Copyright investors

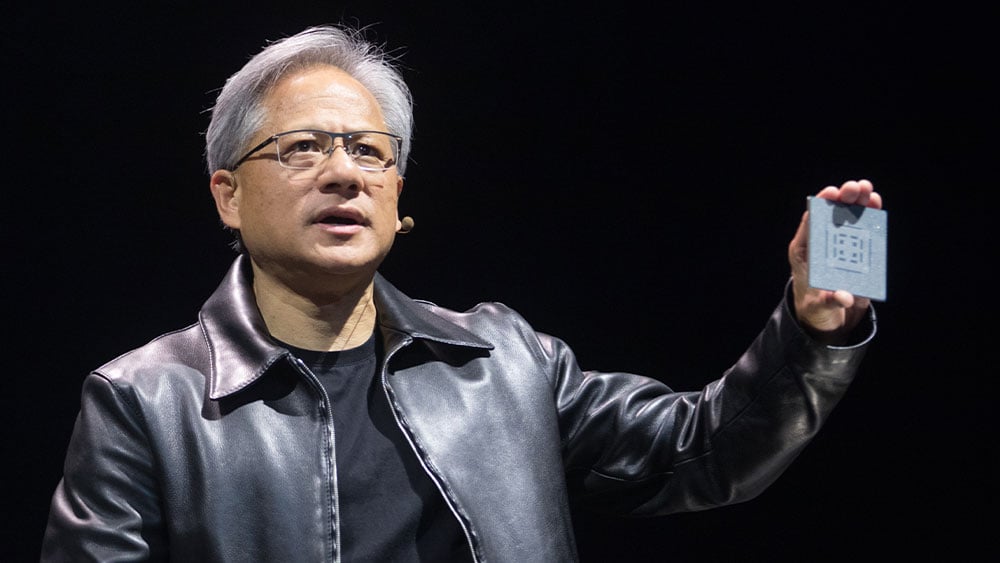

Dow Jones futures were little changed after hours, along with S&P 500 futures and Nasdaq futures. The latest Federal Reserve meeting announcement is on tap, along with earnings and guidance from tech titans Microsoft (MSFT), Meta Platforms (META) and Google-parent Alphabet (GOOGL). Seagate Technology (STX), Visa (V) and Bloom Energy (BE) headlined Tuesday night earnings. The stock market rally the major indexes all hit fresh highs on Tuesday, though small caps fell. Dow giant Nvidia (NVDA) jumped 5%, nearing a $5 trillion market cap, as CEO Jensen Huang unveiled new products at the company's GTC 2025 event. Broadcom (AVGO) broke out on Tuesday. So did SoFi Technologies (SOFI), after wavering initially on earnings. Tesla stock is moving toward a buy point, still in range of an early entry. Broadcom stock and Tesla (TSLA) are on Leaderboard. Microsoft stock is on the IBD Long-Term Leaders list. Nvidia, SoFi and Google stock are on the IBD 50. Broadcom and Nvidia stock are on the IBD Big Cap 20. Broadcom was Tuesday's IBD Stock Of The Day. The video embedded in the article reviewed MongoDB (MDB), Nu Holdings (NU) and SoFi stock. Dow Jones Futures Today Dow Jones futures were little changed vs. fair value, along with S&P 500 futures. Nasdaq 100 futures edged higher. Remember that overnight action in Dow futures and elsewhere doesn't necessarily translate into actual trading in the next regular stock market session. Key Earnings Overnight Seagate stock rose solidly in overnight trade after earnings beat. The memory play is consolidating after a huge run. Rival Western Digital (WDC) reports Thursday. WDC stock climbed late. Visa stock edged higher in extended action after earnings narrowly topped expectations. The Dow Jones credit card giant has been finding support at all of its moving average, is in a flat base going back to June with a 375.51 buy point. Investors could use 355 as an early entry. Archrival Mastercard (MA) is due early Wednesday. MA stock is in a base but below its 50-day. Bloom Energy stock surged overnight as earnings solidly beat. BE stock has skyrocketed in the past few months, recently rebounding of its 21-day line again. Verizon (VZ), Boeing (BA), Caterpillar (CAT), Etsy (ETSY) and Guardant Health (GH) are due before Wednesday's open. Fed Rate Cut, Then What? The Federal Reserve is a lock to cut interest rates by 25 basis points at 2 p.m. ET Wednesday. The real question is whether Fed chief Jerome Powell will signal that cuts will continue, at least in December. Markets expected another move, but policymakers are deeply divided. Stock Market Rally The stock market rally saw the Dow, S&P 500 and Nasdaq hit record highs for a third straight session, buoyed by megacaps Tesla, Microsoft, Broadcom and Nvidia. But breadth was narrow. The Dow Jones Industrial Average climbed 0.3% in Tuesday's stock market trading. The S&P 500 index advanced 0.2%. The Nasdaq composite popped 0.8%. The small-cap Russell 2000 fell 0.5% and the Invesco S&P 500 Equal Weight ETF (RSP) declined 0.9%. Both hit record highs on Monday. Wayfair (W), Celestica (CLS), Cameco (CCJ) and ATI Inc. (ATI) gapped up on earnings or news. The Nasdaq is now 6.7% above its 50-day line, somewhat extended. That raises