Copyright ABC17News.com

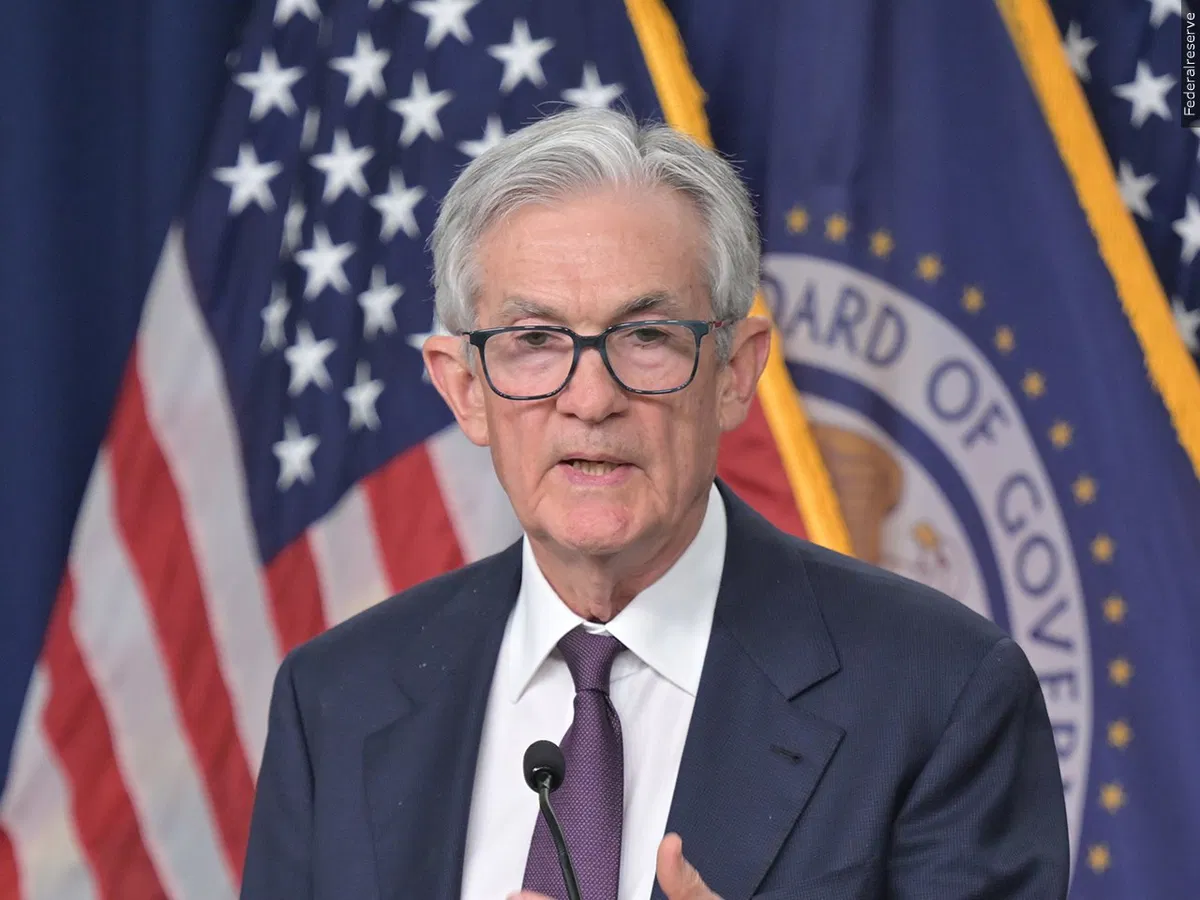

Analysis by Bryan Mena, CNN Washington (CNN) — The Federal Reserve on Wednesday lowered interest rates for the second time this year in a continued bid to prevent unemployment from surging. Fed officials voted for another quarter-point rate cut, lowering their benchmark lending rate to a range between 3.75% and 4%, the lowest in three years. It is the first time since the Fed’s rate-setting committee was established in the 1930s that officials have set monetary policy while lacking an entire month of crucial government employment data due to a government shutdown. The government data blackout comes at an inconvenient time for policymakers as they remain divided over how President Donald Trump’s sweeping policies on trade, immigration and spending are affecting the US economy. Wednesday’s decision drew two dissents; one from Fed Governor Stephen Miran, who backed a larger, half-point cut; and another from Kansas City Fed President Jeffrey Schmid, who preferred to hold borrowing costs steady. Miran, a close Trump ally, also dissented in September in favor of a half-point cut. Central bankers began to lower rates last month after data through August showed employers were adding jobs at the weakest pace since 2010. Major companies such as Amazon and Target have recently announced tens of thousands of layoffs. Fed Chair Jerome Powell warned last month that the combination of rising layoffs and weak job growth “could very quickly flow into higher unemployment.” But the Fed doesn’t have the full picture of the labor market’s health without government data, which would inform officials whether they should continue with quarter-point cuts or shift into a higher gear with a half-point cut. Data from payroll software provider ADP released this week showed that hiring picked up in September, but remained weak. Fed officials said in their latest policy statement that “available indicators” have continued to show weak hiring. At the same time, a continued lack of government statistics could also make additional rate cuts more difficult, preventing any further relief for Americans. The inflation situation also remains murky. So far, inflation hasn’t surged due to new tariffs that have gone into effect, according to the latest Consumer Price Index, largely thanks to businesses managing higher costs without passing the buck to consumers. But economists widely expect that to not last for much longer, especially if Trump makes good on his recent tariff threats. The September CPI, which was released last week despite the shutdown for Social Security’s cost-of-living adjustment, was cooler than economists had predicted, but it showed persistent price pressures that could worsen because of Trump’s tariffs. Trump is meeting with his Chinese counterpart Xi Jingping late Wednesday US time for a wide-ranging discussion in South Korea, which will likely include a potential US-China trade deal. Some Fed officials have said that tariff inflation may be short lived, which helped pave the way for September’s rate cut. But that would also remain unclear if the October CPI, which is scheduled for November 13, isn’t released because the shutdown persisted. Fed officials normally look to the Personal Consumption Expenditures price index, widely known as their preferred inflation measure, but that figure also hasn’t been released due to the shutdown. In a separate decision, policymakers announced the end of a three-year process to shrink the size of their enormous portfolio by December 1. The Fed’s portfolio, or balance sheet, reached about $9 trillion in mid-2022, but is now around $6.6 trillion after a careful effort to reverse the stimulus it introduced into the economy during the Great Recession and the Covid-19 pandemic. It’s a tool that works in the background while the Fed’s key interest rate does much of the heavy lifting to achieve its macroeconomic goals. Officials have judged that the balance sheet is close to a more normal state.