Copyright scmp

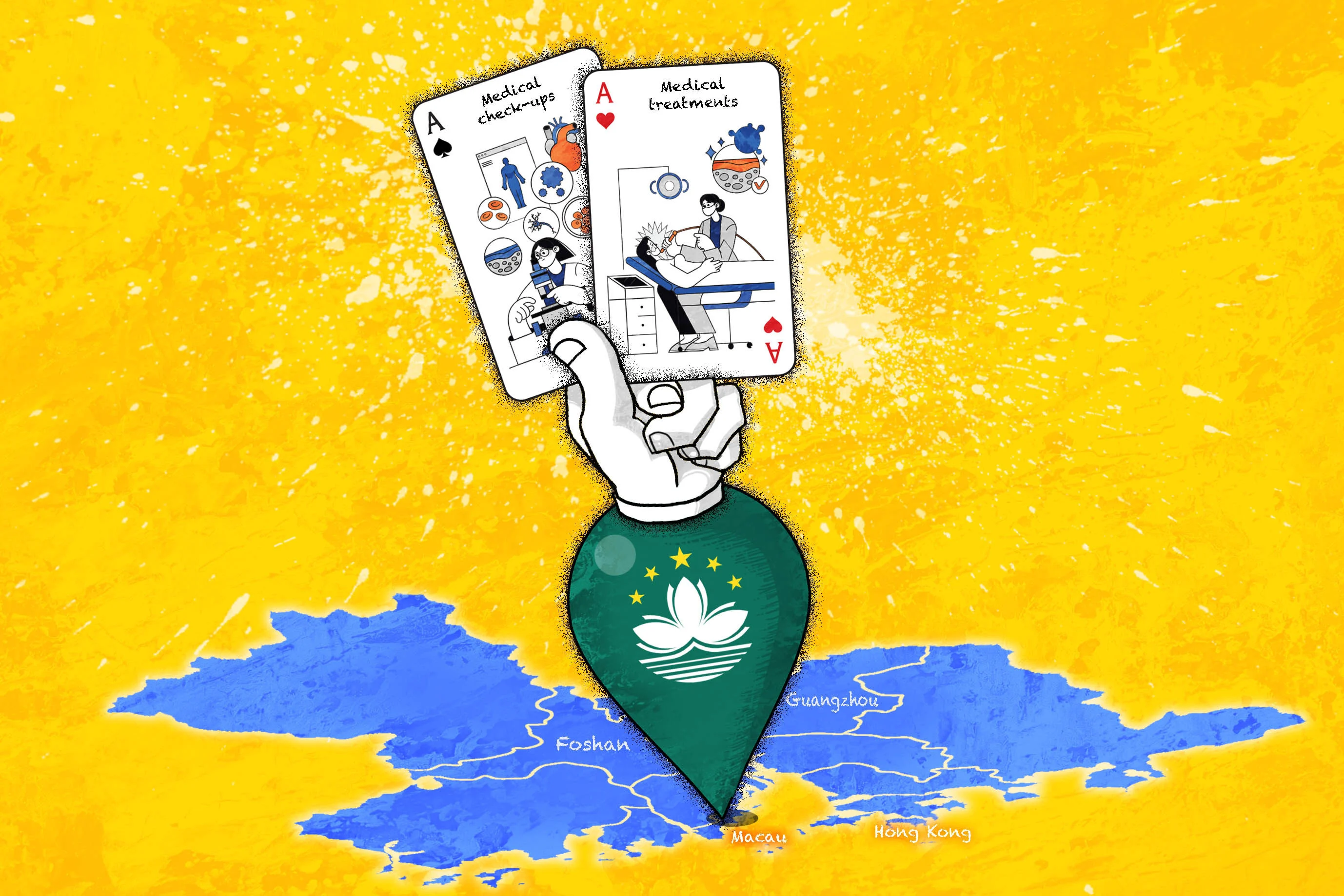

On a Sunday morning earlier this month, five friends from Bangkok stepped through the marble lobby of the Studio City Hotel in Macau – the kind of place better known for gaming tables and stage shows than medical check-ups. Instead, they were heading to iRad Hospital, tucked inside the resort complex, for a round of beauty treatments and wellness sessions. The women – Kwaisun Panchasarp, Nantanat Tejavibulya, Buyasakorn De Jesus and two friends – were in town with their families to catch the NBA Games and enjoy their first holiday together since the pandemic. “This visit to iRad wasn’t planned at all,” said Nantanat. “I’d read about it online and thought it would be some nice ‘me time’ for us.” Kwaisun, also a patient at iRad’s Hong Kong clinic, said she was struck by how calm and welcoming the Macau branch felt. “We just wanted to relax and have some treatments,” she said. “When we come to Macau, we usually enjoy the food and the atmosphere – but now we also have iRad.” If policymakers and investors in southern China get their way, casual medical and wellness shopping trips like this could soon unfold across the Greater Bay Area as the region transforms itself into a cross-border hub for healthcare and wellness tourism. Spearheading this shift is iRad Hospital, the world’s first integrated-resort medical facility offering full diagnostic services. The 15,000 sq ft clinic features MRI and CAT scanners alongside non-invasive beauty treatments such as the Xerf radio-frequency skin-tightening system from Korea – a service still rare in the city. “Our advantage is that iRad here in Macau is located in an integrated resort, where we have many visitors,” said Dennis Tam, honorary chairman of iRad and president and CEO of Black Spade Capital, the family office of billionaire Lawrence Ho Yau-lung. “So, for example, a couple staying here could have the husband going to the casino and the wife could check out the hospital,” he said. “For a family, it’s ideal – the kids could go see the water park and the parents could go to the spa together.” Black Spade – which became iRad’s majority shareholder in 2021 – is also one of the entities holding Ho’s shares in Melco Resorts & Entertainment, owner of Studio City and one of Macau’s six casino concessionaires. Macau’s “1 + 4” economic strategy, introduced by the government to cap gaming’s contribution at less than 40 per cent of gross domestic product, identifies health and wellness as one of four new growth pillars alongside finance, technology and culture. “The long-term vision is to push medical tourism such as health check-ups and aesthetic therapies,” Tam said. “Macau already has the visitors – now we’re giving them new reasons to come back.” According to Macau’s Statistics and Census Service, visitor arrivals were estimated to reach 39 million in 2025, nearly matching Japan’s estimated 40 million. Officials expect tourism spending to surpass pre-pandemic levels this year – raising hopes that health and beauty services could soon become a serious non-gaming revenue stream. The city’s appeal lies not only in its resort infrastructure but in its proximity to the vast bay area, which links Hong Kong and Macau to Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen and Zhaoqing. The region alone has a population of about 86 million and is rapidly becoming a testing ground for China’s healthcare integration, combining Hong Kong’s