By David Wu

Copyright news

ASIC, the body responsible for regulating financial services and consumer credit, on Monday said the big four bank will be slapped with a $240 million fine after it engaged in “unconscionable conduct” which impacted 65,000 customers and the government.

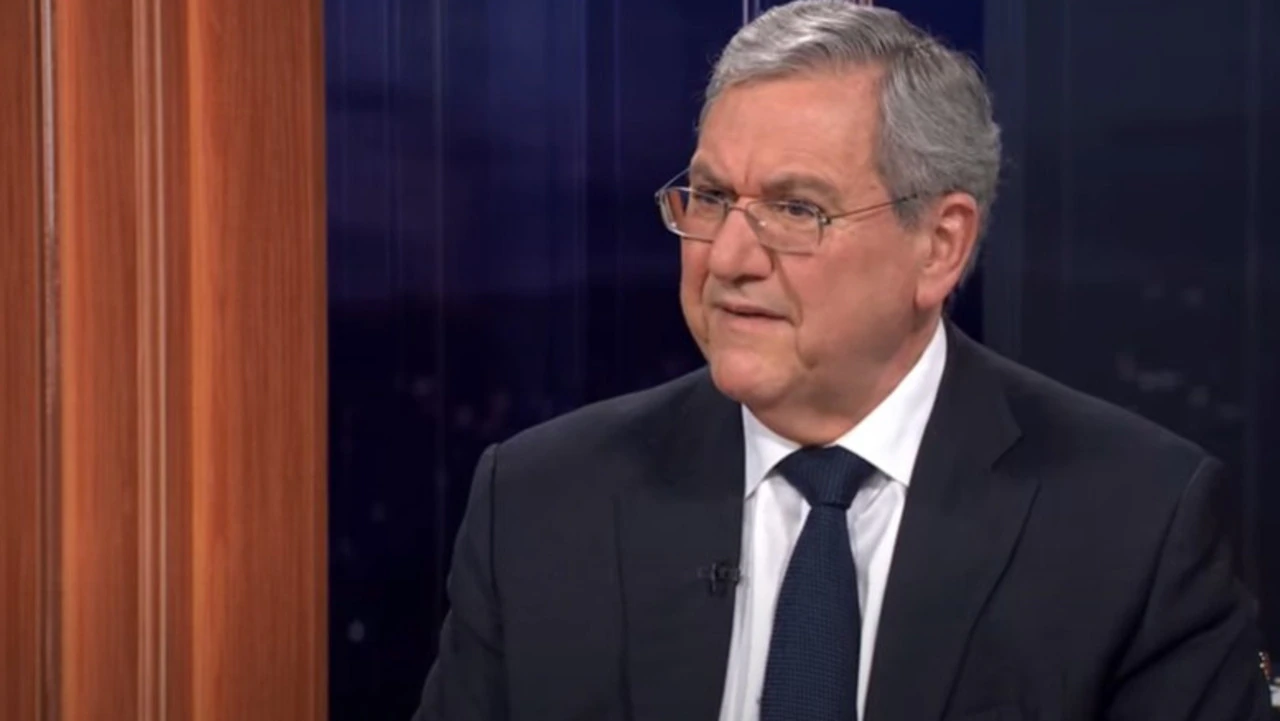

The misconduct occurred “over many years”, with ASIC’s chair, Joe Longo, saying ANZ was “time and time again” betraying the trust of Australians.

Get all the latest Australian news as it happens — download the news.com.au app direct to your phone.

Mr Longo further criticised the bank during his appearance on ABC’s 7.30, saying it was “clearly not managing its non-financial risk properly”.

Host Sarah Ferguson questioned if there was an issue with ASIC given ANZ was known for previous offending with seven civil proceedings filed against it.

“I think it suggests there’s something wrong with ANZ. ASIC is doing its job. This is the biggest penalty ever that ASIC will be asking the court to impose on a bank with its admissions. It’s $240 million on top of earlier matters,” he responded.

Asked if he would bank with ANZ given the new revelations, Mr Longo dropped a bombshell.

“Actually, I do bank with ANZ,” he admitted.

Ferguson wondered if he was now going to switch.

“Well, that’s not appropriate for me this evening to talk about my personal banking arrangements,” the ASIC boss said.

The ABC host argued he made the admission and further asked if he had “confidence” to keep his accounts with the bank “despite being grubby”.

“You also say they betrayed the trust of Australians. You don’t feel betrayed?” she asked.

Mr Sonego said he felt “very let down as a regulator”.

“They should feel disappointed,” he added, when asked how customers should react.

TV star unloads on ANZ

One of the faces of Channel 9 has blasted ANZ for its misconduct.

Discussing the story on A Current Affair on Monday night, host Allison Langdon described the four matters filed against the bank as a “rap sheet”.

“Well, let’s just take a look at what the bank did that was so terrible. It misled the government on a bond deal, but it charged fees to dead customers, didn’t pay promised interest rates, and it ignored clients who were doing it tough,” she told viewers.

“That’s a rap sheet.

“I mean we had a royal commission where we heard story after story of things like this happening. I thought the whole point of that was to stamp this out.”

Langdon also questioned why the fine was not larger given ANZ’s net profit increased to $3.64 billion in the half year to March 2025, up seven per cent from the same time last year.

“This is the 11th breach by ANZ in a decade. What would it actually take … for banks to do the right thing?” she asked her on-air guest.

ANZ admits to ‘widespread conduct’

ASIC will ask the Federal Court to impose a fine totalling $240 million.

It relates to four separate proceedings, including “acting unconscionably” in its dealings with the government while managing a $14 billion bond deal and incorrectly reporting data by overstating it by tens of billions of dollars over 24 months.

The bank is also accused of not responding to just under 500 customers’ hardship notices they sent between May 2022 and September 2024 with some ignored for more than two years.

“ANZ took action to recover debts from customers even when they had not responded to the customers’ hardship notices, including issuing default and demand notices and referring customers to external debt collection agencies,” an ASIC statement said.

It determined ANZ did not have proper processes in place to help those struggling.

The bank also had made false and misleading statements about savings interest rates and failing to pay interest rate to tens of thousands of customers.

Lastly, it charged and then failed to refund charges of dead customers and ignoring loved ones trying to managed deceased estates.

In total, ANZ has been fined more than $310 million since 2016.

ASIC said the bank “admitted the allegations”.

“It is a matter for the Court to determine whether penalties are appropriate and to make other orders,” a statement read.

“Each matter will now be separately considered and determined by the Federal Court.”