CIE, University of London programmes: Rs70bn-80bn ‘untaxed’ remittances sent annually to UK

By Sohail Sarfraz

Copyright brecorder

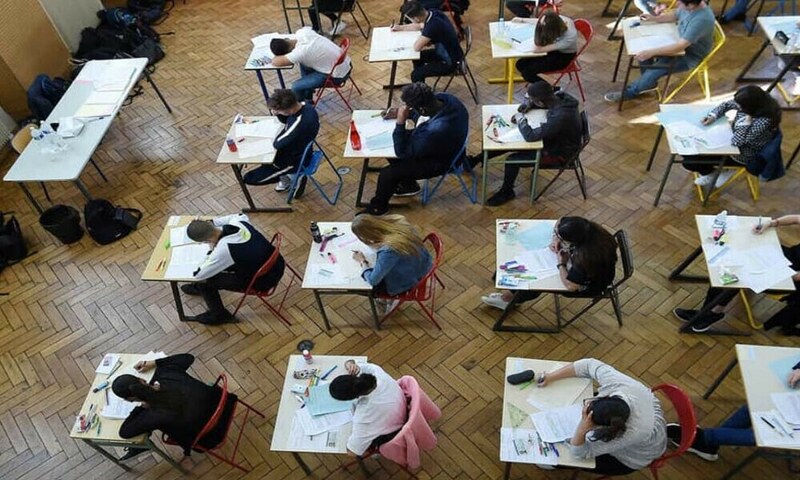

ISLAMABAD: A huge amount of Rs 70-80 billion untaxed money is annually remitted outside Pakistan mainly to the United Kingdom (UK) in the shape of fee paid for Cambridge International Examinations (CIE), which includes the O Level and A Level qualifications and affiliated graduate and post graduate degree programs of University of London, operating in Pakistan.

Sources told Business Recorder that the conservative figure has been worked out on the basis of O-levels and a levels students remitting fee outside Pakistan. Moreover, there are degree programs of University of London charging annual fee from Pakistani students. In this case, the outward flow of money remains untaxed in Pakistan.

The programmes cover the Cambridge school system in Pakistan and foreign degrees supported by a local recognized educational institution or directly via web-supported distance learning. The fee structures of all these programs as disclosed at the respective websites are alarmingly high. After deducting the local fee component, the amounts remitted abroad to University of London are astonishingly high. Unfortunately, this huge outflow of money from Pakistan remained unchecked by the FBR.

Need stressed for proper utilisation of remittances

Under this stream undergraduate as well as post graduate courses/degrees are being offered by foreign universities in Pakistan mainly in the disciplines of Law, Economics, Business Administration, Mathematics, International Foundation Program, Digital innovation, Management, Accounting & Finance and Social Sciences. Though number of foreign universities are working under this stream yet currently University of London is spearheading this stream, offering its degree programmes at dozens of well reputed educational institutions at major urban centres in Pakistan.

The issue has been raised by the Federal Tax Ombudsman (FTO) before the FBR to prescribe rules to check untaxed remitted money outside Pakistan. A new revenue-generating measure has been taken by introducing two new provisions in the Tax Statute, adding subsections (3A) and (3B) in the existing section 101 of the Income Tax Ordinance 2001. Under the new legal provisions, the legislature intended to tax the hitherto untaxed massive outflow of money from Pakistan.

For this purpose, a new legal concept of “significant economic presence” was introduced to be read with the existing provisions of business connection in Pakistan.

The FTO stated that it is strange that even after a lapse of around 15 months from the introduction of sub-sections (3A) and (38) of section 101, both thresholds are yet to be prescribed by the implementing agency; i.e., the FBR.

The FBR, the sole authority, which through delegated powers is obligated to prescribe both thresholds by making rules and issuing explanatory circulars, has thus far failed in discharging its obligation even after the lapse of over one year.

This foreign educational segment/stream can be further divided into (A) The Cambridge school system in Pakistan: This system refers to over 750 schools operating in Pakistan, but it follows the Cambridge Assessment International Education (CAIE) curriculum, which includes IGCSE and International AS & A Levels.

Currently, over 100000 students are taking part in O-level and A-level exams each year. As clarified by the Cambridge Coordinator for Pakistan, during 2025 alone, around 127000 students appeared in A-level exams. These schools are duly recognized by education authorities as the Inter-Board Chairmen Committee (IBCC) recognizes Cambridge qualifications, providing equivalence for higher education in Pakistan. While the tax burden on resident Pakistani citizens & entities is increasing day by day, the above-referred huge outward flow of money remains untaxed, FTO report added.

Copyright Business Recorder, 2025