Copyright Forbes

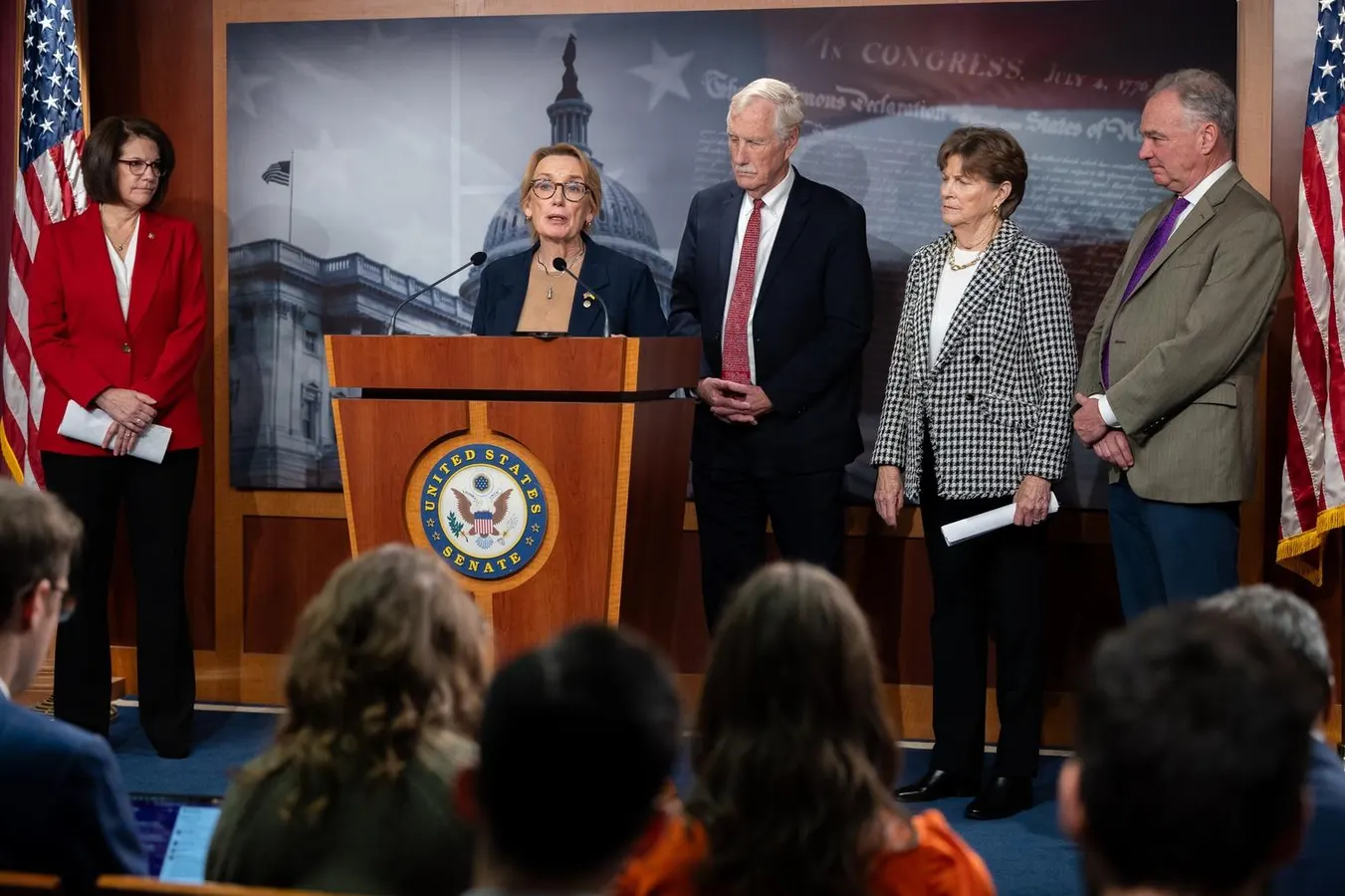

President Donald Trump has gone from a crypto skeptic to one of the world’s biggest bitcoin investors. It’s not doing him any favors. Bitcoin had been surging before the Trump Media and Technology Group purchased $2 billion of the cryptocurrency this summer. But it appears the president got in at the peak, and it has slipped an estimated 12% since. The company’s holdings are now worth $1.7 billion. Trump Media shares have dropped 46% in the last six months, but a bitcoin turnaround could just as easily boost the company and Trump’s net worth. This is a published version of the Forbes Daily newsletter, you can sign-up to get Forbes Daily in your inbox here. FIRST UP Eight Democrats joined Republicans in a procedural Senate vote on Sunday to end the government shutdown and fund most federal agencies through late January. The deal also sets up a mid-December vote on extending Affordable Care Act subsidies, but some Democrats pushed back on the move, as Republicans made no guarantees it would pass. OpenAI CEO Sam Altman has made a streak of deals recently with tech giants like Oracle, Nvidia, Microsoft and Amazon, committing to spend a total of $1.4 trillion on datacenters in the coming years. That’s far more than the company’s current balance sheet can sustain, but experts note that Altman doesn’t have anything to lose, since he has repeatedly claimed he does not have a stake in the company. But Altman believes the bigger risk is not having access to enough cheap compute to train and run better AI models. BUSINESS + FINANCE The Russell 2000, which tracks small-cap stocks, has lagged the S&P 500 this year. But in our annual ranking of America’s Most Successful Small-Cap Companies, Forbes identified winners like technology services firm TSS, which has partnered with Dell and seen its shares grow 6,000% since the start of last year. Small-cap portfolio managers are hopeful that the adoption of AI will help narrow the gaps in valuations between large- and small-cap companies. Consumer sentiment declined to a near-record low this month, as the government shutdown weighs increasingly heavily on Americans, the University of Michigan’s widely-tracked survey revealed. Consumers are feeling pressure on their personal finances from “multiple directions,” according to Joanne Hsu, the survey’s director. WEALTH + ENTREPRENEURSHIP Elon Musk’s fortune fell by $10 billion Friday, despite Tesla shareholders approving a pay package that could award him with as much as $1 trillion over the next decade. Shares of the EV maker plunged 3.7% at the end of last week, and Matt Britzman, senior equity analyst at Hargreaves Lansdown, told Reuters the deal is “outrageous,” though over 75% of shareholders approved it. TECH + INNOVATION California-based BillionToOne surged more than 80% in its IPO last week, giving it a market cap of $5.8 billion and becoming the rare medical diagnostics company to have a successful IPO in 2025. The firm, which was started to create noninvasive prenatal genetic tests for common diseases, has built a fast-growing business, booking $209 million in latest 12-month revenue. MONEY + POLITICS President Donald Trump issued pardons for several of his allies late Sunday, including Rudy Giuliani and other former members of Trump’s legal team who were allegedly involved in a bid to overturn the 2020 election. A total of 77 people were mentioned in the proclamation, which reiterated the president’s unsubstantiated claims about widespread fraud in the election won by former President Joe Biden. TRAVEL + LIFESTYLE Shares