By David Chaplin

Copyright investmentnews

The Financial Markets Authority (FMA) has lost a bid to lump wholesale investment-issuers with extra compliance duties over self-certified ‘eligible’ investors into unregulated products.

In a High Court ruling handed down last week, Justice Fitzgerald essentially upheld the status quo where product-issuers can rely on eligible investor certificates confirmed by third-parties such as accountants or financial advisers without conducting further due diligence.

The FMA filed the case at the end of last year to test legal arguments that wholesale investment providers must carry out further investigations to ensure the basis of eligible investor certificates.

Initially, the regulator lodged the test case unopposed after struggling to find a party willing to take the other side of the arguments but the Angel Association New Zealand Incorporated (AANZ) and New Zealand Private Capital Association Incorporated (NZPC) eventually ‘intervened’ as ‘contradictors’ for the proceedings.

The regulator launched the legal action on concerns “that eligible investor exclusion is being used in circumstances when it considers it should not be”, Fitzgerald says in the ruling.

Most notably, the 2024 collapse of the Du Val property investment group involved alleged misuse of the eligible investor exemption. Last week, the statutory mangers of the Du Val empire, PwC, confirmed wholesale investors in the firm’s Opportunity Fund and the Mortgage Fund would be unlikely to see any return – although the Build-to-Rent investors could recoup about 40 per cent of their investments.

Despite the FMA misgivings about eligible certification process, the judge found the current law did not require investors to disclose details of relevant investment experience nor for issuers to question certificates signed off by approved professionals.

Fitzgerald says in the ruling that the legislation held “no hint that the offeror would… be required to satisfy itself that the investor could make those assessments” of wholesale eligibility.

The decision found against the FMA position in all four questions put to the Court.

Overall, Fitzgerald says “the FMA’s approach tends to undermine the very concept of self-certification, which is a core part of the eligible investor regime”.

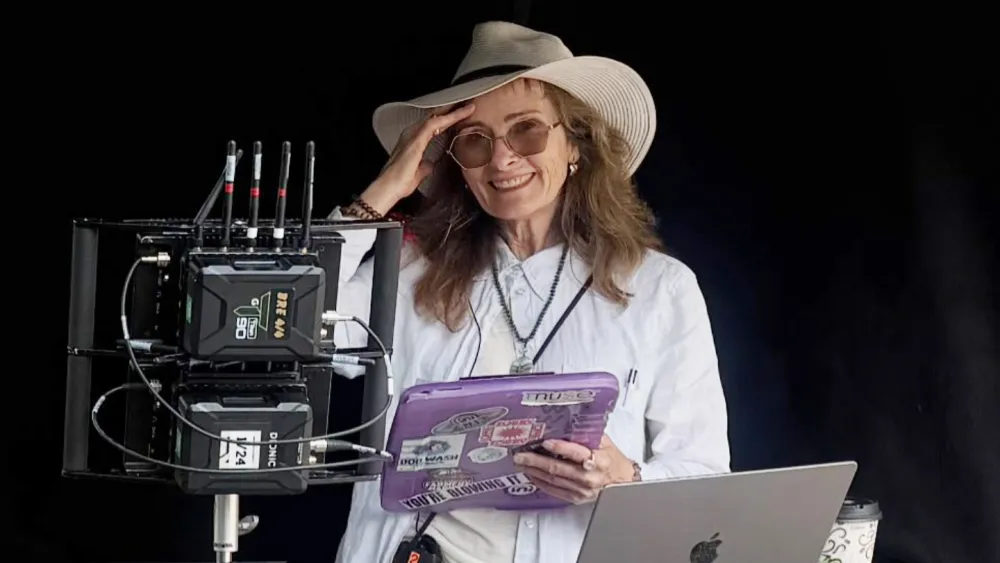

In a release, FMA chief, Samantha Barrass, said the ruling had provided “clarity” on how to interpret the eligible investor legislation as well as the responsibilities of those signing such certificates to check supporting information.

Barrass said the regulator would continue to work with the Ministry of Business, Innovation and Employment (MBIE) on the “appropriate policy settings for the wholesale investment regime, given the changing distribution methods and nature of wholesale offers”..

“We will also continue to take action against conduct that misleads people into these wholesale investments, when they need the protections afforded by retail investments.

“Tackling retail investments dressed up as wholesale investments is an area of concern we have held for some time and remains strongly on our radar.”

Despite losing the arguments, the FMA might glean some support for law reform from the High Court finding.

“..it seems that that issue that may have arisen in practice is not so much with the level or content of the grounds set out in some eligible investor certificates, but that certificates containing patently defective grounds (or no grounds at all) are nevertheless being confirmed. On this basis, it is the confirmation process which is falling down,” Fitzgerald says. “If the confirmation process is not considered sufficient to provide appropriate protection to investors, then it may be that the balance struck in the current legislation needs to be reset. That is of course a matter for Parliament and not for the Court.”

The FMA assumed all costs in the case.