When it comes to financial experts that retail traders recognize from spending hours on social media or watching CNBC, Tom Lee and Dan Ives are among the most well-known names.

Both Ives and Lee have many things in common, including being the names and brains behind new ETF launches.

Here’s a look at the artificial intelligence stocks that Ives and Lee have in common across their ETFs.

See Also: 3 Stocks To Buy According To This 70-Year Market Secret

The 13 Artificial Intelligence Stocks

Lee helped launch the Granny Shots US Large Cap ETF (NYSE: GRNY) in late 2024. Ives is behind the Dan Ives Wedbush AI Revolution ETF (NYSE: IVES), which launched earlier this year.

A review of the Wedbush AI Revolution ETF shows 30 holdings. Thirteen of the stocks belong in the Granny Shots US Large Cap ETF.

Here are the 13 stocks owned by both the Wedbush AI Revolution ETF and Granny Shots US Large Cap ETF.

Tesla Inc (NASDAQ: TSLA): Largest holding in GRNY at 3.2%, largest holding in IVES at 5.3%

Alphabet Inc (NASDAQ: GOOGL): Second largest holding in GRNY at 3.0%, third largest holding in IVES at 4.7%

Palo Alto Networks (NASDAQ: PANW): Fourth largest holding in GRNY at 2.8%, 19th largest holding in IVES at 2.9%

Oracle Corp (NYSE: ORCL): Fifth largest holding in GRNY at 2.8%, sixth largest holding in IVES at 4.5%

CrowdStrike Holdings (NASDAQ: CRWD): Sixth largest holding in GRNY at 2.8%, 18th largest holding in IVES at 3.0%

Apple Inc (NASDAQ: AAPL): Eleventh largest holding in GRNY at 2.7%, fourth largest holding in IVES at 4.7%

Broadcom Inc (NASDAQ: AVGO): Seventeenth largest holding in GRNY at 2.6%, fifth largest holding in IVES at 4.6%

