Copyright ABC17News.com

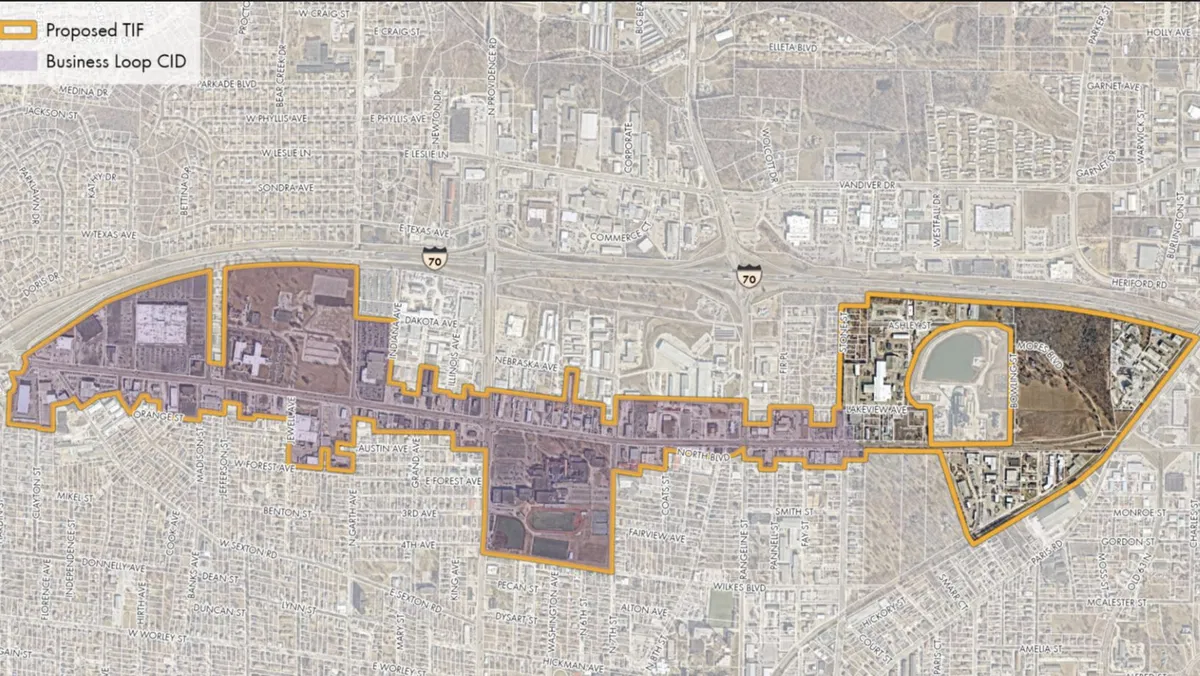

COLUMBIA, Mo. (KMIZ) The City of Columbia is considering a special taxing district for Business Loop 70 that would divert taxes from future development to the companies undertaking those projects. Columbia City Council members met Monday morning to discuss implementing tax incremental financing as a way to revitalize the Business Loop. City Manager De'Carlon Seawood said city officials worked alongside the Business Loop Community Improvement District to determine the possible district boundaries. Tax incremental financing, or TIF, generates revenue through sales and property taxes. The revenue generated in the TIF district is reinvested in private development. Andy Struckhoff with PGAV Planners provided the presentation to council members Monday. Struckhoff said property outside the TIF district could also benefit from the TIF. The property value of the outlined area is calculated, and that number is used as the base value. The base value is frozen during the TIF period to calculate taxes. As properties in the district are redeveloped or as new development is built and values increase, new tax revenue is generated, with some of it going back to developers. Struckhoff said establishing a district takes about six months. First, a city has to establish a TIF commission and a redevelopment area. A period of hearings for public input follows. After that, a redevelopment plan is put together along with a cost-benefit analysis. The final step is approving redevelopment or new development projects; the projects must be approved within 10 years of the TIF's approval. Columbia Mayor Barbara Buffaloe said the city already has a TIF commission in place. A TIF cannot be in place for more than 23 years, but that clock doesn't start until the redevelopment plans are approved. The end goal is that once a TIF expires, the new or revitalized developments can finance themselves along with the extra funds left over from the tax revenue generated by the TIF. Struckhoff said any redevelopment plan has to reflect the community's desire for development in an area, according to Missouri law. He explained how the Business Loop's current community improvement district could work hand in hand with a TIF district to help generate more revenue. Struckhoff said it's common to pair the two together. Struckhoff also introduced the idea of a transportation development district for the Business Loop. The transportation district would be in place for 40 years and could only be used for transportation infrastructure such as sidewalks, parking garages and roads. Revenue is generated by a sales or property tax. The city of Columbia already has 16 transportation districts, three community improvement districts and two TIF districts in place.