By Alan Rutledge

Copyright indiatimes

Explore other editions

Curefoods pre-IPO dough; RBI’s new mandate

Want this newsletter delivered to your inbox?I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5We’ll soon meet in your inbox.

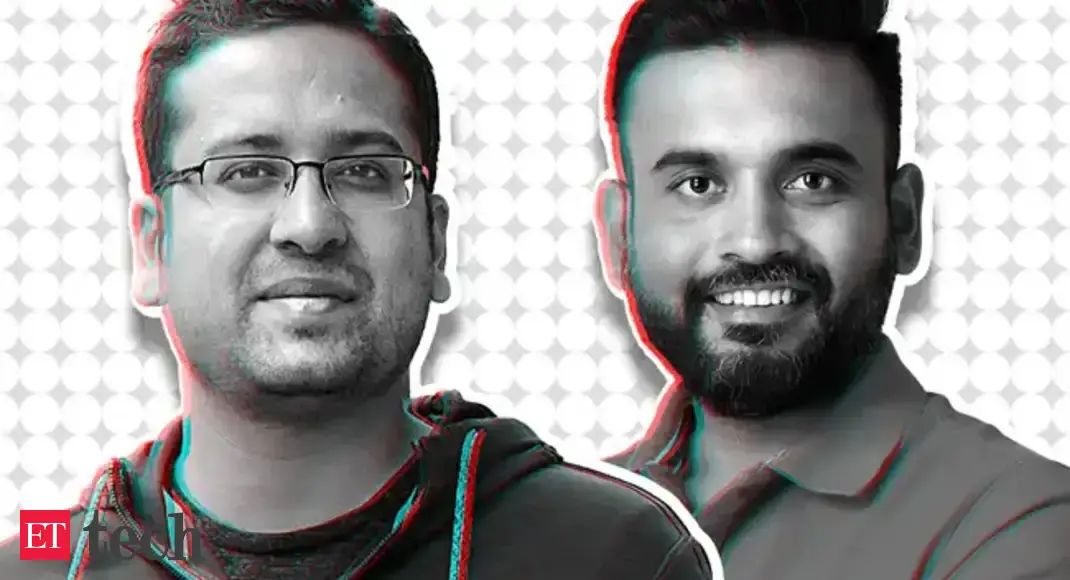

Curefoods secures pre-IPO funding from Binny Bansal’s 3State Ventures. This and more in today’s ETtech Top 5.Also in the letter:■ Amazon’s $2.5B blow■ US rescues TikTok■ Vibes: Meta’s AI playCurefoods raises Rs 160 crore in pre-IPO placement from Binny Bansal’s 3State Ventures (L-R) Binny Bansal, cofounder, Flipkart and Curefoods founder Ankit NagoriCloud kitchen startup Curefoods has bagged Rs 160 crore ($18 million) in a pre-IPO round from Flipkart cofounder Binny Bansal’s 3State Ventures. The raise comes just months after Curefoods filed its draft IPO papers in June.Driving the news: The round pegs Curefoods’ valuation at around Rs 4,000 crore ($450 million), up from its previous mark of $375 million. The fresh capital arrives at a crucial moment for the company as it prepares for its public debut.Past connections: 3State Ventures is Curefoods’ largest external backer, already holding over 17% stake before this round. Founder Ankit Nagori remains the largest shareholder, with more than 27% of the cap table.IPO plans: Curefoods aims to raise Rs 800 crore via its IPO. The funds will go into expanding its footprint through new cloud kitchens, restaurants, kiosks, and central kitchens. A large slice is reserved for scaling Krispy Kreme, for which it recently gained pan-India rights.Edtech startup Vedantu raises $11 million from existing investors Vamsi Krishna, CEO, VedantuBengaluru-based edtech firm Vedantu has secured $11 million via convertible notes from existing backers, including ABC World Asia (Temasek-backed), Accel India, and Omidyar Network. Tell me more: It is the company’s first fundraise since 2022 and is part of a larger round that will include secondary exits for early investors. Why it matters: Vedantu has been navigating a post-pandemic slump in its core K-12 business. The funding gives it a runway to diversify beyond that. The big picture: Cofounder and CEO Vamsi Krishna said the next round and secondary sale will “strengthen the balance sheet, align the shareholder base, and set us up” for a public market listing by 2027.Also Read: Spacetech startup Cosmoserve Space raises $3.17 million in a round led by Alan RutledgeHow RBI tightening digital payments authentication impacts the industry The Reserve Bank of India (RBI) has issued the Digital Payment Transactions Authentication Directions, 2025. While two-factor authentication continues to be compulsory for all digital payments, it has ushering in risk-based models to counter mounting fraud.Dig deeper: For years, India’s payments ecosystem leaned heavily on one-time passwords (OTPs). The new regime compels banks and fintechs to build smarter, more flexible checks, such as biometrics, in-app confirmations, and behavioural analytics. Crucially, issuers will be directly liable for fraud if they fail to comply.Key changes:2FA mandatory: One factor must be dynamic (OTP, token, biometric).Risk-based checks: Stricter rules for high-risk transactions, lighter ones for routine payments.Exemptions: Small-value contactless payments, recurring e-mandates after the first debit, Fastag, gift cards, and offline micropayments.Cross-border scope: By October 1, 2026, issuers must validate one-off (non-recurring) international online payments via risk-based