By Aileen Chuang

Copyright scmp

Hong Kong-based MicroBit Capital Management took two years to launch its bitcoin and ether exchange-traded funds (ETFs), with their debuts coming amid record-high prices for cryptocurrencies and global regulators’ increasing recognition of digital assets.

“Now I believe everybody considers bitcoin, or cryptocurrencies, as quite an important asset class; it’s no longer a scam,” said chief investment officer Kenny Khuong last month during MicroBit’s ETF listings on the Hong Kong stock exchange. “Cryptocurrency is entering a new phase suitable for mass adoption.”

Greater participation from institutional investors would help reduce cryptocurrency volatility, Khuong said. With increasing regulatory oversight globally, including in Hong Kong and the US, he expected cryptoassets to gain greater utility, which would feed a positive outlook.

“This is just the beginning of the regulatory integration of cryptoassets with traditional finance,” Khuong said.

Many surveys showed crypto’s growing mainstream acceptance. This year, nearly 60 per cent of institutional investors planned to allocate more than 5 per cent of their assets under management to cryptocurrencies, “a clear sign that it is moving beyond a niche asset class”, according to a study by EY-Parthenon and Coinbase in January.

Another survey by BNY Wealth showed that family offices’ allocations to cryptocurrencies and other digital assets stood at around 7 per cent, boosted by a 75 per cent surge in allocations by non-US family offices over the past 12 months.

In Hong Kong, a third of private wealth-management firms said they would allocate 6-10 per cent to digital assets in five years from 2 per cent currently, according to a report last year by the Private Wealth Management Association (PWMA). Sixty-four per cent of the respondents said they would allocate less than 5 per cent.

There was plenty of room for growth amid improving regulatory clarity that would spur liquidity and product innovation, according to market participants. In July, the US introduced the Genius Act, a landmark legislation to promote innovation and compliance, while Hong Kong introduced in August a new licensing regime and policy updates to position the city as a digital-asset hub.

Hong Kong’s digital-hub ambitions received another boost this week. On Wednesday, Chief Executive John Lee Ka-chiu said in his policy address that the city’s market regulator was exploring a wide range of digital-asset products and services for professional investors along with sufficient investor protection. Meanwhile, the government would step up international cooperation to combat cross‑border tax evasion, while introducing automated reporting and data surveillance tools to strengthen defences against digital-asset risks in the city.

“These shifts are driving a structural change in investor appetite for digital assets, across both institutional and high-net-worth segments,” said Amy Lo Choi-wan, the chairman for global wealth management at UBS Asia.

With greater on-chain liquidity and clearer regulation, more investment opportunities – from cryptocurrencies and digital asset treasury (DAT) firms to tokenised traditional instruments and real-world assets – would reshape financial markets by leveraging blockchain technologies for enhanced efficiency, openness and access, market participants said.

ETFs have become a preferred means to gain convenient and secure access to digital assets without the complexities of direct ownership, such as managing wallets or safeguarding private keys. Additionally, they help reduce market volatility by enhancing liquidity and encouraging longer-term investment strategies.

BlackRock’s spot bitcoin ETF, launched in January 2024, has become the world’s largest such fund with around US$88 billion in assets and participation from both retail and institutional investors. Harvard University’s US$53 billion endowment fund recently invested US$117 million in the ETF, making it its fifth-largest holding as of June 30 – ahead of Nvidia and Google stocks.

Close on the heels of the world’s largest asset manager, Hong Kong introduced Asia’s first batch of six spot virtual-asset ETFs a few months later. The list has since grown to 13, with combined assets under management surging 14-fold to HK$7.87 billion (US$1.01 billion) as of end-August from the end of 2022, according to Hong Kong Exchanges and Clearing (HKEX).

“This growth reflects strong market demand and the successful launch of spot virtual-asset exchange-traded products [ETPs] in April 2024, which significantly expanded product diversity and investor access, further enhancing market liquidity and attractiveness of Hong Kong as Asia’s leading ETP hub,” said Jean-Francois Mesnard-Sense, the head of ETPs at HKEX.

In July, cryptocurrency ETFs dominated the top four spots among the best-performing ETFs in Hong Kong, according to stock exchange data. The four ETFs posted monthly gains exceeding 53 per cent as their underlying assets surged.