the risks of a pullback, though the Nasdaq could certainly go higher. U.S. crude oil prices fell 1.9% to $60.15 a barrel. The 10-year Treasury yield dipped one basis point to 3.98%. Among growth ETFs, the Innovator IBD 50 ETF (FFTY) dipped 0.2%. The iShares Expanded Tech-Software Sector ETF (IGV) declined 0.4%, with Microsoft stock a huge component. The VanEck Vectors Semiconductor ETF (SMH) rose 0.9%, with Nvidia stock and Broadcom both huge holdings. ARK Innovation ETF (ARKK) fell 1% and ARK Genomics ETF (ARKG) slid 2.3%. Tesla stock is the No. 1 holding across ARK Invest's ETFs. SPDR S&P Metals & Mining ETF (XME) climbed 0.6%. The Energy Select SPDR ETF (XLE) retreated 1% and the Health Care Select Sector SPDR Fund (XLV) shed 0.6%. The Industrial Select Sector SPDR Fund (XLI) gave up 0.7%. The Financial Select SPDR ETF (XLF) shed 0.6%. Tech Titans' Earnings, AI CapEx Key Microsoft, Meta and Google all report Wednesday night, all expected to deliver solid profit growth. Guidance will be key. Microsoft stock is closing in on a shallow cup-base buy point, rising Tuesday on an expanded OpenAI cloud-computing deal. Meta stock has peeked above the 50-day line in a double-bottom base. Google stock is slightly extended from a short consolidation. For the broader stock market, the trio's AI monetization efforts and massive capital spending outlooks will be critical for the AI trade. That includes Broadcom and Nvidia. AVGO stock rose 3% to 327.97 on Tuesday, clearing a 363.24 cup-with-handle buy point, according to MarketSurge. Best Growth Stocks To Buy And Watch Tesla Stock Tesla stock rose 1.8% to 460.60, closing in on a 470.75 handle buy point on a 10-month consolidation. Shares are still in range from a 451.68 early entry. TSLA stock has ultimately powered higher following an earnings miss as investors cheer Elon Musk's continued optimism about self-driving and more. SoFi stock popped 5.6% to 31.67, clearing a 30.30 buy point after initially wavering on strong earnings and guidance. The buy zone extends to 31.82. The relative strength line hit a new high, a bullish sign. What To Do Now The stock market rally is at record highs. A modest number of stocks are flashing buy signals, but investors have had opportunities to add exposure over the past several days via individual stocks as well as broad market and sector ETFs. Still, the avalanche of news in the coming days is a reason to not get too aggressive. The Fed rate outlook on Wednesday could be a nonevent for markets but don't count on that. Microsoft, Meta and Google earnings Wednesday night, followed by Apple (AAPL) and Amazon (AMZN), could be a huge positive or negative catalyst, especially for the broad AI ecosystem. On Friday, President Donald Trump and Chinese President Xi Jinping are set to meet. Investors are counting on at least a trade truce. So investors should stay engaged and flexible, ready to add or reduce exposure in the coming days. So have your watchlists and exit strategies up to date. Read The Big Picture every day to stay in sync with the market direction and leading stocks and sectors. Please follow Ed Carson on Threads at @edcarson1971 and X/Twitter at @IBD_ECarson for stock market updates and more. YOU MAY ALSO LIKE: Why This IBD Tool Simplifies The Search For Top Stocks