudulent cards when they are illegally installed somewhere a customer swipes, taps, or scans a card to finalize a purchase.

“It is estimated that skimming costs financial institutions and consumers more than $1 billion each year,” the Secret Service said.

Law enforcement is steadfast in its “commitment to safeguarding the nation’s financial infrastructure and protecting our communities from fraudsters,” Randy Maloney, special agent in charge of the Boston field office, said in the statement.

Advertisement

During this week’s skimming sweep, investigators sought to educate businesses to better identify the warning signs of illegal skimming devices at their locations.

As for consumers, there are several recommended precautions.

Skimmers can be hard to detect because they are designed to look like the rest of the machine. Watch out for any card reader that seems loosely attached, crooked, damaged, scratched, or wiggles when you move it.

Do not use a card reader if anything appears unusual.

Whenever possible, use tap-to-pay technology or use debit and credit cards with chip technology.

At gas pumps, where skimmers can be concealed inside the machine, look for security tape placed over the panel where the card reader is located.

At gas station, it is recommended to run your payment as a credit card to avoid entering a PIN number.

Tourist areas are popular targets, use care and discretion when using ATMs.

Tonya Alanez can be reached at tonya.alanez@globe.com. Follow her @talanez.