Copyright St. Paul Pioneer Press

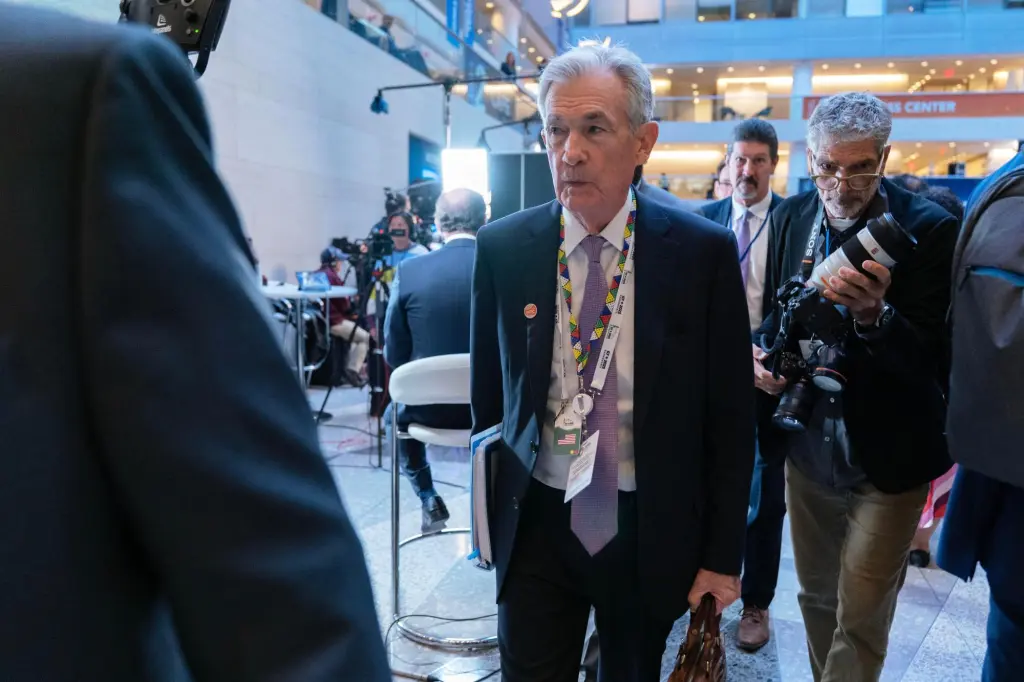

To place an obituary, please include the information from the obituary checklist below in an email to obits@pioneerpress.com. There is no option to place them through our website. Feel free to contact our obituary desk at 651-228-5263 with any questions. General Information: Your full name, Address (City, State, Zip Code), Phone number, And an alternate phone number (if any) Obituary Specification: Name of Deceased, Obituary Text, A photo in a JPEG or PDF file is preferable, TIF and other files are accepted, we will contact you if there are any issues with the photo. Ad Run dates There is a discount for running more than one day, but this must be scheduled on the first run date to apply. If a photo is used, it must be used for both days for the discount to apply, contact us for more information. Policies: Verification of Death: In order to publish obituaries a name and phone number of funeral home/cremation society is required. We must contact the funeral home/cremation society handling the arrangements during their business hours to verify the death. If the body of the deceased has been donated to the University of Minnesota Anatomy Bequest Program, or a similar program, their phone number is required for verification. Please allow enough time to contact them especially during their limited weekend hours. A death certificate is also acceptable for this purpose but only one of these two options are necessary. Guestbook and Outside Websites: We are not allowed to reference other media sources with a guestbook or an obituary placed elsewhere when placing an obituary in print and online. We may place a website for a funeral home or a family email for contact instead; contact us with any questions regarding this matter. Obituary Process: Once your submission is completed, we will fax or email a proof for review prior to publication in the newspaper. This proof includes price and days the notice is scheduled to appear. Please review the proof carefully. We must be notified of errors or changes before the notice appears in the Pioneer Press based on each day’s deadlines. After publication, we will not be responsible for errors that may occur after final proofing. Online: Changes to an online obituary can be handled through the obituary desk. Call us with further questions. Payment Procedure: Pre-payment is required for all obituary notices prior to publication by the deadline specified below in our deadline schedule. Please call 651-228-5263 with your payment information after you have received the proof and approved its contents. Credit Card: Payment accepted by phone only due to PCI (Payment Card Industry) regulations EFT: Check by phone. Please provide your routing number and account number. Cash: Accepted at our FRONT COUNTER Monday – Friday from 8:00AM – 3:30PM Rates: The minimum charge is $162 for the first 10 lines. Every line after the first 10 is $12.20. If the ad is under 10 lines it will be charged the minimum rate of $162. On a second run date, the lines are $8.20 per line, starting w/ the first line. For example: if first run date was 20 lines the cost would be $164. Each photo published is $125 per day. For example: 2 photos in the paper on 2 days would be 4 photo charges at $500. Deadlines: Please follow deadline times to ensure your obituary is published on the day requested. Hours Deadline (no exceptions) Ad Photos MEMORIAM (NON-OBITUARY) REQUEST Unlike an obituary, Memoriam submissions are remembrances of a loved one who has passed. The rates for a memoriam differ from obituaries. Please call or email us for more memoriam information Please call 651-228-5280 for more information. HOURS: Monday – Friday 8:00AM – 5:00PM (CLOSED WEEKENDS and HOLIDAYS) Please submit your memoriam ad to memoriams@pioneerpress.com or call 651-228-5280. By CHRISTOPHER RUGABER, Associated Press Economics Writer WASHINGTON (AP) — The Federal Reserve will almost certainly cut its key interest rate on Wednesday and could signal it expects another cut in December as the central bank seeks to bolster hiring. A cut Wednesday would be the second this year and could benefit consumers by bringing down borrowing costs for mortgages and auto loans. Since Fed chair Jerome Powell strongly signaled in late August that rate cuts were likely this year, the average 30-year mortgage rate has fallen to about 6.2% from 6.6%, providing a boost to the otherwise-sluggish housing market. Still, the Fed is navigating an unusual period for the U.S. economy and its future moves are harder to anticipate than is typically the case. Hiring has ground nearly to a halt, yet inflation remains elevated, and