Copyright Baton Rouge Advocate

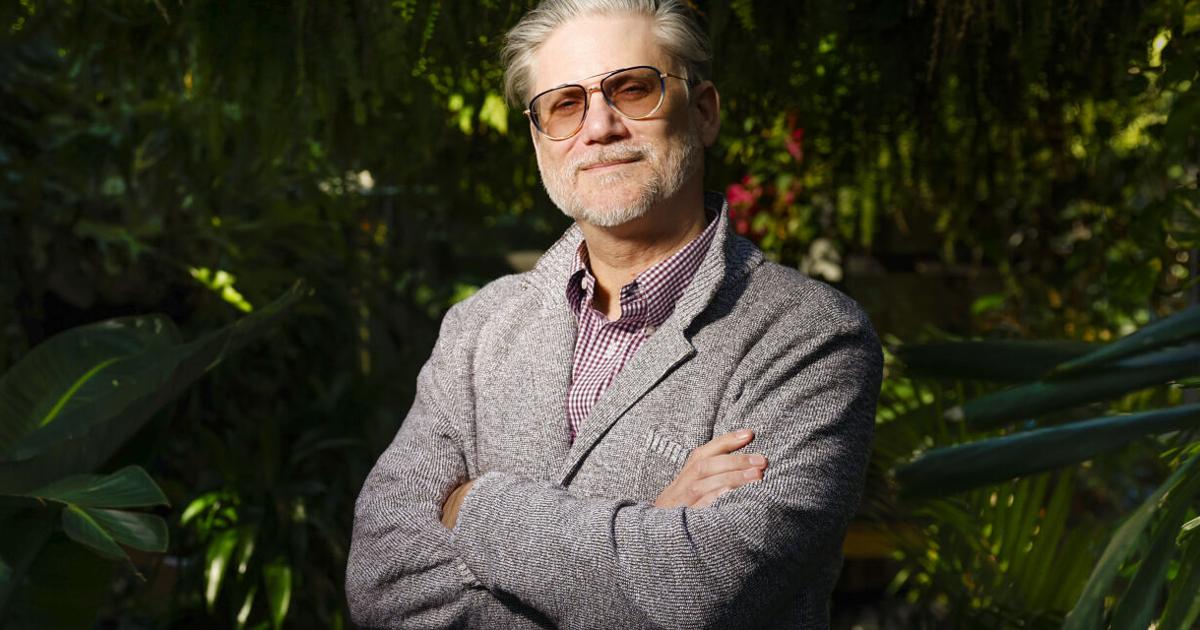

By 8 a.m. most weekdays, Patrick Comer is connected by video call to London, Stockholm, Barcelona and other faraway cities as he meets remotely with executives of the publicly traded market research firm he's run since September 2024. Working from his suburban St. Charles Parish home, and from his stylish office in New Oleans' Lower Garden District, he's the unlikely CEO of Cint, the Stockholm, Sweden-based company that bought his Louisiana tech startup Lucid nearly four years ago for $1.1 billion and created a huge payday for him and his investors. Comer, an Alabama native who moved to the New Orleans area in 2008, is the first to say that he didn't have being CEO of a Swedish tech company on his 2025 bingo card. But then he didn't know the acquisition of Lucid would precede a challenging era for Cint, which has seen its stock market value tumble in the years since. Now, instead of having more time to throw the ball with his kids or sip rum drinks on an island, Comer is back in the trenches, trying to boost the financial performance of the company that absorbed the business he built for more than a decade. He travels multiple times each month to several continents to meet with customers, employees, board members and investors. The surprising turn of events demonstrates that a splashy "exit," the tech world's term for selling a company, isn't always the end of the story. In Lucid's case, Comer is now working harder than ever to preserve his startup's legacy and boost the value of Cint's stock in the process, while he cheers on several former Lucid execs who have created spinoff companies that are turning New Orleans into a small-scale hub for the evolving market research industry. Anyone with a stake in Cint, which reported roughly $180 million in net sales in 2024 and has more than 700 employees, is no doubt rooting for Comer as well. "I feel very responsible and accountable because I stood up to my investors, much less Cint's investors, and said this deal was going to work," Comer said during an interview at his Lower Garden District office last week. "So my primary reason for being back in the deal is because I said it was going to make it work. People are like, 'Well, the share price will make me money.' All that may be true. But the clear reason is to fulfill my obligations." Opportunity to expand At the time of their merger, Lucid and Cint were doing similar things from different sides of the Atlantic. They both connected brands, researchers, political campaigns and other clients to a global audience of survey respondents, who might trade their feedback for airline miles, loyalty card points or other perks. By 2021, Lucid had grown to employ more than 500 people globally and about 130 in New Orleans while reporting revenue for the first three quarters of the year in excess of $80 million. Cint, meanwhile, which had been acquired in 2016 by a private equity firm, had about twice as many employees and reported more than $150 million in revenue for that year. Its owners saw in Lucid an opportunity to expand, and in October offered roughly $580 million in cash and $470 million in shares for the company. On paper, the merger made a lot of sense. Former Cint CEO Tom Buehlmann said then it would "enable our customers to access millions of people's opinions in an easier, faster and more efficient way." But, in hindsight, the timing might have been better for Lucid than Cint. The deal closed just before rising interest rates and inflation, combined with AI disruption, shocked the entire tech industry, leading to the loss of nearly $7 trillion in market value industrywide over the next year. “I sold at the absolute top of the most recent bull market for technology globally: Dec. 29, 2021," Comer said. "The share price of Cint dropped by 90% in the next 18 months because the value of technology stocks fell from its high-water mark." 