It may feel like efficiency, but it is also a crack for fraudsters to slip through. If an operator is already stressed with a heavy workload, he or she may not feel there is enough time to confirm identity, validate insurance, or cross-check safety requirements. The very pressure that drives competition, whether scarcity in a down market or urgency in a hot one, become the conditions that allow fraud to flourish.

Speed as Vulnerability

The fifteen-minute rule is only one example of how speed becomes a vulnerability. Across the supply chain, the demand to move fast weakens every layer of defense. At the dock, the gate staff are told to load quickly, because man hours effects P&L. A driver shows up with a bill of lading and a rate confirmation that looks correct, and the shipment is released. Too few facilities pause to cross-check the driver’s identity with the broker, and this is how fictitious pickups have surged. CargoNet reported a sixty percent increase in these incidents in 2023, with average losses exceeding $200,000 per case (CargoNet 2024).

Digital communications carry the same risk, as brokers conditioned to measure success in minutes are more likely to miss small anomalies in email addresses. A spoofed email address with one altered character, a cloned signature block, or forged insurance certificates can pass un-noticed when the process is to cover a load before the clock is up. The faster the work, the easier the fraud.

The Trap of Cheap

If speed lowers defenses, cheapness invites fraudsters right through the door. The spot market has conditioned shippers to expect bargain rates and brokers to reward the lowest bidders. The obsession with cost creates an environment for scams to flourish.

Double brokering is the most common scheme: a fraudulent actor accepts the load at slightly below market rate, and then re-brokers it at a further discount to another carrier. Often, the truck never arrives because the fraudulent actor never had the capacity to cover it. In other cases, the freight is picked up in the wrong equipment, transloaded en route, or co-mingled with other shipments. Whatever the variation, the result is the same: the fraudster takes the money and vanishes, while the legitimate broker, carrier, or shipper is left with the loss. The Transportation Intermediaries Association (TIA) reported that fraud tied to double brokering now costs the industry hundreds of millions of dollars annually (TIA 2023).

Identity theft is another byproduct of cheapness. Fraudulent carriers undercut legitimate rates, knowing that brokers focused on cost will prioritize a low number over a trusted relationship. The Commercial Carrier Journal (CCJ) documented a twenty-seven percent rise in fraudulent activity in 2024 over 2023, much of it tied to low-ball bids and stolen MC numbers (CCJ).

Legitimate carriers also suffer from the price trap. Operating at unsustainable rates forces them to defer maintenance, reduce insurance coverage, or cut compliance corners. Those weaknesses make it harder for brokers to distinguish between struggling carriers and outright fraudsters. And when the primary measure of value is price, credibility too often becomes secondary.

Competition as a Breeding Ground

The reason speed and cheapness dominate the spot market is competition. Every player knows the hesitation means losing to someone else, and a broker who takes too long to vet a carrier may risk losing the customer. A carrier who bids too high risks losing the load. The system itself punishes caution.

Fraudsters exploit this competitive environment by mirroring the same qualities that win legitimate businesses. They respond instantly, often faster than real carriers can, and they price below market, sometimes unsustainably. They deliver documents that look polished and professional, and they do it in a flash. In a system where fast and cheap are proof of value, fraudsters slip through the cracks, and once the freight is gone, the damage is done, the cost always outweighs the savings.

The numbers confirm the pattern. According to Truckstop’s Broker Insight Survey of more than 700 brokers, two-thirds of brokers say fraud is a top-of-mind issue and 86 percent of those who have experienced it identify double brokering as the top threat (DC Velocity). The FMCSA also continues to warn about “chameleon carriers,” which are entities that dissolve after fraud investigations and reappear under new entities that attract desperate brokers and shippers (FMCSA 2024). Each of these schemes thrive because the market rewards shortcuts.

