Copyright scmp

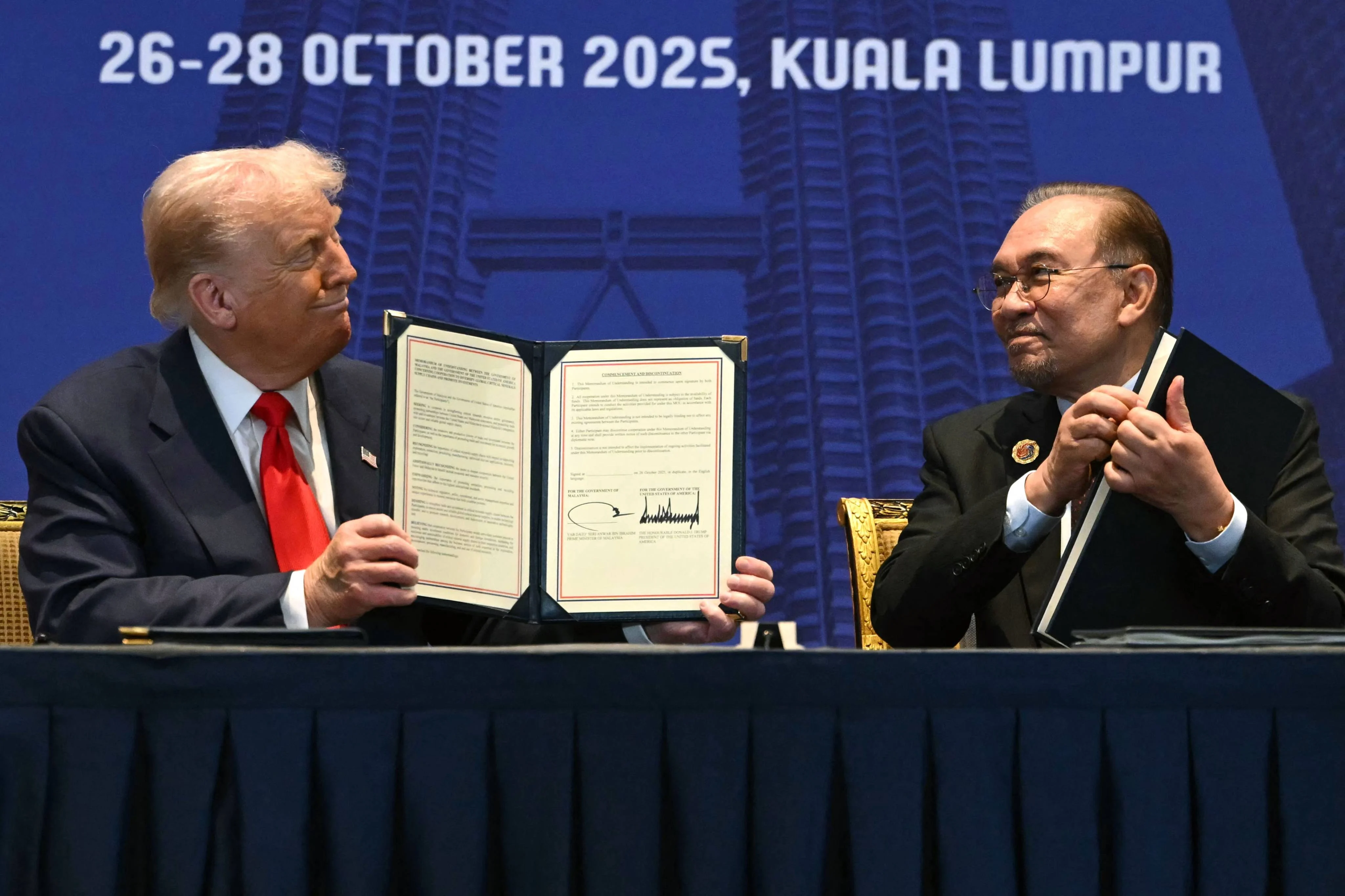

The deals that US President Donald Trump sealed with several Asean partners in Kuala Lumpur earlier this week are what critics have called a “mixed blessing” that could lead to long-term economic costs outweighing short-term trade benefits. The American leader closed deals on trade and critical minerals with four members of the Association of Southeast Asian Nations on Sunday, including reciprocal agreements with Malaysia and Cambodia, and pacts with Thailand and Vietnam to address trade barriers. Washington maintained the 19 to 20 per cent tariffs it had imposed on these countries, but allowed for certain concessions, such as zero per cent tariffs on certain products and more commercial deals in exchange for wider market access for American goods. Malaysia managed to secure zero tariffs on certain products, including aerospace equipment, pharmaceuticals and key commodities such as palm oil, cocoa and rubber. Details on lower or zero levies for Thailand and Cambodia have yet to be released. Trump did not address his previous threat of imposing a 100 per cent tariff on semiconductors, as well as 40 per cent on transshipments, with the latter aimed at curbing US goods from being exported to China via Asean. The US concessions at the Asean summit, including limited tariff reliefs, are largely incremental, according to analysts. For Malaysia, Thailand, Cambodia and Vietnam, these deals offer short-term market access. However, they do not significantly alter a global trade landscape dominated by tariffs and non-tariff barriers, analysts say. The deals were more advantageous for the US than for the four Asean members, “as they now face increased imports of US agricultural and industrial products and commitments that favour American exporters”, Vu Lam, a policy analyst and Asean observer, told This Week in Asia. Lam called the agreements with Trump “more a tactical respite than a transformative shift, providing some immediate gains but falling short of a deeper, long-term economic reset for the region”. Joanne Lin, a senior fellow and coordinator at the ISEAS-Yusof Ishak Institute’s Asean Studies Centre, said that the tariff concessions “may look like good news on the surface, especially for export-driven economies like Vietnam, Malaysia, and Thailand that rely heavily on access to the US market, but they do come with strings attached”. Lin added that the reciprocal trade deals were narrow in scope, benefitting specific product lines such as semiconductors and apparel, and requiring Asean partners to open their markets more widely to US exports and reduce non-tariff barriers. In effect, Washington gets both the political optics of tariff relief and commercial advantages for US industries Joanne Lin, ISEAS-Yusof Ishak Institute’s Asean Studies Centre “In effect, Washington gets both the political optics of tariff relief and commercial advantages for US industries,” she said. Kevin Chen, an associate research fellow at the S. Rajaratnam School of International Studies, said that while the deals contained “some good news … the costs are far more prominent than the benefits that these Southeast Asian countries gain”. Chen referred to estimates