'Tons of challenges' Post acquisition, Cint battled with external problems, like a reduction of research technology budgets, and internal ones, most notably the much slower-than-expected integration of the platforms Cint and Lucid used to serve their customers. "We have struggled to combine these companies and their technology," Comer said. "In a vacuum, either one of them worked great, but pulling all these things together has created tons of challenges." The numbers tell the story: Cint was trading at over 100 Swedish krona on the Stockholm Nasdaq stock exchange at the time of the deal. After a steep decline in 2022 and a slower descent after that, the company’s share price was hovering in the single digits in September 2024, when Comer was tapped to take the reins. Since then, Comer has focused on a turnaround even as tariff uncertainty and the lack of a major national election cycle have softened demand for market research. In its most recent earnings report, Cint reported a roughly 20% quarter-over-quarter net sales decline in the third quarter of this year. But Comer said the drop in revenue happened for the right reason: the company chose to avoid a “death by a thousand cuts” by moving most Cint customers to the new consolidated tech platform in a burst rather than over time. Now that most customers are working on the same system, he believes his teams around the globe can focus on bringing in new ones. "This is not a falling market, nor is this a failed strategy, but this is literally the cost of the transition," he said in his Oct. 24 presentation. Last week, he said the company can now shift "back to innovation, back to revenue, back to our customers." Specific moves that have Comer excited include the release of a new chatbot feature that will let customers interact with their data, and a partnership with a vendor that will provide sales data to quantify the effectiveness of ad campaigns. The 'Lucid mafia' For several years after the Lucid sale, Comer served as chairman of the Cint board of directors. That advisory role allowed him to focus on his family and pursue other interests. During that time, he founded the gaming startup Gripnr, and he co-founded NieuxCo., which operates a tech community gathering place based in the Eiffel Tower building on St. Charles Avenue. He and his wife, Christina, also have supported civic causes in New Orleans, like a $1.5 million donation to the Son of a Saint nonprofit, and a bigger gift to the choir at their shared alma mater, the University of the South in Sewanee, Tennessee. He's not the only one who's been busy. Since 2021, several former Lucid execs — who Comer called the "Lucid mafia" — have launched tech ventures of their own. Rep Data, founded by former Lucid employee Patrick Stokes, completed a major fundraising round earlier this year for its software that promises high-quality data and fraud protection. The company has 100 employees, including about 20 in New Orleans. Rep Data bought Research Defender, founded by another former Lucid employee, Vignesh Krishnan, in 2023. Rick Rogers, who moved to New Orleans in 2015 to work for Lucid, launched RevOptimal in 2023 to help companies better target audiences for their online ads. The company has 16 employees, including four in New Orleans. Cint itself has about 50 employees working in Louisiana, but that's not the only way its CEO is boosting the region's tech scene. Comer is among the tech founders who contributed to a venture capital fund that invests in some of the startups that graduate from accelerator programs at the Idea Village, the city's most high-profile nonprofit business accelerator. "That's a clear and undeniable example of the passing on," said Comer, who said he sees similarities between the business climate now and 15 years ago when he launched Lucid. "We were coming off the economic crisis of 2008 through 2011," he said. "Now, the next bull run is about to start, and you always want to start companies when things are tough, because you've got the most runway or ramp to build from there."