By Ghana News

Copyright ghanamma

Ghana’s mobile money interoperability system achieved record transaction values of GHC 4.9 billion in August 2025, marking the highest monthly performance since the service’s launch and extending a recovery that began in July following a June decline.

The August figure represents a 4.3% increase from GHC 4.7 billion recorded in July and a substantial 25.6% jump from GHC 3.9 billion in June, when cross-network transfer activity experienced a temporary slowdown, according to Bank of Ghana (BoG) data.

Cross-network transaction volumes also demonstrated growth momentum, climbing to 26.4 million transfers in August from 26.0 million in July and 23.3 million in June. This reflected a 1.5% month-on-month increase and 13.3% growth compared to June levels.

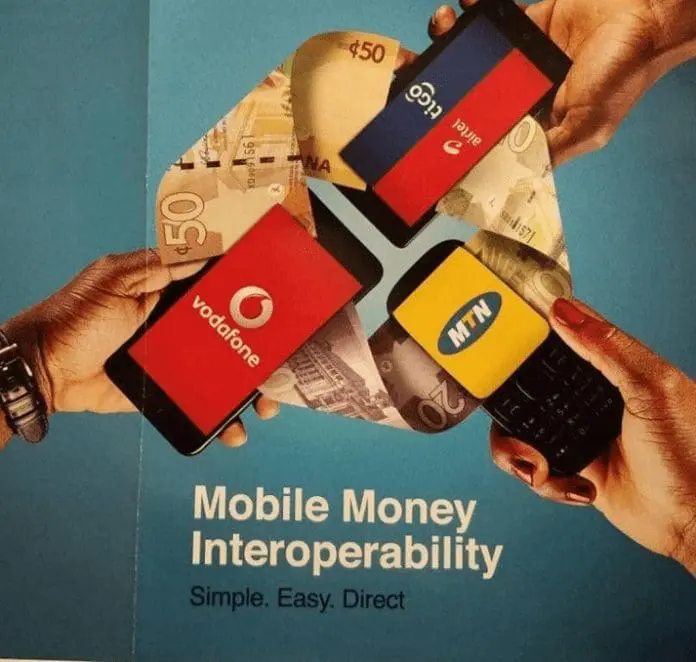

The interoperability service, launched in 2018, enables customers to transfer money across different mobile network operators and between mobile wallets and bank accounts, eliminating previous restrictions that limited users to single network operators.

Overall mobile money ecosystem performance remained robust, with total transactions across all platforms reaching GHC 354.1 billion in August 2025, according to the Bank of Ghana’s Summary of Economic and Financial Data. Total transaction volumes hit 831 million in August, compared with 778 million in July.

The system has become integral to Ghana’s payment infrastructure, supporting financial inclusion initiatives, reducing transfer costs, and facilitating the transition toward a cash-lite economy across urban and rural communities.

Registered mobile money accounts expanded to 77.7 million in August from 70.5 million a year earlier, while active accounts reached 25.1 million. The network of registered agents nationwide grew to 938,000, reflecting the service’s expanding geographical reach.

Despite recent growth, mobile money interoperability still accounts for just one percent of total mobile money transaction value, indicating relatively limited uptake of cross-network transfers compared to same-network transactions. This suggests significant potential for expansion as awareness and adoption increase.

The August performance builds on previous momentum, with the platform achieving a historic milestone in April 2025 when it recorded GHC 4.0 billion in transaction value across 23.1 million transfers. The continued growth trajectory demonstrates increasing consumer confidence in cross-network capabilities.

Industry analysts attribute the gradual uptake to factors including insufficient incentives, technical complexity, and awareness gaps, noting that cross-network transfers must match same-network convenience in cost and user experience to achieve broader adoption.

The interoperability system strengthens Ghana’s payments infrastructure resilience by providing alternative channels when individual network operators experience technical difficulties or capacity constraints during peak usage periods.

Everyday transaction applications include remittances, retail purchases, bill payments, and salary disbursements, with the system particularly valuable for users who maintain accounts across multiple mobile network operators for various business or personal reasons.

The service supports broader government objectives of promoting digital financial inclusion and reducing dependency on cash transactions, particularly in rural areas where traditional banking infrastructure remains limited.

Ghana’s mobile money success story continues attracting international attention as a model for digital financial services in emerging economies. The country’s mobile penetration rate exceeds 100%, providing a solid foundation for continued digital payment system expansion.

The August record performance coincides with broader economic digitization efforts, including government initiatives to promote electronic transactions and reduce cash circulation in the formal economy.

Recent regulatory developments have focused on enhancing security protocols and consumer protection measures while maintaining the accessibility that has driven rapid adoption across demographic segments.

The growth trajectory positions Ghana’s mobile money interoperability system as a critical component of the country’s financial services landscape, with potential for further expansion as digital literacy increases and smartphone adoption continues.

Technical infrastructure improvements and simplified user interfaces are expected to address current barriers to broader interoperability adoption, potentially increasing its share of total mobile money transaction values.

The sustained growth in both transaction values and volumes demonstrates the service’s evolution from experimental technology to essential financial infrastructure supporting millions of Ghanaians in their daily economic activities.

Future expansion plans focus on integrating additional financial service providers and enhancing cross-border payment capabilities to support regional trade and remittance flows within the Economic Community of West African States (ECOWAS) framework.