medical expertise, Macau’s hospitality infrastructure and the mainland’s scale and policy support. While Hong Kong and Guangzhou remain the region’s two leading medical hubs – addressing healthcare challenges at the highest level in China and, in some areas, globally – other mainland cities and Macau were fast catching up, Hu noted, promoting their medical standards abroad and showcasing the region’s growing expertise. For investors such as Black Spade, iRad’s hybrid model – medical diagnostics and wellness in a leisure setting – could become a blueprint for other destinations within the Greater Bay Area. “We see it as a bridge between tourism and medicine,” Tam said. Asia accounts for 60 per cent of the world’s population, and its combination of rising wealth, ageing demographics and chronic disease was fuelling what Boston Consulting Group projects would be a US$5 trillion healthcare market by 2030. Yet the region still attracted only about a fifth of global healthcare investment, according to BCG, leaving plenty of room for expansion. For players such as Black Spade and China’s Fosun Health, that imbalance represents opportunity. “The Greater Bay Area naturally has the closest ties to Southeast Asia,” said Frank Hu, chairman and CEO of Fosun Health, a subsidiary of Shanghai Fosun Pharmaceutical. He said many countries in the region faced shortages of doctors and advanced medical equipment, so patients increasingly look abroad for treatment. The Greater Bay Area, he added, was ready to meet that need. Hu noted that Indonesia faced a shortage of health professionals, with just 0.6 to 0.7 doctors for every 1,000 people. According to a 2024 report from PwC, that ratio ranged between 2.4 and 3.8 on the mainland’s nine Greater Bay Area cities. “Their climates are relatively similar, and patients can adapt easily to the environment here,” Hu added. “Hospitals in the Greater Bay Area are also likely to benefit from shorter flying times from major Southeast Asian cities.” Fosun Health now operates four hospitals in the area – in Foshan, Shenzhen, Guangzhou and Zhuhai – all geared towards serving a cross-border clientele. Its flagship facility, the 60-year-old Chancheng Hospital in Foshan, offers general and specialist consultations, robotic-assisted surgery and advanced cancer therapies at roughly half the price of comparable Hong Kong services. The hospital recently introduced the M6 CyberKnife, a robotic radio surgery system that targets tumours with sub-mm precision, alongside Da Vinci and orthopaedic surgical robots and CAR-T cell therapy. “We value technological innovation, expertise and the ability to offer high-quality, affordable medical services,” Hu said. The policy environment is also shifting in favour of players such as Fosun and Black Spade. In 2023, Chancheng became one of several Greater Bay Area hospitals authorised to use Hong Kong-registered drugs and devices – in total 22 innovative medicines and medical devices – in a move designed to harmonise medical standards across the region. Financial integration is following close behind. In May this year, the hospital also partnered with Prudential Hong Kong to allow policyholders to settle bills directly, avoiding the need for upfront payments or reimbursement claims. Such integration, analysts said, was part of a wider effort to make healthcare a seamless experience within the Greater Bay Area. “Hong Kong has a dualistic structure, with a significant quality