New technologies are often marketed as the solution to fraud, but in reality, are often used to let people move faster, meaning they become the shortcuts in themselves. Carrier verification platforms allow brokers and carriers to validate one another instantly, cutting down on time it would take to vet a partner manually. CargoNet has built alert systems that push out fraud warnings in real time to help brokers avoid repeat offenders. FMCSA’s SaferWatch and similar databases, free and paid, all provide snapshots of carrier safety and authority. These tools all promise speed and confidence, but their integration is still lacking. A broker may have access to several systems, yet each one exists in its own silo. Logging in separately, reconciling data, and piecing together a full picture takes time that operators under fifteen-minute clock do not have.

That gap creates a false sense of security. A load may be cleared in one system, but red flags exist in another, and a fraudster only needs to pass through the one tool that is most checked. The issue is not only that integration is lacking, but also that new programs keep emerging faster than people can keep up. There are AI engines promising real-time fraud detection, new carrier validation programs, and payment security systems rolling out almost weekly. Each one arrives with the same promise: it will make the process faster and safer. But the more systems there are, the more fragmented the process becomes. Operators under pressure do not always have the time to cycle through a half a dozen platforms, and the fraudsters know it. They only need to slip past one tool, or one inexperienced broker.

The Cost of Shortcuts

It looks efficient in the moment, but fast and cheap create hidden costs that are devastating. A vanished load means re-delivery charges, insurance disputes, and fractured customer trust. Operations teams will lose hours on investigations instead of covering freight, and margins that looked solid evaporate in a single issue. And while they are tied up untangling one issue, their guard is lowered for the next.

The cost of fraud is not just measured in dollars but in reputation, which is why so many cases are kept quiet and resolved out of sight. Brokers associated with repeated fraud incidents find it harder to win new business or attract quality carriers. Carriers with reported fraud may not be able to get awarded new broker loads, depending on the platform on which it was reported. Shippers who experience fraud through either are less likely to trust that carrier or broker again. What looks like a quick victory easily turns into a long-term loss.

Toward a Culture of Caution

The spot market will never stop being competitive, speed and cost will always matter, but if they are treated as the only measures of success, fraud will continue to flourish. The industry must reset its expectations. These cannot remain the standards for decision making when the stakes are this high.

There are solutions. Technology now makes real-time identity verification possible, with tools that can validate a carrier in under two minutes. Shippers are beginning to reward brokers not only for saving money but for protecting freight. Brokers are training teams to slow down at critical decision points, even if it means losing a load, because the long-term cost of fraud is greater than the short-term cost of caution. CargoNet has urged brokers to treat the fifteen-minute clock as a warning rather than a standard, pointing out that most high-value fraud cases exploit rushed booking decisions (CargoNet 2024). FMCSA has encouraged consistent reporting of fraudulent activity to improve visibility and disrupt repeat offenders (FMCSA 2024).

The spot market may always be the most volatile corner of freight, but volatility does not have to mean vulnerability. The industry can compete with service, security, and trust as well as speed and price.

