Denton County Approves Budget with Lower Property Tax, Boosts in Public Safety and Judicial Funding, Prioritizes Workforce Retention

By Sofia Vasquez

Copyright hoodline

In a move that’s sure to please Denton County residents, the Fiscal Year 2025-2026 adopted budget is ushering in a property tax rate decrease, funding boosts for public safety and judicial services, and a continued emphasis on maintaining competitive employee salaries without accruing new debt. According to a statement on the Denton County official website, the new property tax rate will be set at $0.185938, down from the previous year’s $0.187869.

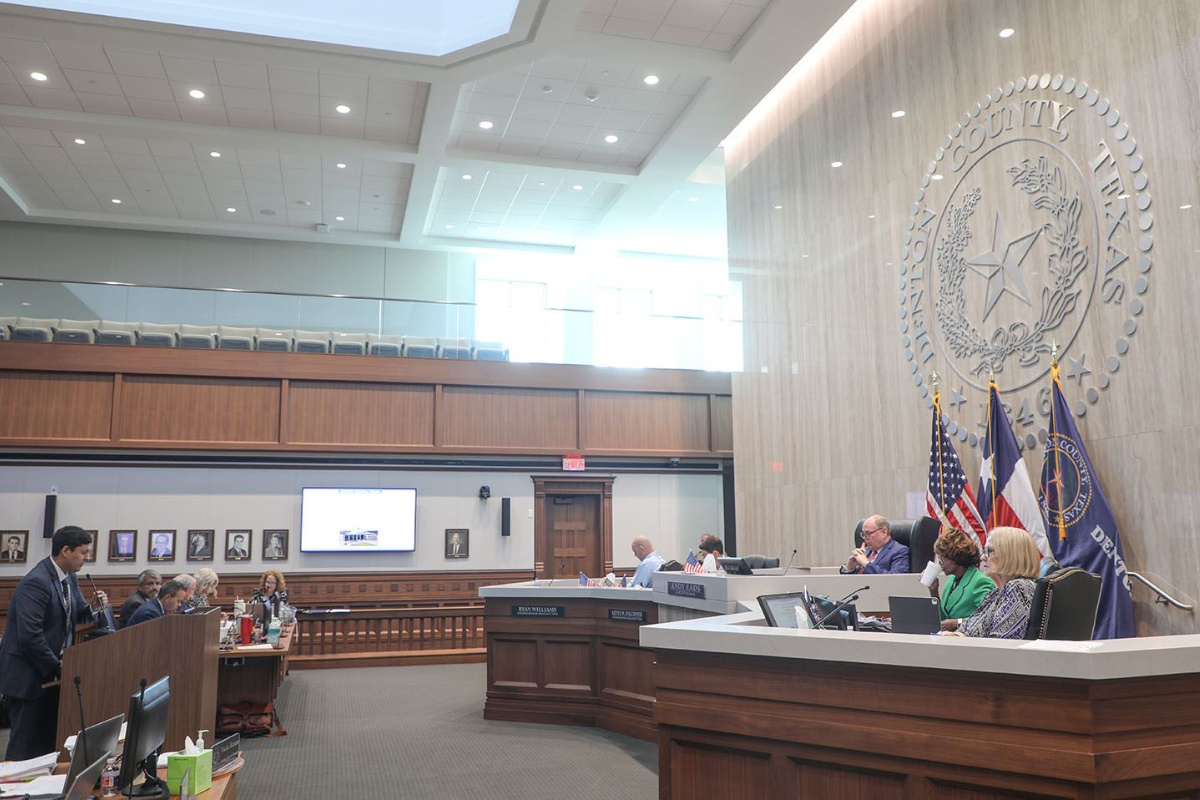

This adopted budget also prioritizes operational efficiency and long-term financial health, setting aside $7.5 million for pay-as-you-go projects, allocating funds for preventative maintenance to county facilities, and investing in technology upgrades and competitive salaries to attract and retain staff, the pressure to address the needs of a growing population remains high with almost 90 new residents arriving daily though the county holds a strong commitment to these core aspects of governance, as noted by Denton County Judge Andy Eads who emphasized the dual focus on improvement and preparedness for the future.

Dedicated funds include an estimated $11.12 million and $5.39 million to bolster public safety and judicial/legal divisions, respectively, representing significant investments in critical county functions. As highlighted in the county’s announcement, Precinct 1 Commissioner Ryan Williams specifically emphasized the need for competitive salaries to ensure high-quality service from both existing employees and recruits.

A notable aspect of the budget is its proactive allocation of $4.7 million for preventative maintenance and $1.83 million for Technology Services, including new positions and software maintenance, demonstrating a forward-thinking approach to county infrastructure and operations and as Precinct 2 Commissioner Kevin W. Falconer said, this readiness to address today’s issues positions Denton County well in terms of both immediate needs and future demands, striking a balance between expansion of services and maintaining a low tax rate—a key objective echoed across the Commissioners Court’s actions.