the economy’s mostly solid growth is heavily dependent on massive investment by leading tech companies in artificial intelligence infrastructure. The central bank is assessing these trends without most of the government data it uses to gauge the economy’s health. The release of September’s jobs report has been postponed because of the government shutdown. The White House said last week October’s inflation figure may not even be compiled. The shutdown itself may also crimp the economy in the coming months, depending on how long it lasts. Roughly 750,000 federal workers are nearing a month without pay, which could soon start weakening consumer spending, a critical driver of the economy. Federal workers laid off by the Trump administration’s Department of Government Efficiency efforts earlier this year may formally show up in jobs data if it is reported next month, which could make the monthly hiring data look even worse. Powell has said that the risk of weaker hiring is rising, which makes it as much of a concern as still-elevated inflation. As a result, the central bank needs to move its key rate closer to a level that would neither slow nor stimulate the economy. Most Fed officials view the current level of its key rate — 4.1% — as high enough to slow growth and cool inflation, which has been their main goal since price increases spiked to a four-decade high three years ago. The Fed is widely expected to reduce it to about 3.9% Wednesday. WIth job gains at risk, the goal is to move rates to a less-restrictive level. Kris Dawsey, head of economic research at D.E. Shaw, an investment bank, said that the lack of data during the shutdown means the Fed will likely stay on the path it sketched out in September, when it forecast cuts this month and in December. “Imagine you’re driving in a winter storm and suddenly lose visibility in whiteout conditions,” Dawsey said. “While you slow the car down, you’re going to continue going in the direction you were going versus making an abrupt change once you lose that visibility.” In recent remarks, the Fed chair has made clear that the sluggish job market has become a signficant concern. “The labor market has actually softened pretty considerably,” Powell said. “The downside risks to employment appear to have risen.” Before the government shutdown cut off the flow of data Oct. 1, monthly hiring gains had weakened to an average of just 29,000 a month for the previous three months. The unemployment rate ticked up to a still-low 4.3% in August from 4.2% in July. Layoffs also remain low, however, leading Powell and other officials to refer to the “low-hire, low-fire” job market. At the same time, last week’s inflation report — released more than a week late because of the shutdown — showed that inflation remain elevated but isn’t accelerating and may not need higher rates to tame it. Yet a key question is how long the job market can remain in what Powell has described as a “curious kind of balance.” “There have been some worrisome data points in the last few months,” said Stephen Stanley, chief U.S. economist at Santander, an investment bank. “Is that a weakening trend or are we just hitting an air pocket?” The uncertainty has prompted some top Fed officials to suggest that they may not necessarily support a cut at its next meeting in December. At its September meeting, the Fed signaled it would cut three times this year, though its policymaking committee is divided. Nine of 19 officials supported two or fewer reductions. Christopher Waller, a member of the Fed’s governing board and one of five people being considered by the Trump administration to replace Powell as Fed chair next year, said in a recent speech that while hiring data is weak, other figures suggest the economy is growing at a healthy pace. “So, something’s gotta give,” Waller said. “Either economic growth softens to match a soft labor market, or the labor market rebounds to match stronger economic growth.” Since it’s unclear how the contradiction will play out, Waller added, “we need to move with care when adjusting the policy rate.” Waller said he supported a quarter-point cut this month, “but beyond that point” it will depend on what the economic data says, assuming the shutdown ends. Financial markets have put the odds of another cut in December at above 90%, according to CME Fedwatch — and Fed officials have so far said little to defuse that expectation. Jonathan Pingle, chief U.S. economist at UBS, said that he will look to see if Powell, at a news conference Wednesday, repeats his assertion that the risks of a weaker job market remain high. “If I hear that, I think they’re on track to lowering rates again in December,” he said.