Copyright New York Post

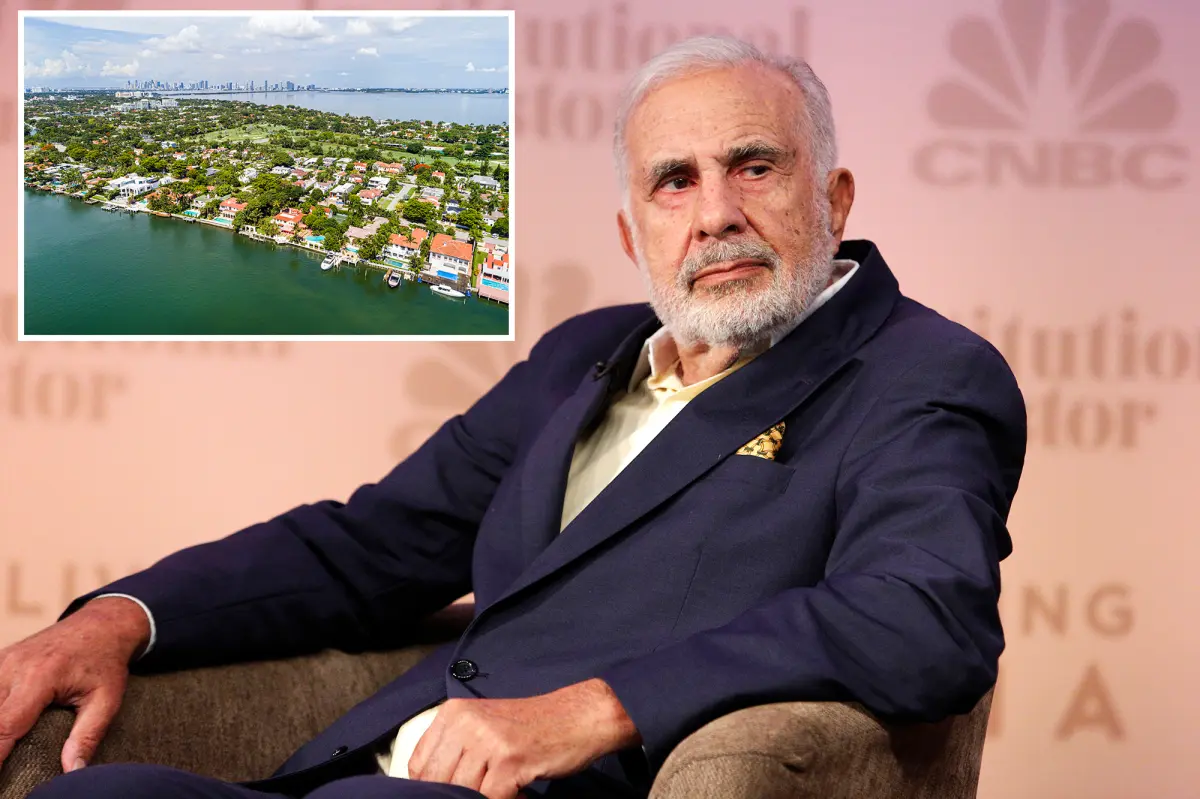

Carl Icahn’s fortune has plummeted from a recent peak of about $17.5 billion to roughly $4.8 billion — the biggest drop of his storied career — after a bruising battle with short-seller Hindenburg Research, according to Forbes. The nearly 75% drop in Icahn’s net worth from 2023 to this year came as Hindenburg accused his firm of inflated valuations and unsustainable dividends — allegations Icahn strongly rejected. The 89-year-old activist investor — once considered one of Wall Street’s fiercest corporate raiders — insisted in a recent series of interviews with The Wall Street Journal that he’s still a fighter. He also reportedly enjoys betting on NFL games every week, winning about $80,000 through bets on the San Francisco 49ers and the Seattle Seahawks on Sunday. Friends of Icahn told The Journal that he spends more time reading and reviewing investments than socializing, though he remains on civil terms with his ex-wife, Gail. His health, while fragile after recent surgeries, has reportedly stabilized. Recent years have seen Ichan battle a series of challenges including an operation on his ankle that left him unable to walk comfortably for months and forced him to give up daily tennis. Soon after, he was treated for an enlarged spleen, with medication initially causing fatigue and shortness of breath — though he says he never missed a day of work because of the procedure. “I keep going,” he recently told The Journal. “I enjoy the game.” But the game has changed. Icahn Enterprises — once a symbol of his ruthless success — has lost about 80% of its market value since the May 2023 short-selling attack by Hindenburg Research. The short seller likened Icahn’s business model to a “Ponzi-like” structure. Icahn dismissed the allegations as lies, but the fallout erased billions from his fortune and sent his company’s stock to its lowest level in decades. The decline was amplified by Icahn’s own use of leverage. He pledged more than half his holdings in Icahn Enterprises as collateral for personal margin loans. When the stock price collapsed, lenders forced him to renegotiate to avoid a margin call. Icahn fought back in familiar fashion, denouncing short sellers and defending his accounting practices. “They took part of my army away, like Alexander the Great,” Icahn told The Journal when asked about the fallout of the Hindenburg attack. “He has to change his battle plans, but it’s not that bad,” he added. Inside Icahn Enterprises, succession planning has grown uncertain, according to The Journal. The founder’s son Brett Icahn rejoined the firm in 2020 under a seven-year contract, but recent bets have stumbled. A major position in Bausch Health lost more than $700 million, and key lieutenants have departed. One, Steven Miller, left after clashing with Brett Icahn; another, Andrew Teno, is now chief executive and considered the most likely operational successor. Carl Icahn himself still lives and works in near isolation at his waterfront home on Miami’s Indian Creek Island, known as “Billionaire Bunker,” The Journal reported. Icahn insisted to the publication that the tide is turning. He pointed to a rebound in third-quarter earnings — among the company’s best ever — and says new investments in EchoStar and Monro, an auto-service chain, signal fresh momentum. Icahn Enterprises reported $287 million in net income last quarter — up sharply from a year earlier — buoyed by gains in CVR Energy, the refiner it controls. Yet Icahn’s focus has shifted beyond balance sheets. He has launched a campaign against what he calls the “cartel” of BlackRock, Vanguard and State Street, arguing that their dominance of index-fund voting power has neutered shareholder activism. He’s drafting a white paper urging Congress and President Trump to restrict their influence, convinced that activists like himself are vital to corporate accountability, The Journal reported. He says his greatest investment remains the Icahn School of Medicine at Mount Sinai, which he endowed with $200 million in 2012. He also funds animal charities and still believes his activism makes capitalism stronger. Still, Icahn admitted to being too proud in the past. “It was hubris,” he told Puck News last year. “I thought I could figure out what the market was going to do. That’s the dumbest thing you can do.”