of Expedia closed up 18% Friday as the travel firm reported its strongest earnings in over two years, boosted by higher travel demand, AI and tighter cost control. Demand for premium travel has accelerated, Expedia CFO Scott Schenkel said, though the lower end has been resilient, as experts have worried about a “K-shaped” economy. DAILY COVER STORY It’s Not Just An AI Bubble. Here’s Everything At Risk Asset bubbles give off a scent. Stocks far outpace earnings. Junk debt looks gold-plated. But, no matter how good the rally feels, eventually skepticism arises. The S&P 500 sits at 6,700, nearly double what it was five years ago. The Magnificent 7 tech titans are the rocket fuel. They account for nearly 40% of the index, and they’re placing trillion dollar bets that AI rewires the world.It’s not just frothy stocks. Inflation-adjusted gold prices have doubled since 2023, topping $4,000 an ounce for the first time. Bitcoin, the ultimate risk-on asset, is up more than 130% since it was packaged into exchange traded funds in January 2024. Amid bidding wars, home prices rise further out of reach for buyers. Even junk bonds trade as if nothing can go wrong. The late economist John Kenneth Galbraith wrote that bubbles form the same way every time. A new idea casts a spell. Credit expands. Prices rise. Everyone feels smarter. Then crack, reality bites and it all comes crashing down. Galbraith argued the real fuel isn’t credit, it’s boundless hope and fleeting memory. Each generation convinces itself that this time is different. Gold rarely rises alongside stocks. One asset reflects optimism, the other fear. It could just be a market hedging its bets. Or maybe it’s a sign some investors have been smelling smoke before the rest of us. WHY IT MATTERS “The four most dangerous words in investing are ‘this time is different,’” says Forbes senior reporter Brandon Kochkodin. “These charts don’t guarantee a crash, but they do show patterns that usually come with a hangover. Timing is the hard part. Being early can feel the same as being wrong. As another famous investing saying goes, more money has been lost preparing for recessions than in the recessions themselves. Still, it helps to keep your eyes open and your mind prepared for the good times to end.” MORE Forget Market Technicals, Trump Trades Are Almost A Sure Thing FACTS + COMMENTS Cornell University became the latest school to strike a deal with the Trump Administration over antisemitism allegations. The agreement will immediately restore Cornell’s research funding: $60 million: The amount the school will pay in federal government fines and required investments into agriculture research Over $250 million: How much federal research funding will be restored Around $1 billion: The amount Cornell considered issuing in bonds, and it also warned about potential layoffs in June STRATEGY + SUCCESS There are some email phrases you may want to avoid, as they can trigger passive aggression or unnecessary panic. Rather than saying that you need something “ASAP,” provide specific deadlines in your messaging. For many, the phrase “Can we chat?” without additional context can also cause anxiety. Make sure to demonstrate clarity and empathy in your emails, and respect your colleagues’ boundaries. VIDEO QUIZ A IRS attorney who has been furloughed during the government shutdown has gone viral for setting up a food stand in Washington, D.C. What kind of food does he serve? A. Hot dogs B. Pizza C. Pretzels D. Hamburgers Check your answer. Thanks for reading! This edition of Forbes Daily was edited by Sarah Whitmire, Chris Dobstaff and Caroline Howard.