gap between public and private healthcare services,” Hu said. “If Hong Kong residents seek quality services in private hospitals with affordable prices, they will come to the mainland. When more people receive high-quality medical services in mainland cities, word of mouth will spread. The comprehensive integration of the Greater Bay Area medical market is irreversible.” That momentum is already rippling across the border. According to Jennifer Song, senior equity analyst at Morningstar, the launch of iRad in Macau marked a “milestone” in the region’s “big health” ambitions. “Casinos and hotels, with their high foot traffic, are ideal venues for health and beauty clinics in Macau,” Song said. “However, as Macau’s integrated resorts have long been focusing on the gaming business, establishing a new healthcare arm will require building operational expertise and recruiting specialised professionals.” There remain other challenges too. Mainland visa restrictions and language barriers continue to deter some Southeast Asian patients, said Prudence Lai, consultant at Euromonitor International. “Securing a visa can be one of the biggest bottlenecks,” she said. “To attract Asian tourists as patients, providers will need to tailor their services and communication for different markets.” The draw of innovative medical technology, it is hoped, may be enough to overcome some of these barriers, with Greater Bay Area healthcare providers already competing on state-of-the-art equipment and cost. At iRad in Macau, for example, the attraction for the Thai patients was a premium service like the Xerf machine, a non-invasive radio-frequency device for skin tightening. “This Xerf machine is from Korea and so far, there are just a few clinics offering this treatment,” said Clara Do, head of international business at iRad. “This is a first in Macau.” Ming Lee, a Hong Kong-based lawyer in her 50s who was visiting Macau for some rest and recreation, also went to have a 3D mammogram at iRad. “I’m also a patient at iRad in Hong Kong, so when I learned that they had a new hospital in Macau, I was curious to try their services here,” Lee said. “It seemed to me the equipment here was more advanced than the one in Hong Kong.” In the past, Hong Kong residents seeking similar preventive screenings might have travelled to hospitals such as Bumrungrad International in Bangkok, long regarded as a leader in regional medical tourism. For Lee, being able to access comparable technology a short trip over the Hong Kong-Zhuhai-Macau Bridge hints at how the balance of convenience in Asian healthcare is starting to shift. Like the Thai patients, Lee found the Macau setting more relaxing for diagnostic examinations. “Here in Macau, you can relax and enjoy the casinos and at the same time you can do the medical check-ups and beauty treatments – all in one go,” she said. “You can do all these in a relaxed mood.” As one Hong Kong dollar is typically equivalent to more than one Macau pataca, Lee said she also found the prices favourable. For policymakers, investors and patients alike, such experiences hint at how the Greater Bay Area’s vision of cross-border healthcare could take shape – with Macau as its most visible showcase. For travellers like Lee, it’s a gentler form of luxury: part medical check-up, part mini-break. In a city once synonymous with luck, the odds now favour a different kind of investment – one measured not in jackpots, but in longer, healthier lives.