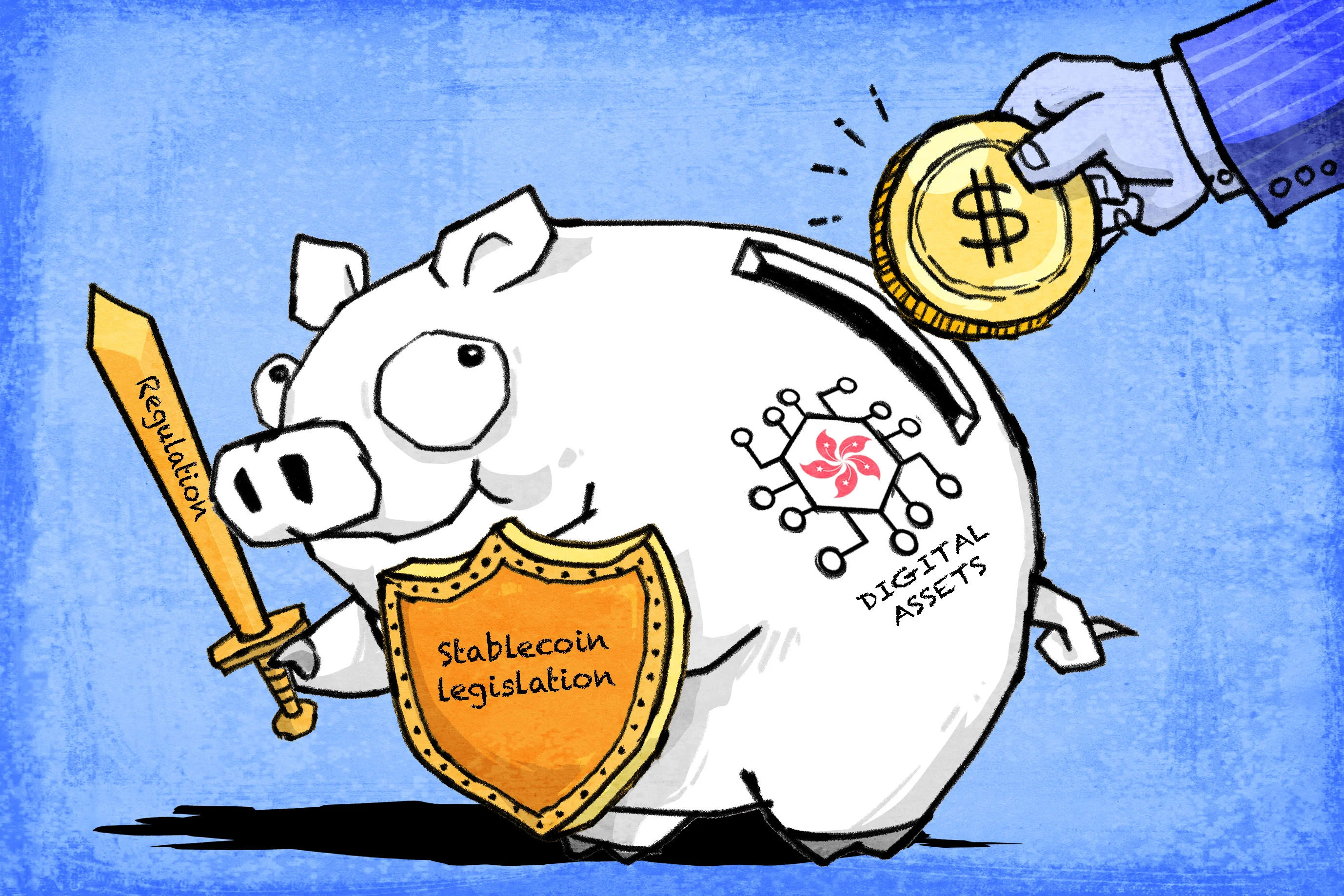

Hong Kong was positioning to secure its status as a global financial hub in digital assets, underpinned by regulatory efforts to build a full-fledged ecosystem, analysts said. Initiatives include stringent stablecoin legislation, rules governing custody and dealer activity, and a licensing regime for virtual-asset exchanges and products such as tokenised securities and real-world assets – moves that could gain investors’ trust and put the city on a par with the US.

“Hong Kong has been very forward-looking in terms of regulation, with frameworks covering not only the licensing regime but also the treatment of financial products – albeit the global benchmark is based on the US,” said Deng Chao, CEO of Hashkey Capital.

“This industry has one defining characteristic: global liquidity. If Hong Kong maintains a more open and investor-friendly environment, then capital, institutions and participants will naturally gravitate here.”

Last month, Amina Bank, a Swiss lender specialising in virtual assets, appointed an Asia-Pacific head in Hong Kong. Michael Benz, a wealth management and private banking veteran, has been tasked with leveraging the city’s evolving regulatory framework and the region’s accelerating institutional adoption.

“Hong Kong is the right place in Asia for us,” said Benz, citing the city’s proximity to mainland China – the heart of global crypto mining a decade ago – and efforts to establish itself as a digital-asset hub.

To be sure, cryptocurrencies and other digital assets are still risky investments prone to volatility, regulatory fragmentation, security and custody risks, and malicious activity.

“Crypto remains a volatile asset class,” said UBS’ Lo. “We currently view broad portfolio adoption within a strategic asset allocation framework as premature.”

