By Ghana News

Copyright ghanamma

Industry leaders are intensifying pressure on Ghana’s central bank to slash borrowing costs further as the Monetary Policy Committee concluded its September meeting amid expectations of another significant rate reduction.

The Bank of Ghana’s policy rate stands at 25 percent following a dramatic 300 basis point reduction in July, when inflation dropped to its lowest point in nearly three years. While that aggressive cut provided relief to businesses, corporate Ghana argues current lending rates remain prohibitively expensive.

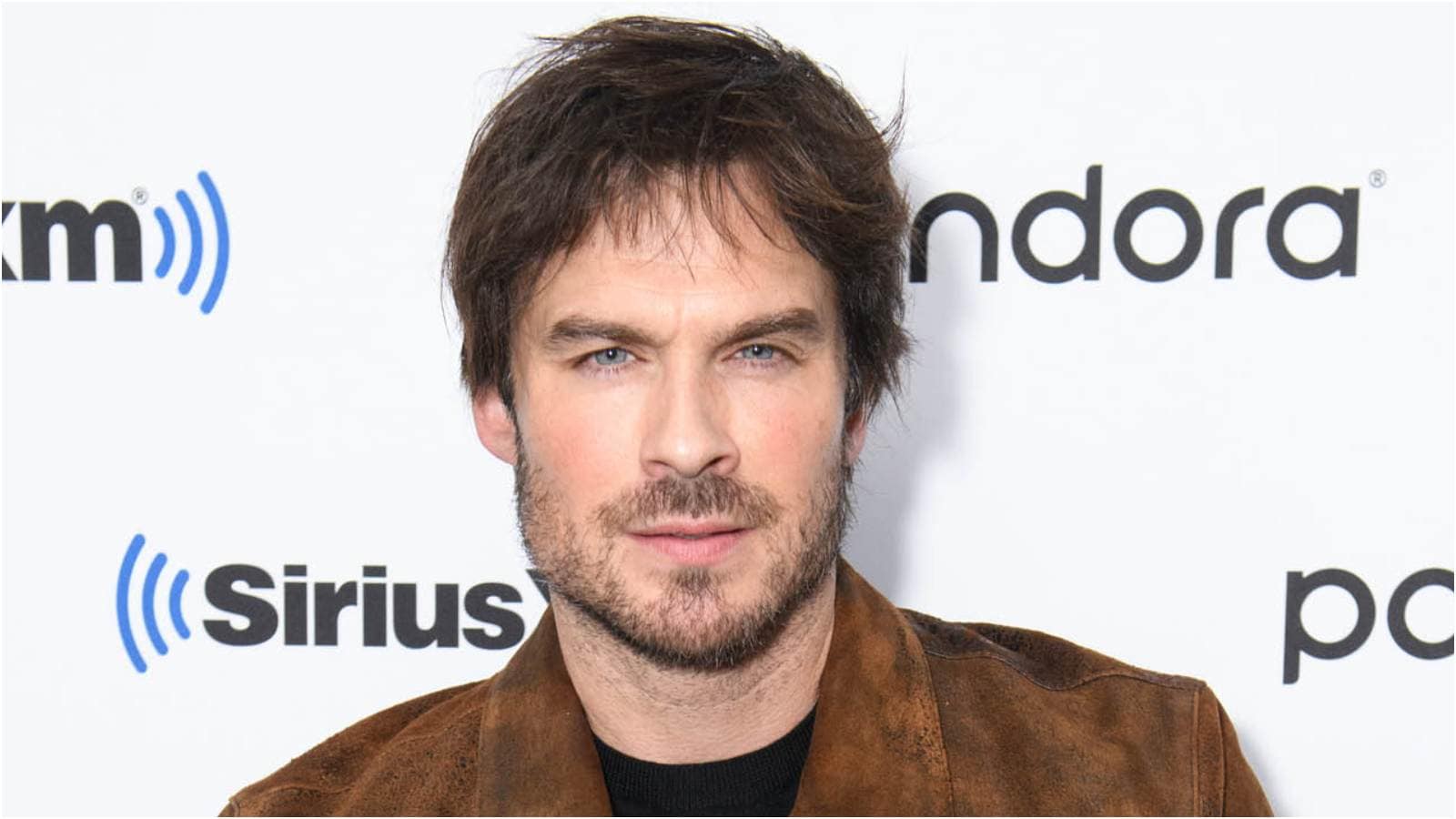

Tsonam Akpelo, Greater Accra Regional Chairman of the Association of Ghana Industries, called on monetary authorities to recognize the urgent financing needs facing local manufacturers and businesses.

“High interest rates make it nearly impossible to access capital for business expansion,” Akpelo stated. “We need the government to remain responsive to these challenges and continue lowering the policy rate.”

The industrialist emphasized that affordable credit represents a cornerstone of Ghana’s economic recovery strategy, enabling companies to scale operations and generate employment opportunities across the country.

Manufacturing sector representatives have directly connected their financing demands to President Nana Akufo-Addo’s signature 24-hour economy initiative, designed to boost industrial output while creating jobs for Ghana’s unemployed youth population.

“Achieving these ambitious economic goals requires competitive borrowing rates,” Akpelo explained. “Businesses must be able to access bank financing at rates that support growth rather than constrain it.”

