By Ji Siqi

Copyright scmp

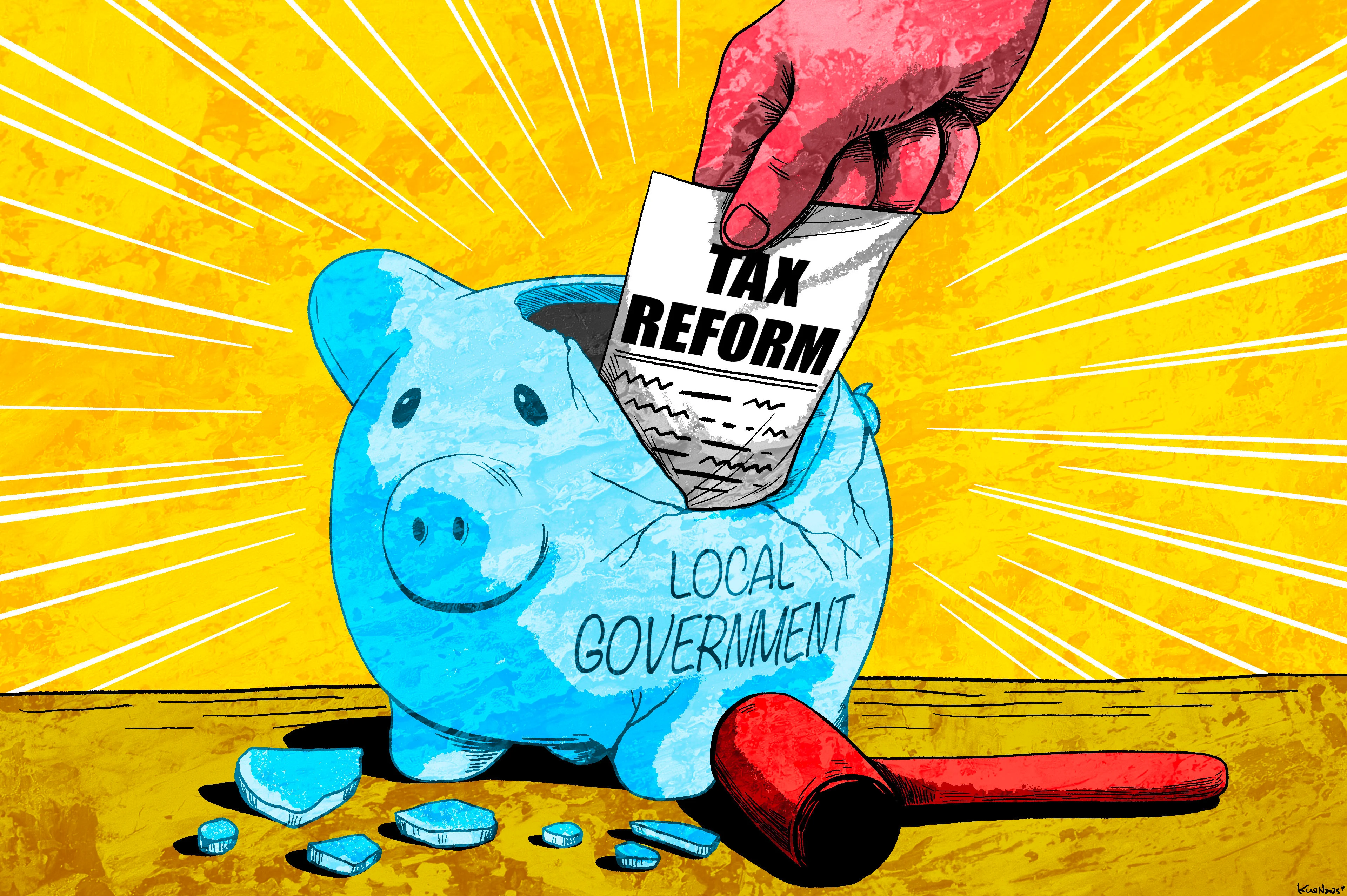

As China drafts its 15th five-year plan – the next entry in a line of expansive blueprints that have set the tone for the country’s development over more than seven decades – we examine how these documents inform and reflect high-level policy priorities, and what to expect in the coming iteration, such as how it could help alleviate local-level financial woes.

For more entries in this ongoing series, click here.

In late March, an announcement by the central Hubei province sent a shiver down the spines of wealthy individuals across China: a local resident had been forced to pay 1.41 million yuan (US$200,000) in back taxes and late fees on undeclared overseas income.

Within days, three other local tax departments had announced similar cases of individuals being hit with huge tax bills on their foreign earnings, with some of the payments reaching as high as 1.26 million yuan.

The moves were part of a wider clampdown by Chinese authorities: although the country has long required individuals to pay tax on their overseas income, enforcement was, until recently, often lax and discretionary.

But that is now changing as China’s government finances come under immense pressure, with tax revenues declining amid an economic slowdown and prolonged property crisis.