by British bank Barclays that the tariff exemptions for Malaysia “would only cover a modest fraction of their exports to the US, in exchange for commitments to purchase hundreds of billions of dollars’ worth of US goods”. Barclays’ estimates show that tariff exemptions for Malaysia apply to over US$12 billion of its US-bound exports, but in reality, only US$1 billion worth of exports would receive zero tariffs. “This appears to be the cost of doing business with the current administration in the United States,” Chen said. Calling the deals “a mixed blessing”, Lin said: “They provide short-term relief and certainty for some sectors, but the commitments could also expose domestic industries to competitive pressures and complicate Asean’s collective trade approach.” On Sunday, deals to diversify supply chains for critical minerals were high on Trump’s agenda after China expanded export controls on rare earths earlier this month. He signed deals with Thailand and Malaysia, with Kuala Lumpur committing “to refrain from banning, or imposing quotas on, exports to the United States of critical minerals or rare earth elements”. Lin said the deals on critical minerals were targeted at securing supplies for key tech products, including electric vehicles, batteries and semiconductors. “Given China’s dominant position in controlling global rare earth supplies, the US-led efforts to diversify and secure alternative supply chains with Asean partners signal a strategic push to reduce dependency on China,” Lam said. Trump: one-on-one versus collective Trump’s deal-making at the summit signalled that he did not view Asean as a collective bloc, given his preference for bilateral pacts in line with his “America First” agenda, according to analysts. Lin said: “His preference for bilateral, transactional agreements, rather than engaging Asean as a collective, reflects how he views Southeast Asia primarily through an economic and political optics lens, not an institutional one.” The president’s approach could contribute to deeper fragmentation within Asean’s trade landscape “if not managed carefully”. Lam agreed and said the deals Trump signed revealed a “transactional, state-by-state approach aligning with his ‘America First’ agenda”. Nonetheless, Chen said Trump’s first visit to the region in years was aimed at redefining Washington’s trade ties with its partners after he skipped the Asean summit from 2018 to 2020 following his first attendance at the bloc’s meeting in 2017 during his first term. “While the deals struck with Southeast Asian countries might disproportionately favour the US, at the very least they give a shred of clarity as to Mr Trump’s intentions for the region,” he said. “Mr Trump’s coercive approach might make for a less-than-desired narrative for the region’s economies, but it is better than the uncertainty of an absent narrative.” Lin said Trump’s participation indicated that the US remained “100 per cent committed” to Asean. “For many in the region, it offered reassurance that Washington is not retreating from Southeast Asia altogether. Trump may not be strengthening institutions, but his presence and outreach signal that he sees value in Asean as a platform for visibility and influence.”