Copyright Baton Rouge Advocate

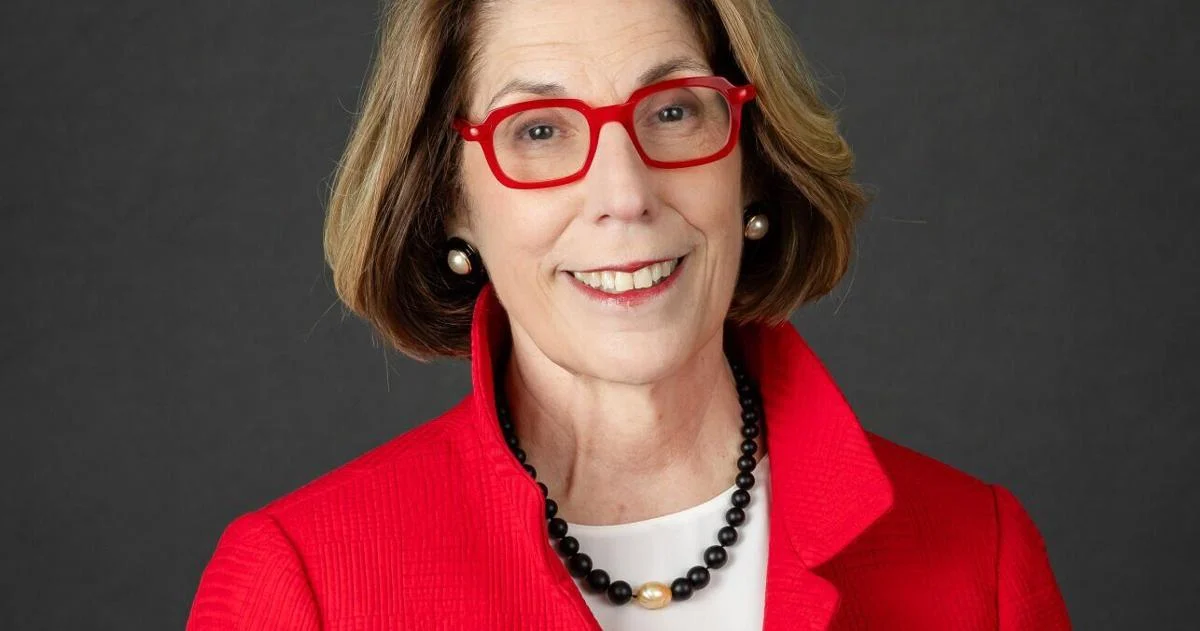

When Gay LeBreton joined Chaffe and Associates in 1987, the New Orleans-based financial advisory and investment banking firm was helping its clients — local banks and savings and loans — work through what, at the time, was the worst financial crisis since the Great Depression. Many local institutions didn’t make it. “We were like hospice workers for banks,” LeBreton said. “So many were dead or dying.” The downturn became an opportunity for Chaffe, which helped its healthy clients reposition themselves either by acquiring smaller banks or selling themselves to larger ones. Eventually, LeBreton parlayed her experience with banks into a mergers and acquisitions advisory service for clients in other industry sectors. Today, LeBreton is the managing partner for Chaffe and knows more about M&A activity in south Louisiana than almost anybody. In this week’s Talking Business, she discusses the changes she’s witnessed over her nearly 50-year career, how Chaffe positioned itself as one of the foremost financial advisory firms in the area and why she’s still bullish on her native New Orleans, despite downturns and the departure of dozens of corporate headquarters during her time. Interview has been edited for length and clarity. What are some of the biggest changes you have seen in the New Orleans business community during your career? When you say the New Orleans business community, I never think Orleans Parish. I am incapable of thinking at that level because businesses work across parish lines, state lines, and a lot of our businesses service customers nationally and internationally. But when I look at the New Orleans area, I know we are not projected to have a lot of growth, population wise, in the next year. Still, I look at Venture Global in Plaquemines; LIT in St. Bernard; investment in the River District, and downtown by Tulane and Domain Cos. (which are partnering to redevelop Charity Hospital); Ochsner’s new Children’s Hospital. There is a lot of new activity in the market that is building a good economy while existing employers like Michoud have fascinating things going on. There is also a lot going on in the industrial sector. Some $44 billion in industrial activity is underway in the New Orleans area and another $33 billion is awaiting final investment decision. Shell and BP are doing things offshore, and the facilities that are needed to support that are based here. I get excited by that. We have a lot going on. The banking industry has seen the departure of corporate headquarters of all the regional and national players. Doesn’t that concern you? Our biggest banks like Regions, Hancock Whitney and, obviously, JP Morgan Chase are all out of state, true. But we have several local banks — Gulf Coast Bank, Resource Bank, First Guaranty Bank out of Hammond, b1Bank out of Baton Rouge, an impressive group of people building across the state. In north Louisiana, we have Origin Bank, and let’s not forget Liberty Bank in New Orleans, which is a great bank and is expanding itself. No doubt, losing headquarters of any company is a loss to Louisiana and that is true in banking. But we have built some sizable banks that are filling some of the gap. Maybe they are not going to be the bank to Venture Global but they can handle the needs of most of all our business community in Louisiana. Let me go back to corporate headquarters. Does it concern you to see Louisiana continue to lose corporate headquarters? I look at what’s coming, not going. You have Meta building in north Louisiana. You have Radiance Technologies building a facility in Ruston that is fabulous. I find Ascension Parish fascinating, and I am still amazed the first new steel plant being done in the country is being built in the Donaldsonville area. All of our companies here that operate in industrial construction and maintenance, which are all over the state, with the amount going on in the state, they are all going to have a lot of work for a number of years. We talked recently about all the M&A activity in the market. What do you think is driving it? Third-quarter numbers are just coming out, and we are seeing a lot more deal activity locally and nationally. I think there are several reasons. You have stabilized interest rates with the expectation of at least one or more further cuts in the rate, which is giving people confidence. The One Big Beautiful Bill passed and is very pro-business and supports capital investment. Just knowing the lay of the land, rather than having a big question mark, helps give people confidence. And I think we are seeing it across the country. Locally, there are more sales of local companies than purchases by local companies, but there are plenty of purchases. And we’re seeing a lot of industrial services activity. Everyone is looking at the work that is going to be in the pipeline. I do think we will see more activity in the maritime sector — not only M&A but people building companies. You seem to be optimistic. Does that just go with your job? If you are going to be in M&As, there is a certain amount of optimism you better have going into the job, and honestly, you have to have a bit of a stick-at-it attitude because there are bumps in every deal. So, you have to have a little bit of optimism because you are always looking for how to make it work. That said, how do you see things right now? New Orleans proper has an opportunity to change its profile over the next 20 years with higher-paid jobs, industry and it just remains to be seen whether we are going to do it. Tourism has been wonderful, but it generates lower-paying jobs. We have improved our educational system. Now, we need to build on that. We cannot relent. What kind of challenges did you face as a woman in this field? There are some challenges. I never really thought about them. I just was focused on getting the job done. That seemed to work. I grew up at a time when you maybe had to have a little tougher skin than you do today. If someone called me "honey," at least they were calling me. So long as we were getting the job done, we were employed. That’s all that mattered. Today, there is more flexibility in the workforce, so women can define what they want to do a little more easily. They can work from home if they need to. It is definitely easier today.