Copyright Forbes

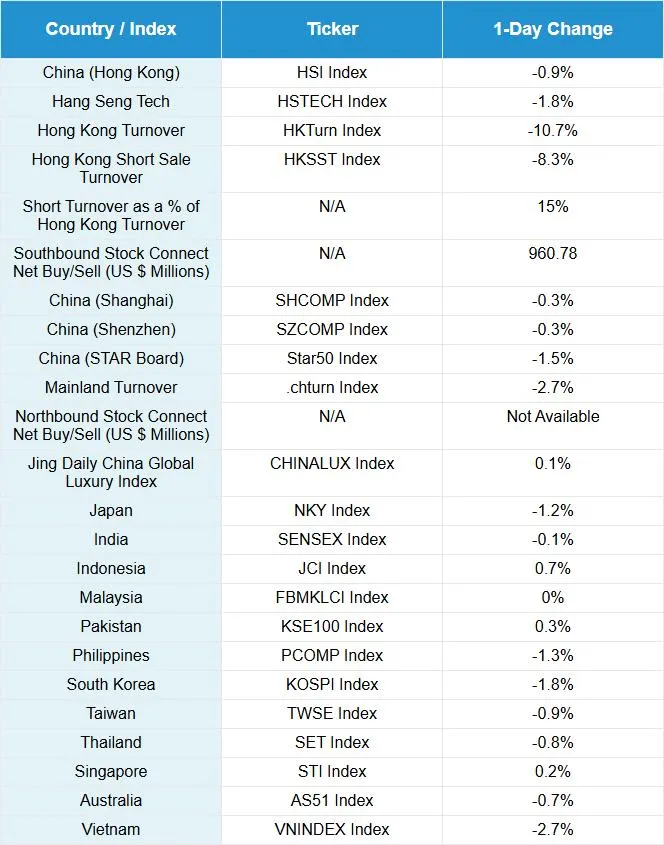

Week in Review Asian equities were mostly lower for the week as Indonesia and Singapore outperformed with gains, while Korea and the Philippines underperformed. On Wednesday, the Trump White House announced that, effective November 10th, the tariff rate on China will be reduced from 34% to 10%, and the fentanyl-responsive tariff will be lowered from 20% to 10%, with similar reductions on China's side related to US goods. Yum China reported Q3 financial results on Tuesday that met analyst expectations as revenue rose +4% year-over-year (YoY) to $3.2B as the company now operates 17,514 stores. Appliance giant Midea announced it is making a home housekeeping humanoid robot that will be available for purchase in two to three years. Key News Asian equities ended the week with a thud as the US AI bubble talk and potentially fewer US Fed cuts on weakening US economic data led to indiscriminate profit taking in growth and technology stocks. It is interesting that the high valuations are really a US equity phenomenon, though several sectors with very high valuations such as Mainland China-listed semiconductor stocks were off, including Semiconductor Manufacturing (SMIC), which fell -2.19%, Cambricon, which fell -3.21%, and Hygon, which fell -2.92% following Hua Hong Semiconductor’s lackluster results yesterday, as the stock fell -0.83% in Hong Kong and -1.18% in Mainland China. Profitless tech was weak, as Pony AI fell -11% after falling -9% yesterday following their Hong Kong IPO. So, today was a drawdown, though there were positives and, remember, Tencent reports Wednesday and JD.com reports on Thursday. The General Administration of Customs announced the resumption of US soybean imports from firms CHS, Louis Dreyfus and EGT, following a March decision to cancel their import licenses due after detecting “ergot and seed-coated soybeans in imported U.S. soybeans.” The reversal is clearly a result of the Trump-Xi meeting last week, a positive development in US China relations, and a win for US farmers! Solar stocks bucked today’s downdraft, as LONGi gained +3.03% and Tongwei gained +6.77%, after reports production will be further curtailed. The China’s government's anti-involution effort, which is meant to reduce excess capacity, on solar appears to be working as Tongwei and LONGi’s Q3 earnings per share (EPS) losses narrowed considerably from the second quarter and year-over-year (YoY). Maybe my thesis on Chinese renewable energy companies being an AI play is coming to fruition? Alibaba fell -2.97%, despite CEO Eddie Yu’s speech at World Internet Conference on the company’s AI and cloud efforts. XPeng gained +1.68% on the strong pre-sales of the extended range X9. NIO fell -5.14%, despite announcing that 300,000 ES6 cars had been made. MORE FOR YOU Labubu doll maker Pop Mart fell -5.88% after an employee questioned the price of goods during a live streaming event. JD.com -2.29% despite announcing a fully autonomous delivery station will become operational next April. Electric truck maker Deepway Technology, which is 37.5% owned by Baidu, gained +0.4% after an affiliate filed for a Hong Kong IPO, following yesterday’s close. Autohome gained +1.15% after beating low expectations on the big three: revenue, adjusted net income and adjusted EPS. The Ministry of Finance released a "Report on the Implementation of China's Fiscal Policy in the First Half of 2025" that speaks to the department’s efforts to promote “active fiscal policies”, “boost consumption” and issue government bonds for consumer subsidies. The report garnered attention in China but clearly had zero effect on markets. China’s trade data was not great, per the below. Several Mainland sources reported the data’s weakness was due to a high base effect, though in checking the data this isn’t true. The trade data is not a great sign for the global economy. October Exports -1.1% versus September’s 8.3% and expectations of 2.9% Imports 1.0% versus September’s 7.4% and expectations of 2.7% Trade Balance $90.0 billion versus September’s 90.4 billion and expectations of $95.8 billion Over the weekend, October’s producer price index (PPI) and consumer price index (CPI) will be released. Live Webinar Join us Wednesday, November 12th at 10 am EST for: China Q3 Update: Tech Leads Bull Market, Trade Deal Updates, & New Goals Set In 15th Five-Year Plan Please click here to register New Content Read our latest article: Labubu & Gen Z Spending: What China’s Designer Toy Craze Tells Us About the New Consumption Wave Please click here to read Last Night’s Performance Last Night’s Exchange Rates, Prices, & Yields