Copyright Benzinga

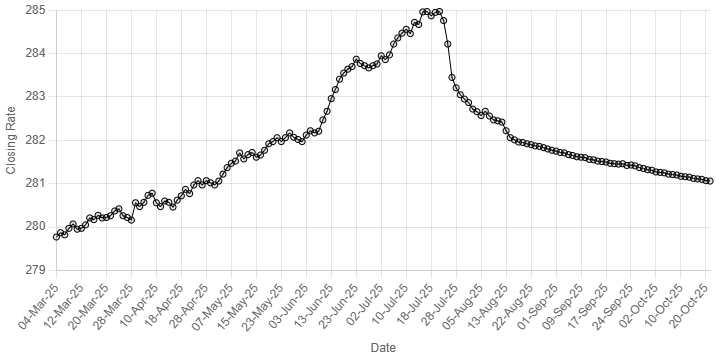

Cruise lines head into the third-quarter reporting season amid firm demand and growing cost concerns. Bank of America Securities analyst Andrew G. Didora issued a third-quarter preview on major cruise lines. He sees data supporting a strong 2025, while 2026 cost pressures could take center stage. Also Read: Why Is GoPro Stock Trading Higher Wednesday? Didora said cruise spending showed no signs of slowing down in recent months. In fact, Bank of America Securities data accelerated in the third quarter of 2025, rising 10% compared to 3% in the second quarter. He noted Carnival Corp‘s (NYSE:CCL) results showed strong onboard spend and resilient late bookings. Viking Holdings Ltd.‘s (NYSE:VIK) September update indicated that 2026 pricing would rise 5%, up from 4% previously. Airlines also discussed robust premium revenue trends supporting higher-end travel. These indicators should aid Royal Caribbean Cruises Ltd. (NYSE:RCL), Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH), and Viking revenue growth in the third quarter and fourth quarter. After Carnival’s late-September call, investors increasingly focused on costs. Guidance that 2026 costs rise only by low single digits could catalyze the lagging group. Royal Caribbean Cruises The firm will report earnings on October 29. Didora forecasts EPS of $5.65, versus guidance of $5.55 to $5.65 and the Street's $5.68. He projects third-quarter reported net yields up 2.8% and net cruise costs ex-fuel up 6.4%, both near the high end. Given Royal Caribbean's beat history, he believes investor expectations sit modestly above consensus. Norwegian Cruise Line Didora expects Norwegian Cruise’s third-quarter net yield and non-fuel unit costs to align with guidance at 2.0% and 0.7%. That translates to third-quarter EPS of $1.16. He forecasts fourth-quarter reported net yields to increase by 4.4% and non-fuel unit costs to rise by 0.6%, driving EPS to $0.32, versus a consensus of $0.29. His 2025 EPS estimate is $2.09, modestly above the company’s guidance of $2.05. Carnival Corporation Didora modestly raised his Carnival estimates after its $1.25 billion unsecured debt issuance in October. He now models 2026/2027 EPS of $2.37/$2.61, up from $2.33/$2.57, reflecting lower interest costs. Viking Holdings Didora kept Viking's third- and fourth-quarter EPS estimates at $1.19 and $0.56, slightly above the Street's $1.18 and $0.53. He said booking curves remain the focal point, but after last month's update, changes appear unlikely. Read Next: Palantir Vs. OpenAI: The AI Underdog That Might Be The Smarter Bet Photo: Shutterstock