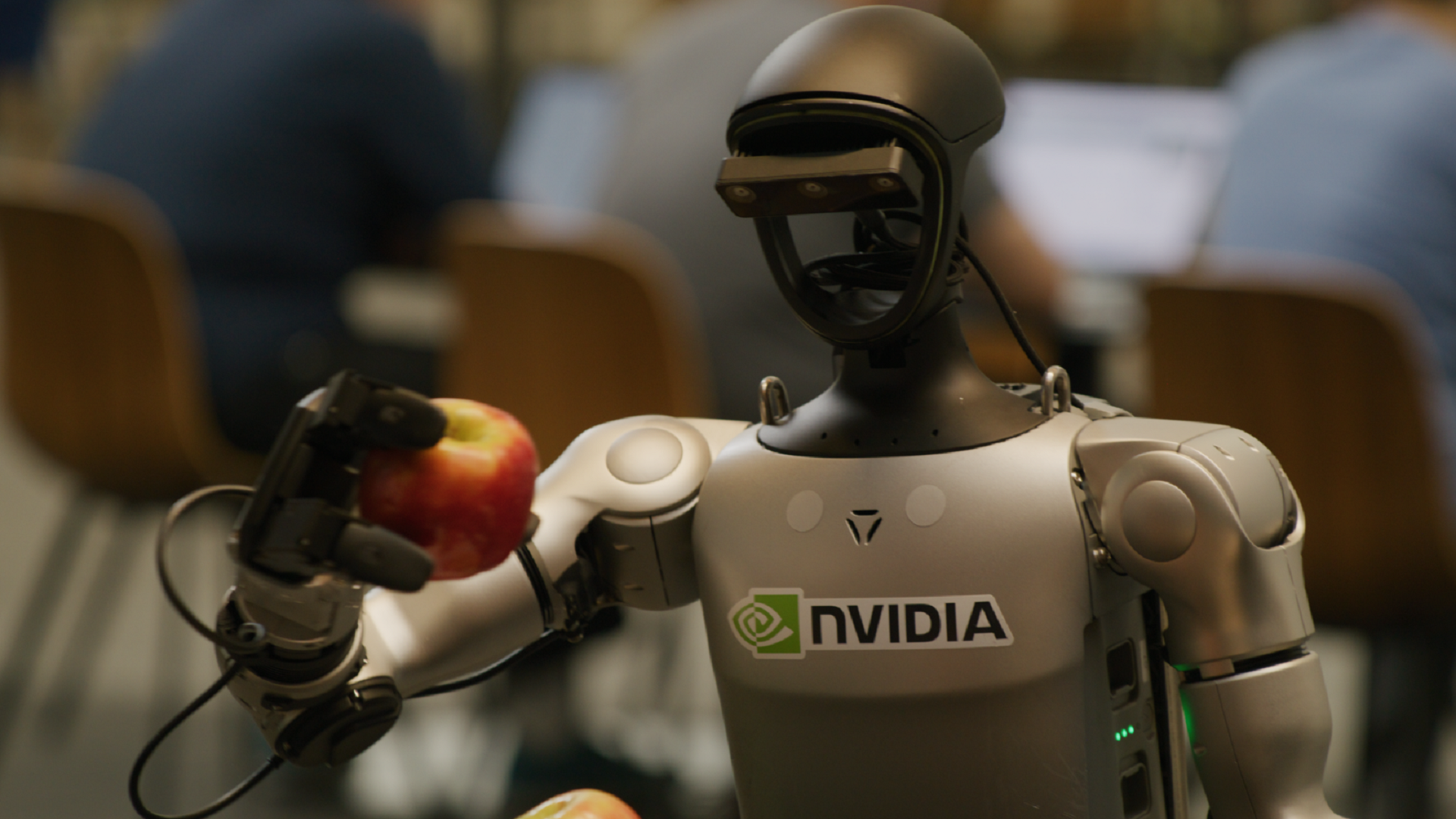

NVIDIA Corporation (NASDAQ: NVDA): Twenty-seventh largest holding in GRNY at 2.4%, eighth largest holding in IVES at 4.4%

Microsoft Corporation (NASDAQ: MSFT): Twenty-ninth largest holding in GRNY at 2.4%, ninth largest holding in IVES at 4.3%

Palantir Technologies (NASDAQ: PLTR): Thirtieth largest holding in GRNY at 2.4%, 12th largest holding in IVES at 4.0%

GE Vernova Inc (NYSE: GEV): 31st largest holding in GRNY at 2.4%, 20th largest holding in IVES at 2.9%

Amazon.com Inc (NASDAQ: AMZN): 33rd largest holding in GRNY at 2.3%, 11th largest holding in IVES at 4.0%

Advanced Micro Devices (NASDAQ: AMD): 37th largest holding in GRNY at 2.2%, 15th largest holding in IVES at 3.2%

When it comes to the biggest overlap, there are three stocks that are in the top 10 of both ETFs. Tesla, Alphabet and Oracle rank as the top shared bets between the two ETFs based on their position in the respective ETFs. Apple narrowly misses the cut at 11th in GRNY and fourth in IVES.

Read Also: Cathie Wood, Dan Ives Align On These 11 AI Stock Picks — Some Might Surprise You

ETF Themes

The Ives ETF focuses specifically on artificial intelligence stocks, with the Wedbush analyst calling AI the fourth Industrial Revolution.

Ives has discussed the “fourth industrial revolution” multiple times and assigned multi-billion or trillion-dollar opportunities for AI among several top stock picks like Tesla.

Earlier this year, Ives highlighted the Donald Trump administration and the AI Action Plan as being a key to AI growth going forward.

“We have barely scratched the surface of this 4th Industrial Revolution now playing out around the world led by the Big Tech stalwarts,” Ives said previously.

“The Dan Ives Wedbush AI Revolution ETF seeks to capitalize on the rapid growth of artificial intelligence by investing in companies poised to lead the AI transformation. This fund offers investors exposure to a diversified portfolio of firms at the cutting edge of AI technology,” the ETF’s website reads.

The Granny Shots ETF focuses on rules-based processes and highlights key themes believed to be good investment areas moving forward.

Current themes for the Granny Shots ETF include PMI recovery, energy stocks, cybersecurity stocks, labor suppliers, targeting millennials, and easing financial conditions.

Both ETFs are up over 25% year-to-date in 2025 and outperforming the 13.5% gain of the SPDR S&P 500 ETF Trust.

Read Next:

Beyond Magnificent 7: Can Thematic ETFs Like IVES Lead The Next Wave Of AI Investing? CIO Cullen Rogers Explains

Image: Shutterstock