Conclusion

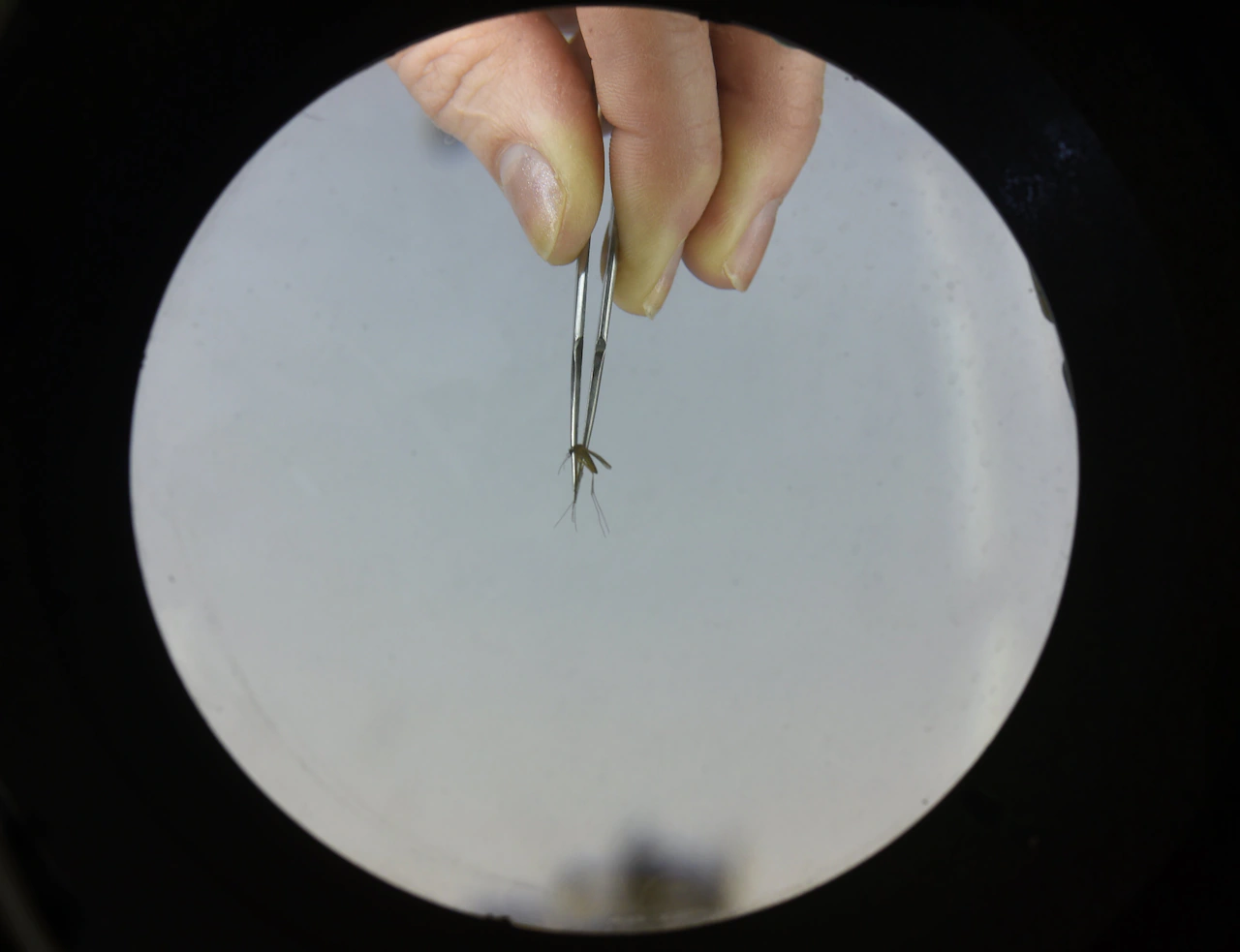

The spot market is the petri dish where the majority of freight fraud sprouts, and it has taken root because the industry keeps feeding it shortcuts instead of real solutions that require time and effort. Sometimes the pressure comes from too many trucks chasing too little freight, and sometimes it comes from too much freight chasing too few trucks. But in both cases the outcome is the same: the expectation of booking quickly, combined with the obsession with the lowest rate, strips away the safeguards that prevent fraud.

Fraudsters exploit those same pressures, thriving in the cracks of a system that values instant responses and bargain prices above all else. The lesson is clear: fast and cheap are not strengths, they are the shortcuts that fuel fraud.

The only way forward is to slow down when it matters. That doesn’t mean not embracing technology, but it does mean building a strong base around it. Every operation should have a written standard operating procedure to prevent fraud, that defines how carriers are vetted, how identities are confirmed, and how fraud cases are escalated when suspicion arises. Training operators to follow these steps consistently is the real defense. Tools and platforms support the process, but they cannot replace it. Without procedures and training, technology becomes just another shortcut.

Fraudsters don’t have to be brilliant; they just have to mirror the behaviors the market rewards. When brokers and shippers are conditioned to see that as efficient, the conditions for fraud are already in place. Speed and price should not be the measure of success, when they are actually the weakest links in the chain. Acquiring a new customer can cost five to twenty-five times more than retaining an existing one (Harvard Business Review 2014). But winning a customer back after fraud is not just difficult, it is one of the most expensive forms of business you will ever do. Once a trust by fraud is broken, earning back costs more than any discount saved.