systems.Zoom out: For customers, this means a shift beyond OTPs to quicker, yet safer, authentication. For banks and fintechs, it means retooling fraud detection, building interoperability, and ensuring compliance with the Digital Personal Data Protection Act, 2023.Also Read: The story of DPDP: How the data law came to beAmazon hit with $2.5 billion Prime settlement The US Federal Trade Commission (FTC) has secured a record $2.5 billion settlement with Amazon, after alleging it misled users into Prime sign-ups and made cancellations deliberately complex.The details: The package includes a $1 billion penalty and $1.5 billion in consumer refunds, the largest civil fine ever imposed under an FTC rule.Insider roles: Internal records showed senior executives Neil Lindsay and Jamil Ghani knew of manipulative enrolment tactics, with staff privately dubbing them as “shady.” Prime, Amazon’s biggest profit driver, counts over 200 million subscribers and rakes in billions from shipping, streaming, and deals.Task at hand: Amazon must now provide a clearly labelled decline button, disclose terms upfront, simplify cancellations, and appoint an independent monitor to oversee refunds.Also Read: Amazon’s AWS CEO chides staff for slow product rolloutsTikTok’s future secured in US as Trump signs executive order US President Donald Trump has signed an executive order approving the sale of TikTok’s US arm to a group of American investors, ensuring the app stays live for its millions of users.Deal details: The new entity, valued at approximately $14 billion, will be majority-owned by Oracle, Silver Lake (existing ByteDance investor), and Abu Dhabi’s MGX. ByteDance will hold less than 20%. The structure hopes to keep the app American-run while limiting Beijing’s influence. Why it matters: The order addresses US national security worries by mandating oversight of TikTok’s algorithm, data handling, and content moderation. The deal must be completed within 120 days, by January 20, 2026.Also Read: US-China TikTok deal: All you need to knowBuilding consensus: Trump claimed Chinese President Xi Jinping gave tacit approval, though Beijing hasn’t confirmed. The key test lies in retaining and monitoring TikTok’s recommendation engine under joint US security and corporate control.Also Read: ETtech explainer | The TikTok ‘framework’ deal between the US and ChinaMeta unveils ‘Vibes’, an AI-generated short video feed Meta has introduced Vibes, a new short-video feed within the Meta AI app and meta ai. Similar to TikTok or Instagram Reels, but with a twist: every clip is AI-generated.How it works: Users can browse through surreal creations—from cats kneading dough to a woman in Egyptian attire taking a selfie—and the feed customises itself to their preferences over time. You can also create or remix videos, adding visuals, music, and styles, before sharing them on Vibes, DM, or Meta’s other platforms.Also Read: Meta to launch ad-free Facebook and Instagram subscriptions in UKWhy it matters: The launch highlights Meta’s AI expansion as it develops its own models while collaborating with Midjourney and Black Forest Labs. The timing is notable: just months ago, Meta told creators to focus on “authentic storytelling” rather than unoriginal content.Also Read: Snapchat sees sharp rise in engagement among Indian Gen Z users

Explore other editions

Want this newsletter delivered to your inbox?I agree to receive newsletters and marketing communications via e-mailThank you for subscribing to Daily Top 5We’ll soon meet in your inbox.