Copyright Naked Capitalism

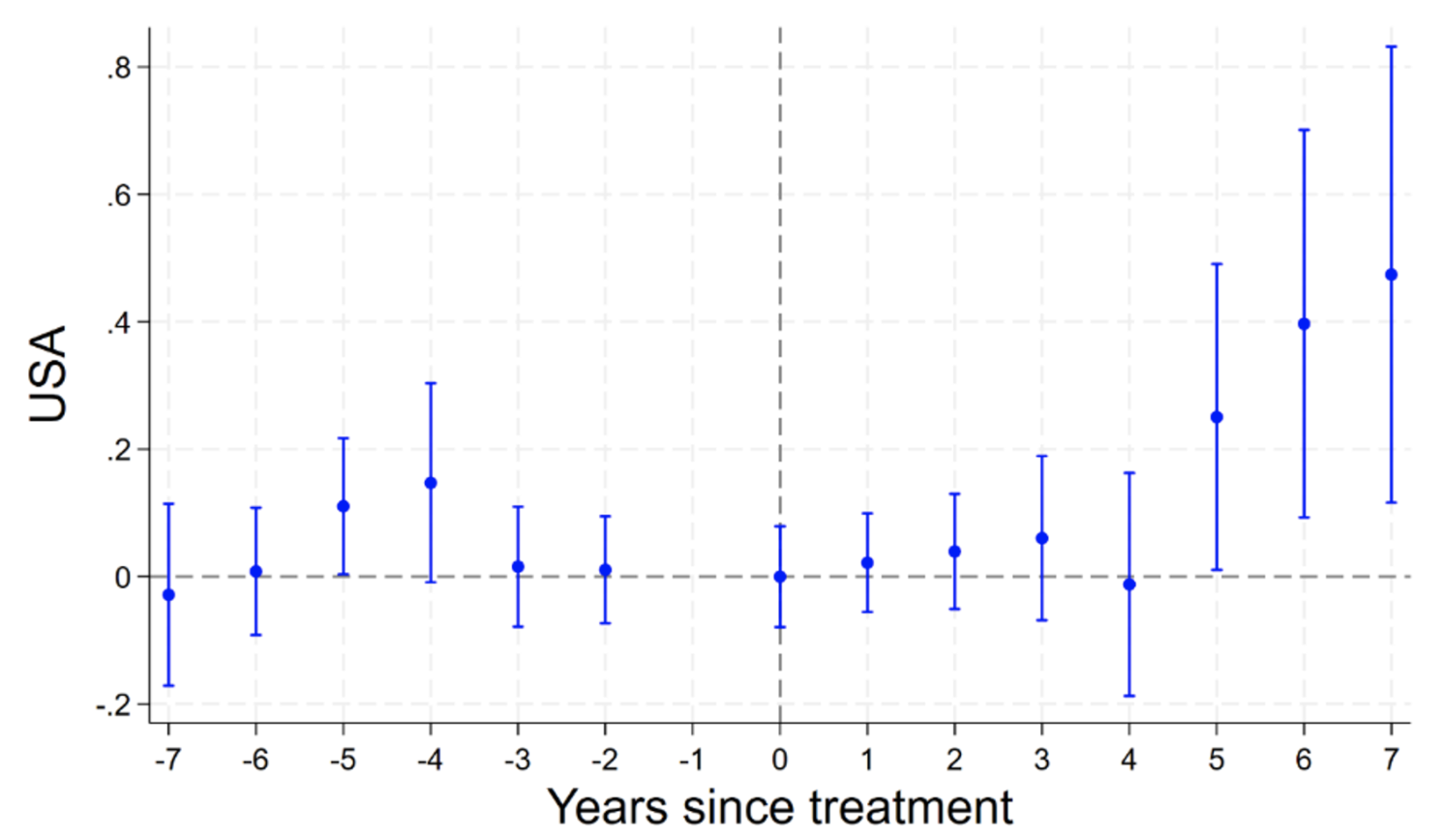

Yves here. This interesting and useful study looked at how China’s major strategic competitors, the US, Japan, and the UK, responded to China Belt and Road investments. Interestingly, the US increased investments in Belt and Road participant countries, presumably for defensive strategic reasons but potentially also due to improved profit opportunities. By Yasuyuki Todo, Professor in the Faculty of Political Science and Economics Waseda University, Shuhei Nishitateno, Professor Kwansei Gakuin University; Research Associate Research Institute of Economy, Trade and Industry (RIETI) and Sean Brown. Originally published at VoxEU China’s Belt and Road Initiative has reshaped international economic and political ties among countries and reorganised global value chains. This column reveals that the initiative has triggered strategic and divergent responses among major investor countries, depending on their economic and political relationships with China. The US increased its investment in countries after they signed BRI agreements with China, largely driven by strategic competition, while the UK reduced investment, reflecting concerns over political and supply chain risks linked to China. Japan’s investment in BRI countries appears to be largely unaffected by its strategic stance toward China. China’s Belt and Road Initiative (BRI) was launched in 2013, first aiming at the development of transport infrastructure between China and the rest of the world, including Asia, Europe, and Africa, and then expanding to energy and digital projects. By 2024, 149 countries had signed Memorandums of Understanding (MoUs) for the BRI with China, and BRI engagement boasted US$71 billion in construction contracts and $51 billion in investments – the highest level since its start (Nedopil 2025). As a result, the BRI has reshaped international economic and political ties among countries and reorganised global value chains. Some research in the dense empirical literature on the BRI has examined how it has affected trade with China, while others focus on foreign direct investment (FDI), an important part of global value chains. Generally, FDI from China to BRI countries is found to increase, possibly because of improved infrastructure that lowers production and transport costs and strengthened political relationships with China that reduce investment uncertainty (Nugent and Lu 2021, Yu et al. 2019, among many others). In addition to FDI from China, the BRI may affect FDI from other countries for several reasons. First, improved infrastructure may attract FDI from any country, not restricted to China. Second, participation in the BRI signals closer political alignment with China because China intends to assert greater international influence through the BRI (Huang 2016). Under these circumstances, Western nations that are not comfortable with China’s expansion in international politics could react to BRI countries in various ways. If Western nations feel that investing in BRI countries which strengthen political ties with China is risky, they could reduce FDI in BRI countries. However, if Western nations consider they need to compete against China for political and economic leadership in BRI countries, they should increase FDI. Our study (Todo et al. 2025) examines the possible differences in the effect on FDI into BRI countries from various Western countries such as the US, Japan, and European countries, in addition to China, adopting the staggered difference-in-differences (DID) estimations to data for global bilateral FDI. We reveal how the BRI has triggered strategic and divergent responses among major investor countries, depending on their economic and political relationships with China. The findings underscore the reality of a world where investment is no longer driven only by economic fundamentals, but also by political and security factors. Figure 1 FDI from major Western investors to BRI countries a) United States b) United Kingdom c) Japan Note: The horizontal axis shows years since one year before the signing an MOU between China and the BRI country. The US: Competing Against China Through FDI in BRI Countries First, our empirical results show that despite refusing to join the BRI, the US actually increased its investment in BRI countries after they signed MOUs with China, as shown in Panel (A) of Figure 1. Our study suggests strategic competition is a major reason for that investment. China becoming an economic and technological superpower and strengthening economic and political ties