However, economic analysts warn the Monetary Policy Committee faces competing pressures that could limit aggressive rate cutting in the near term.

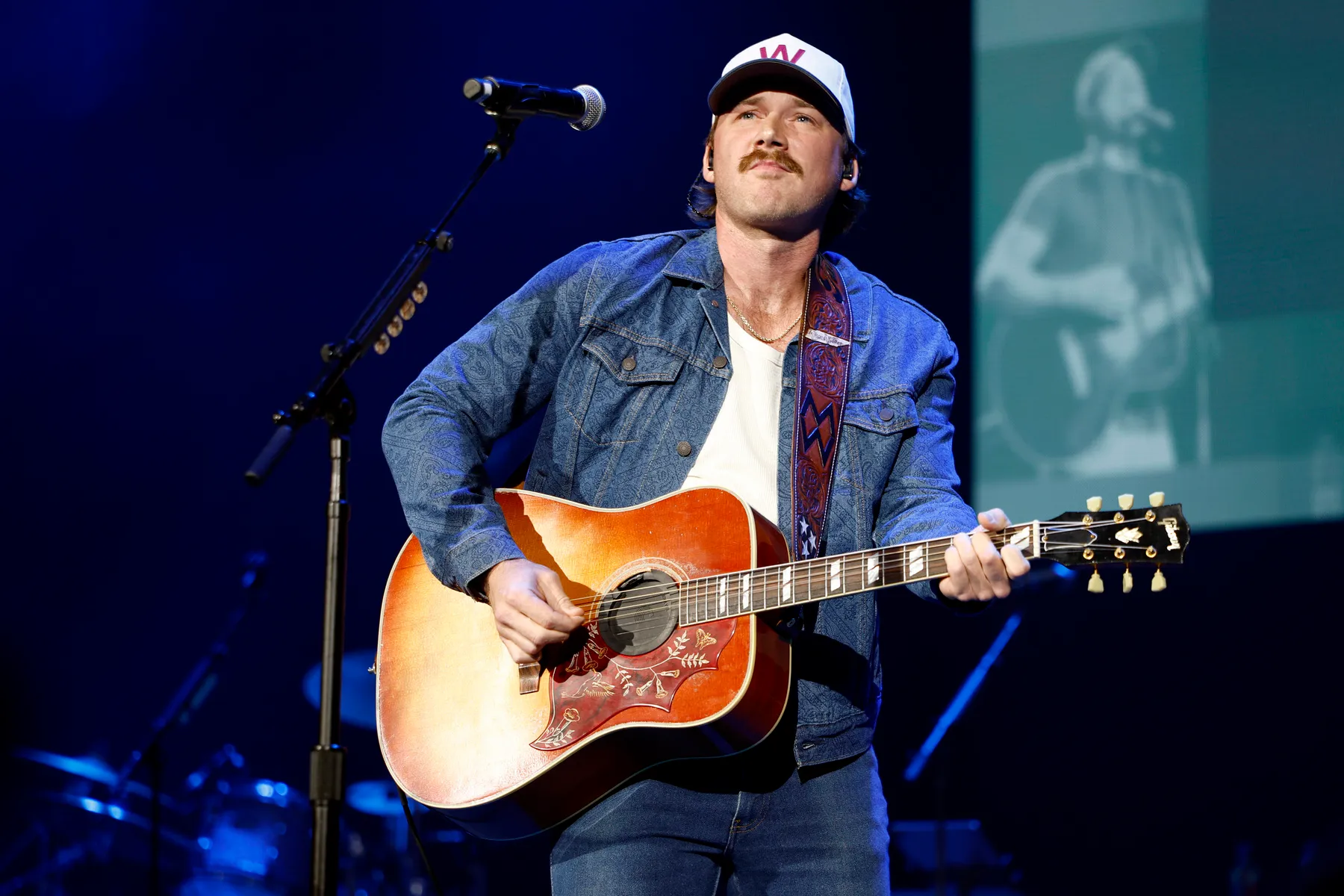

Dr. Edu Owusu-Sarkodie, a prominent economist, acknowledged the case for monetary easing while highlighting potential inflationary risks from excessive loosening.

“Currency depreciation pressures and anticipated utility tariff adjustments create headwinds that the MPC must carefully consider,” Dr. Owusu-Sarkodie observed.

The economist projects a measured approach from policymakers, with potential cuts of 150 to 200 basis points that would bring the benchmark rate to approximately 23 percent.

“Despite calls for 500 basis point reductions, such dramatic action appears unlikely given current economic conditions,” he noted.

Ghana’s central bank confronts the delicate challenge of stimulating business investment through lower borrowing costs while maintaining price stability and currency confidence.

July’s significant rate reduction energized business sentiment across multiple sectors, yet corporate leaders maintain that insufficient easing could derail the country’s economic recovery momentum.

Monetary policy experts emphasize that overly aggressive cuts risk undermining recent progress in macroeconomic stabilization, particularly given external pressures facing emerging market economies.

The September MPC decision will signal Ghana’s monetary policy direction for the remainder of 2025, balancing immediate growth imperatives against longer-term stability concerns.