Investors should approach historical analysis and strategic crypto allocations “with caution”, UBS Chief Investment Office analysts said in a note last month. They noted that many prominent crypto tokens had collapsed, including luna, which once had a market capitalisation of more than US$40 billion, adding that more than 1.8 million crypto projects had failed in the first four months of this year alone.

“There are more ways to build structure and encourage institutions to participate in this space,” said Vivien Khoo, CEO and managing director of PWMA. “The last cycle was more retail and individuals participating in virtual assets like non-fungible tokens. Now, the space shows maturity looking at the rate of adoption.”

A pressing challenge was the lack of clear, harmonised regulation across jurisdictions, said Benz. “The industry needs to continue improving standards for custody, transparency and risk management to build trust.”

Crypto markets were cyclical and volatile, and investors should be prepared for both upside and downside scenarios, he added.

The participation of mainstream and professional institutions in the digital-asset space will help address some of the risks.

The collapse of US cryptocurrency giant FTX and Singaporean hedge fund Three Arrows three years ago drove many investors away. As confidence returns, wealthy investors and publicly listed companies are leading investment strategies related to Web3 – a term that refers to applications based on decentralised technologies such as blockchain.

The number of public companies’ treasuries investing in bitcoin globally increased more than 135 per cent in the 12 months to June, according to industry estimates. These companies now hold about 4.6 per cent of all bitcoin, while ETFs account for about 7.1 per cent.

Meanwhile, the number of DAT companies continues to grow. Firms like Strategy, whose main business is accumulating digital assets, allow investors to gain exposure to these assets via publicly traded shares. The Nasdaq-listed firm’s shares have surged more than 140 per cent in a year.

“A public company holding bitcoin is one of the safest ways for retail and institutional investors to get exposure over the short and long-term,” said John Riggins, CEO of Moon Inc at the Bitcoin Asia conference in Hong Kong last month, highlighting the stringent auditing, fundraising and operating guidelines for listed companies.

Moon, formerly HK Asia Holdings, was acquired by a consortium led by UTXO Management and Sora Ventures earlier this year to focus on bitcoin treasuries, digital assets and Web3 innovation.

VMS Group, an investment manager for some of Hong Kong’s richest families, said in May that it planned to allocate up to US$10 million into funds run by decentralised-finance hedge fund Re7 Capital, which has generated double-digit yield since its launch in July 2021. VMS’ managing partner Elton Cheung said the move into Web3 was in response to client interest after noticing institutional players’ adoption and rising regulatory clarity.

Re7’s strategy makes returns from providing liquidity on decentralised exchanges and lending stablecoins to various underlying revenue-based projects. “There’s no direct correlation to the volatility of particular cryptocurrencies”, providing more stable returns and reducing market risks, Cheung said.

VMS, with US$4 billion in assets under management, intended to increase its exposure to the growing Web3 sector, Cheung said. Possible uses include cryptocurrency payments and tokenisation of its Vietnam luxury resort project, and tokenising private equity investments to improve liquidity and provide alternative exit opportunities for investors, he added.

At Raffles Family Office, a multifamily office with dual headquarters in Hong Kong and Singapore, clients’ attitudes towards digital assets had shifted from scepticism to a “fear of being left out”, said co-founder Ray Tam.

Apart from launching its first digital-asset fund in April, Raffles was eyeing long-term opportunities, including helping clients plan and transfer such wealth to future generations.

“The wealth you transfer to the next generation is no longer limited to fiat currencies but also includes stablecoins and other digital assets,” he said. “It’s crucial to ensure everything is well protected under the law. Hong Kong will be a hub to deal with it because the regulatory regime is clear.”

The city’s infrastructure and frameworks were being built to connect custody, stablecoins and virtual-asset licences, which could drive greater participation, said PWMA’s Khoo.

Hong Kong’s stablecoin ordinance, which took effect on August 1, ushered in a new era for digital finance as it put cryptocurrency under the same stringent oversight as banks.

“Hong Kong has taken the first step towards having a stablecoin regime,” said Michael Chan, CEO of Zand, an artificial intelligence-powered fintech and financial services group in the United Arab Emirates (UAE).

“Tokenised products simply can’t flourish without proper legal backing and a well-defined structure,” said Chan, whose firm is building a UAE-Hong Kong digital trade corridor by using its dirham-pegged stablecoin and Hong Kong’s proposed stablecoins.

The competitiveness of digital-asset products in Hong Kong remains to be seen given the cross-border, decentralised nature of these products, VMS Group’s Cheung said. “It’s hard to say one jurisdiction, one place, is a clear number one.”

However, “Hong Kong is a superconnector of people, which is valuable in the context of Web3 investment,” Cheung said. “When capital comes to Hong Kong, the city will have investment managers for them to choose from.”