Many local authorities find themselves needing to raise money to plug gaping holes in their budgets. That is leading officials to crack down on tax violations that used to be widely tolerated – including undeclared income from abroad.

These enforcement campaigns, though, are unlikely to fix China’s fiscal challenges in the long run. The problems run much deeper – ultimately stemming from an unbalanced tax system that has long needed an overhaul.

During China’s property boom, local authorities were able to rake in huge sums from selling land, allowing them to balance the books despite having to hand over most tax revenue to the central government.

But those days are now over. Land sales have plunged since 2021 and are unlikely to bounce back any time soon, with developers still lumbered with millions of unsold properties. Replacing that income will not be easy.

The government has long been aware that its fiscal and taxation structure is not so reasonable

Li Lixing, professor of public finance

“When economic growth slows and the real estate market decelerates, fiscal and tax-related difficulties become increasingly apparent,” said Li Lixing, director of Peking University’s China Centre for Public Finance.

The issue has become a focus of discussion in China as the government begins drafting its next five-year plan, which will set the country’s policy trajectory for the rest of the decade.

Some are calling for China’s leaders to seize the chance to introduce bold tax reforms. The measures would not only fill up government coffers but also help address major imbalances in the world’s second-largest economy: from industrial overcapacity to weak consumption and a widening wealth gap, economists say.

But implementing any changes will be a formidable challenge. With China’s economy battling both weak domestic demand and rising external trade barriers, any tax rises risk putting further pressure on households and businesses.

“The government has long been aware that its fiscal and taxation structure is not so reasonable and has consistently sought to fix it,” said Li, who is also a professor at Peking University’s National School of Development, at an event in August.

“However, our approach to [tax] reform … has developed substantial inertia and strong path dependency, making a turnaround very difficult.”

Yet, a turnaround is urgently needed. The deterioration in local government finances is already having a direct impact on the public, as local authorities in China are responsible for providing most frontline public services.

Bus services in many cities have been cut. Some areas have reduced their medical insurance coverage plans. Civil servants are facing pay cuts and late salary payments – even in some of the country’s richest regions.

During last year’s third plenum, a meeting of the ruling Communist Party’s top leaders, officials laid out goals to revise the tax system and adjust the fiscal relationship between central and local governments as part of their long-term reform agenda.

That signals that “deeper structural changes” will be required over the next five years, Li said.

Official data indicates the scale of the challenge. In 2024, China’s tax revenue fell 3.4 per cent year on year to 17.5 trillion yuan. While overall fiscal revenue rose 1.3 per cent to 21.97 trillion yuan, that was mostly driven by a startling 25.4 per cent jump in some non-tax revenue, such as administrative fees and government fines.

Meanwhile, China’s tax take remains low by international standards. The country’s tax revenue last year was equivalent to just 13 per cent of its gross domestic product, whereas the average ratio for countries in the Organisation for Economic Co-operation and Development was nearly 34 per cent in 2023.

Last year’s decline in tax revenue was mostly driven by a fall in income from value-added tax (VAT) – China’s largest source of tax revenue that accounts for nearly 40 per cent of the total.

As it is collected based on the value of goods and services at each stage of production, income from VAT soared during China’s decades of rapid growth. But the current economic slowdown, coupled with persistent deflationary pressure, is now acting as a major drag on revenue.

Lou Jiwei, China’s former finance minister, argued in an article earlier this year that a hike in VAT rates would be the simplest way for China to boost its tax revenues. The country’s standard VAT rate of 13 per cent – and preferential rates of 9 and 6 per cent – is “indeed too low”, he wrote.

“If timely VAT credit refunds can be achieved, it would neither tie up business capital nor increase the corporate tax burden,” Lou said, arguing that previous cuts to VAT had not been effective in revitalising markets.

VAT also has the advantage of being much easier to collect than other major tax sources. While personal income tax and corporate tax, for example, heavily rely on self-reporting or complex profit calculations, businesses have incentives to ensure their suppliers have correctly paid their share of VAT.

However, China’s system for distributing the revenue from VAT has long faced criticism from some economists, who argue the policy exacerbates structural imbalances in the Chinese economy.

As the current system allocates tax revenue to regions based on where a product or service was produced, rather than where it was consumed, local governments have an incentive to prioritise production over consumption – meaning they are more likely to pursue growth strategies that focus on heavy investment in factories.

The incentive is all the stronger because local governments are heavily reliant on the income from VAT – unlike other major taxes, where the central government keeps the lion’s share of the money, VAT revenue is split evenly between central and local authorities.

“For local governments, whose revenue sources are relatively limited, countering downward economic pressure and implementing countercyclical macroeconomic adjustments inevitably relies heavily on investment,” Li said.

“This makes it difficult to resolve the structural imbalance between investment and consumption.”

Some economists argue the problem could be addressed by revamping the allocation system to ensure that more VAT revenue is directed to locations where consumption occurs.

