Financial institutions should have a comprehensive strategy in place for AI adoption: RBI Dy Guv Rao

By Bl Mumbai Bureau

Copyright thehindubusinessline

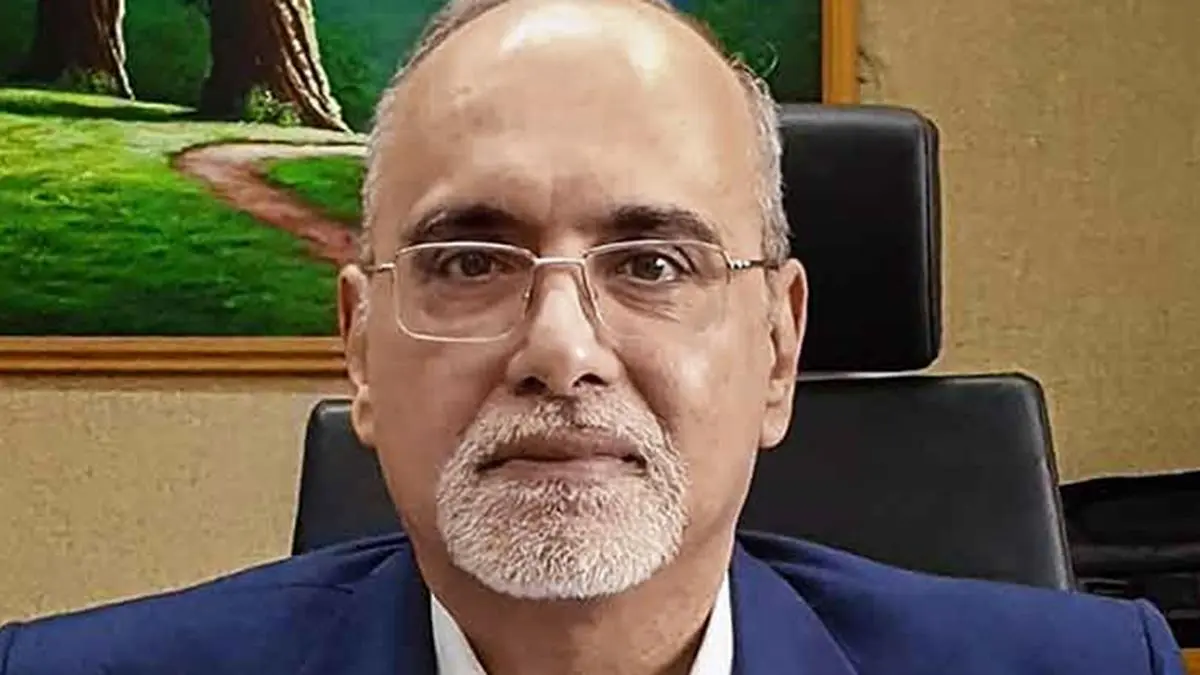

Financial institutions’ excitement around AI’s benefits should not overshadow prudent risk management, according to M Rajeshwar Rao, Deputy Governor, RBI.

In this regard, he emphasised on aspects such as governance, human-in-the-loop, maintaining data quality and security and regulatory guardrails for new technologies, among others.

In his keynote address at a business TV channel’s Banking Transformation Summit, Rao noted that among emerging technologies, Artificial Intelligence (AI) stands out for its vast potential for strengthening internal operations and risk management to delivering faster, more seamless customer experiences.

Though banks have been using AI in some areas of lending, there is potential use cases for its usage across other areas of the credit lifecycle, he said.

Clear policies

The Deputy Governor said financial institutions should have in place a comprehensive strategy for AI adoption. It should be accompanied by clear policies, risk appetites, criticality and impact assessments as well as ethical standards that cascade through the organisation.

“Robust monitoring and reporting mechanisms should be put in place to ensure alignment between innovation goals and institutional stability. Further, in a regulated industry like banking, it is essential to understand how a model arrives at its decisions, making explainability a critical requirement,” he said.

Thus, there is a need for financial institutions to invest in explainable AI frameworks that provide clear, auditable reasons for loan decisions. Strong governance is central to managing AI-driven model risk.

Rao emphasised that while AI can automate and recommend, humans should be responsible for the decisions.

Financial institutions, while adopting AI for business processes, should implement the principle of human-in the-loop to ensure that AI is leveraged as a tool to support and enhance human decisions and not replace them.

High-quality data

Rao underscored that high-quality data is the backbone of safe and effective AI in finance.

“While the RBI already collects data through supervisory reports, regulatory returns and surveys, the introduction of model risk guidelines, aligned with global best practices, will soon extend this scope to include data on AI models used by regulated entities,” he said.

Financial institutions should, therefore, adopt robust data strategies, incorporating diverse, reliable indicators that reflect both the scale of AI adoption and associated vulnerabilities.

Rao observed that recognising the increasing usage of model-driven credit assessments and decision-making in REs, the RBI had issued a draft circular on model risk management in credit, setting out expectations on governance, validation, monitoring, and accountability.

“Building on this foundation and recognising the increasing usage of models by the REs, not only for credit functions but also for wide spectrum of processes across functional and operational domains, the RBI is in the process of expanding the scope of these guidelines and will issue overarching Model Risk Management Guidelines applicable across all models,” he said.

Published on September 22, 2025