By Bedirhan Demirel,Contributor,Paul Weinstein Jr

Copyright forbes

At its September 17th meeting the Federal Reserve lowered interest rates as expected by 25 basis points. The decision was almost unanimous (11 to 1 in favor), a rare exhibition of consensus in these days of hyper-partisanship.

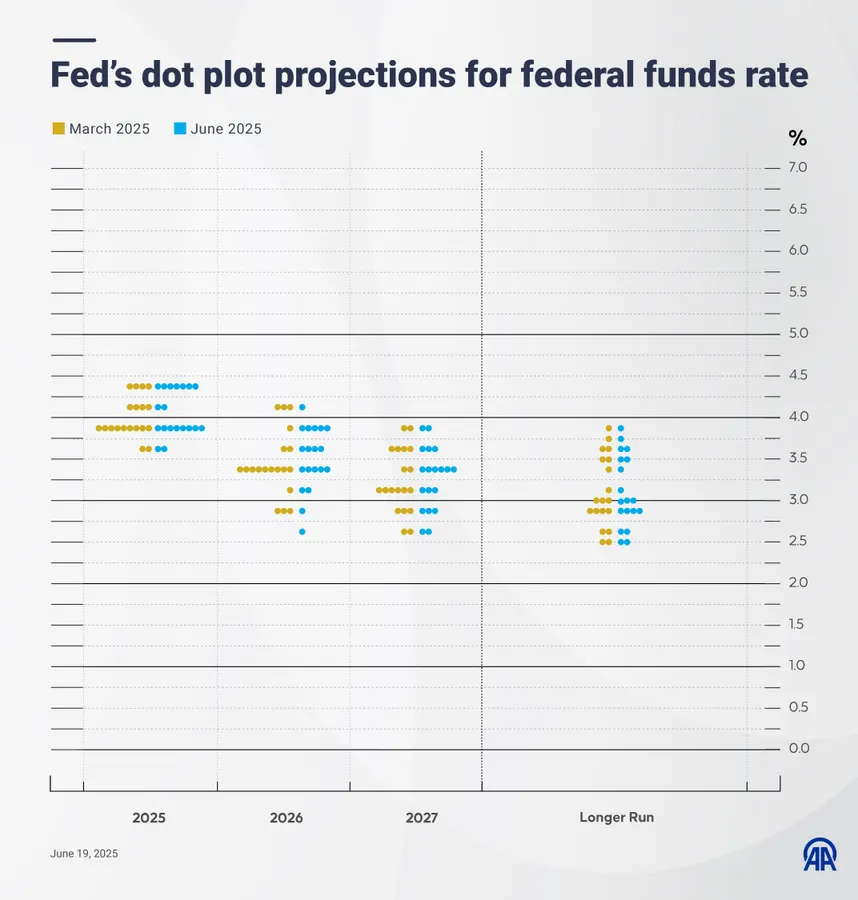

However, no one should be fooled into thinking the Fed is unified about the future direction of interests rates. In fact, a quick review of the central bank’s dot plot underscores just how divided the Fed Governors are on the question of whether to cut interest rates (and by how much) over the next 12 months.

The dot plot visually represents where the Fed’s most senior policymakers think the federal funds rate is headed. The Fed has published the dot plot quarterly since 2012 as part of its drive toward transparency and to try to remove uncertainty about future interest rate policy.

In March, there was a strong consensus around rate cuts for the rest of 2025 among members of the Federal Open Market Committee (FOMC). Thirteen members of the FOMC predicted 1 or 2 more rate cuts with only 4 members foreseeing no rate change. Importantly, no one predicted rates dropping more than 50 basis points by the end of 2025.

In June, divisions among the Federal Open Market Committee – which sets the federal funds rate (the amount of interest that banks charge each other when borrowing overnight and the key lever of U.S. monetary policy) – began to widen. At that time, the dot plot still showed a majority of Fed policymakers (8) believed that rates would be cut twice more in 2025. However those who saw rates remaining the same jumped to 7 members, indicating a more hawkish position for the Fed and raising the ire of the current administration.

An infographic titled “Fed’s dot plot projections for federal funds rate” June 19, 2025. (Photo by Bedirhan Demirel/Anadolu via Getty Images)

Anadolu via Getty Images

MORE FOR YOU

Today’s release of the third quarter dot plot underscored even greater disparity on rate policy for the rest of 2025. Nine of the 19 participants indicated just one more reduction this year, while 10 saw two, which would suggest more rate cuts at the FOMC’s October and December meetings.

In addition, only one official called for no cuts, while another member of the FOMC thought the central bank should cut rates by an additional 1.25% percentage point by the end of 2025.

Because the dot plot is anonymous we don’t know for sure which member of the FOMC made each of these predictions. But given calls by the Administration for a significant cut in interest rates, it seems likely it was made by one of the President’s recent appointments. What also seems likely is that all things being equal, the Fed is now ready to embrace a more neutral, and possibly even a more accommodative policy on interest rates for the rest of 2025.

Editorial StandardsReprints & Permissions