But Lu Bingyang, a professor at Beijing’s Renmin University of China, has argued such a move could also create new issues: unless a system is first created to accurately calculate the total retail sales of consumer goods in each region, there is a risk that local governments might interfere with the statistics to inflate their revenues.

In an article last year, Lu recommended another approach based on the destination of sales on VAT invoices: the tax income from sales within a jurisdiction could go to the central government, while income from sales outside could go to local governments.

“This mechanism both incentivises local economic development and prevents vicious competition and interference with the establishment of a unified national market,” he said.

In addition to VAT changes, another step that Beijing is widely expected to take is reforming the consumption tax system. China’s leaders have already pledged at the third plenum to “shift the collection of consumption tax to the retail stage and steadily allocate the funds to local governments”.

If consumption tax is designated as a local tax, it would encourage governments to stimulate the consumption of these products – the opposite of the policy’s original intention

Lu Bingyang, professor

Unlike sales taxes levied by US states, China’s consumption tax is mostly designed to regulate consumer behaviour rather than generate revenue. It is only imposed on certain categories of goods – such as alcohol, tobacco and fuel – and the income generated goes entirely to the central government.

Redirecting some of this revenue to local authorities could help alleviate their financial pressure. But it could also create new problems, according to Lu.

“The goal of such a tax is … often to suppress the development of certain industries, like tobacco, alcohol or highly polluting goods,” he wrote.

“If designated as a local tax, it would directly link local fiscal revenue to these products, encouraging governments to stimulate the production or consumption of such goods – the exact opposite of the policy’s original intention.”

Collecting consumption tax at the wholesale and retail stage, meanwhile, would boost local government revenues and make regional tax allocation more equitable, according to Ma Long, leader of PwC China’s national tax policy services team. However, the change could be difficult to implement.

“The future trend of consumption tax reform will involve first implementing changes on categories with mature conditions, followed by others that meet the necessary criteria,” Ma said. “However, due to the significant increase in administrative costs, progress is expected to face considerable challenges.”

Besides, reforms to VAT and the consumption tax will not be enough to fill the hole in local government finances, economists argue. A lasting solution would almost certainly require increases in direct taxes – such as personal income tax – which provide the bulk of local government revenues in most major economies.

Beijing has long been aware of this. China’s previous five-year plan, announced in 2021, included the goal of “moderately raising the share of direct taxes” in government revenues. At the third plenum, leaders again vowed to strengthen the direct tax system, including by improving the personal income tax regime.

Yet progress in this area has been limited. Compared with developed economies, China’s personal income tax has a narrower taxpayer base and a lower collection compliance rate. It also imposes a heavy tax burden on income from labour but a light one on capital income.

As a result, it remains common for high-net-worth individuals in China to avoid personal income taxation almost entirely by deriving most of their wealth from non-salary sources.

At the third plenum, China’s leaders said it was necessary to “standardise tax policies on business, capital and property income and implement unified taxation on labour income, while deepening reforms to tax collection and administration”.

Zhuang Bo, global macro strategist at Loomis Sayles Investment Asia, an affiliate of Natixis Investment Managers, said China’s individual income tax accounted for a “much lower” share of total tax revenue than in most other countries.

Increasing revenue from direct taxes would give local governments a more diversified and stable income stream – helping them cope with collapsing land sales and fluctuations in indirect tax revenue, which can be volatile during economic cycles, according to Zhuang.

“No matter how much the headline [economic] figures go up and down, these direct taxes will be there forever,” he said.

Pivoting from indirect to direct taxes would also help reduce inequality and, in turn, boost consumption, Zhuang added.

Local governments should also be allocated a higher proportion of the revenue from personal income taxes, economists argued. The central government currently keeps 60 per cent of the funds, with local authorities taking 40 per cent.

Another measure that economists have long called for is the introduction of a property tax – a common form of direct taxation that would provide local governments with a large and stable revenue stream.

However, Beijing appears unlikely to implement the tax while the real estate sector remains mired in a deep downturn, despite some cities having already run years-long pilot schemes.

The goal of “moving forward with property tax legislation” was included in China’s previous five-year plan, but it was absent from the third plenum communique. Analysts suspect the policy has been quietly shelved – perhaps permanently.

“Before the property market crash in 2021, it was almost certain that Beijing would start to introduce a property tax within the next few years,” Zhuang said. “But in the end it didn’t happen, and now it might never come.”

Given the domestic and external economic challenges facing China, and the fragile state of market confidence, any further expansion of property tax pilot programmes appeared unlikely for now, analysts from Great Wall Securities said in a report published in January.

“This caution is intended to prevent excessive interpretation of the impacts of tax system reforms,” they added.

In response to a question from the Post, Liao Min, China’s vice-minister of finance, said the ministry had developed plans for reforming the tax system in line with arrangements made during the third plenum.

“Moving forward, we will roll out reforms one by one as conditions mature and in light of evolving circumstances,” Liao said at a press conference in early September.