with other countries through the BRI and other measures have added fuel to the US-China rivalry (Li 2021). Through initiatives like the Blue Dot Network and the G7’s Build Back Better World, the US has sought to provide alternatives to the BRI (Savoy and McKeown 2022). FDI is part of that toolkit. In practice, US firms and development finance institutions have targeted the same infrastructure and energy sectors where China is most active. For example, former US President Biden visited Angola in December 2024 and initiated a 1,344 km railway project together with other G7 countries in order to compete with China, which had already invested heavily in Angola’s railways (BBC 2024). This dynamic illustrates a key point: the BRI does not crowd out Western engagement everywhere; sometimes it provokes it. The UK: Avoiding Risks of Supply Chain Links with BRI Countries By contrast, the UK has reduced its FDI in BRI participant countries (Panel (B) of Figure 1). This retreat reflects a growing perception of political and supply chain risks linked to China, especially after 2018 when concerns over 5G, technology transfer, and national security intensified. Notably, the UK government’s view of China and the BRI shifted from positive to substantially negative in 2019, formally stating “systemic challenges” from China as the reason for this shift (Ashbee 2024). The recent literature on supply chains has demonstrated that global supply chains are vulnerable to foreign economic shocks that arise due to geopolitical issues (Alfaro and Chor 2023). Private efforts to mitigate these supply chain disruption risks seem to have resulted in a negative effect on FDI from the UK. Japan: Not Strategic to Deal with the BRI Japan’s pattern is more muted. We show that Japanese FDI in BRI countries rose after BRI participation, but the increase is statistically insignificant (Panel (C) of Figure 1). The result implies that the positive effect through strategic rivalry with China and the negative effect through minimising supply chains with unfriendly BRI countries cancel each other out. Moreover, when the effect of host-country fixed effects are controlled for, we find that FDI from Japan was quite stagnant both in the pre- and post-BRI periods. This implies that host-country characteristics that do not clearly appear in data such as the levels of transport infrastructure and institutions with potential for investment led to the increasing (although insignificant) trend in FDI from Japan in the post-BRI period. This analysis confirms that Japan’s FDI to BRI countries is not largely affected by its strategic stance toward China. Autocracy and Investment We further analysed how the level of democracy of BRI countries affects FDI to these countries, finding that autocratic BRI members attracted more FDI from both China and the US than democratic members. For China, this is consistent with its preference for regime-compatible partners, where infrastructure deals face fewer transparency constraints (Huang 2016). For the US, these findings are in line with our interpretation that the US invests in BRI countries to strategically compete with China. Because autocratic BRI countries are more likely to strengthen their economic and political ties with China than democratic BRI countries, the US is better motivated to invest in autocratic countries. What Should the West Do? Until recently, the BRI had been criticised because it caused debt crises and labour disputes in many of the member countries. However, because US President Trump has imposed high tariffs on most countries, closed down USAID, and shrunk foreign aid, countries in the Global South are currently more willing to strengthen their economic and political links with China. China has responded to this shift quickly and increased the amount of investment in BRI projects to the maximum level in 2024, after a drop during the COVID-19 pandemic period (Nedopil 2025). Our results indicate that the Western nations did not react uniformly to the BRI by increasing FDI to BRI countries. Regardless of this, reducing economic ties with the Global South may lead to increased vulnerability of supply chains for Western nations, because diversified supply chains are found to increase their resilience (Ando and Hayakawa 2021, Kashiwagi et al. 2021). In addition, shrinking economic ties may also shrink political ties. Therefore, Western nations may have to change their strategic responses to the resurgence of the BRI and strengthen economic and political ties with the Global South to promote supply chain resilience and national security.