By Recorder Report

Copyright brecorder

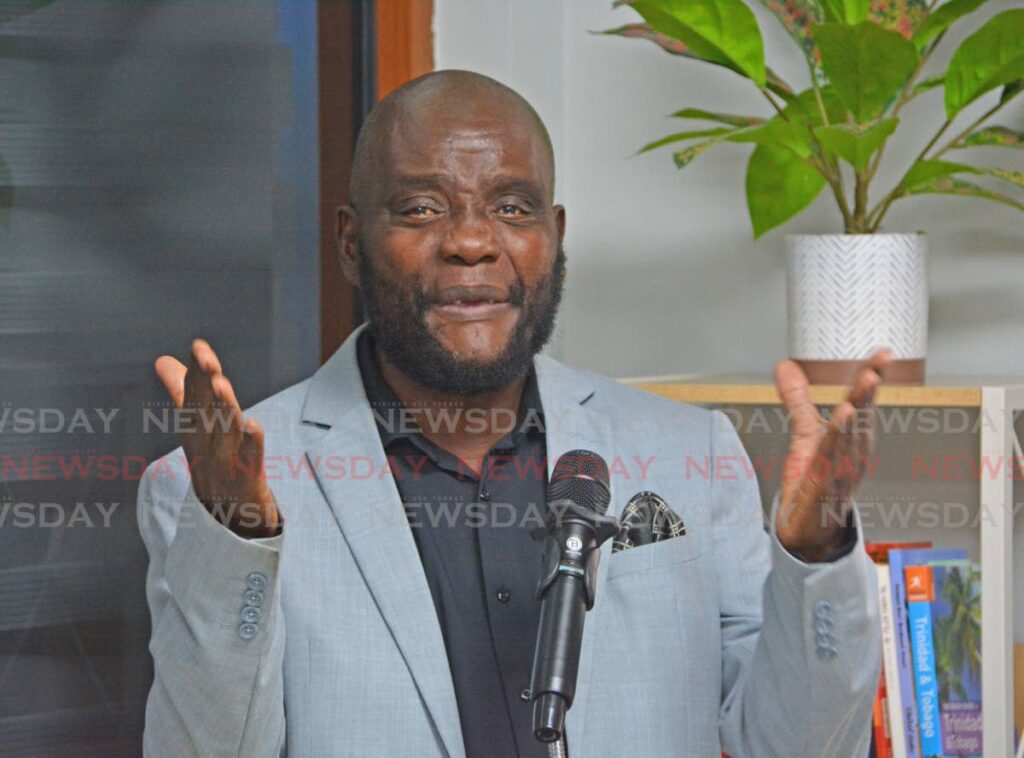

KARACHI: Mian Zahid Hussain, President Pakistan Businessmen and Intellectuals Forum & All Karachi Industrial Alliance, Chairman National Business Group Pakistan, Chairman Policy Advisory Board FPCCI, has said that in a period of profound challenge and contradiction, Pakistan’s economy is navigating a precarious equilibrium between financial market optimism and the severe realities of an ongoing flood crisis.

“Our nation faces a dual challenge: the devastating aftermath of the 2025 floods and a troubling reversal in foreign capital flows,” said Mian Zahid Hussain. “While the KSE100 index has soared to an all-time high—a vote of confidence in our government’s policy stability under the IMF program—this financial optimism masks a fragile reality on the ground.

A critical point of concern, highlighted by Hussain, is the significant net capital outflow observed in the first two months of the current fiscal year. New Foreign Direct Investment (FDI) inflows of $364 million were significantly outpaced by the profit repatriation of foreign investors, which more than doubled year-on-year to $593 million.

“This net outflow of $229 million in July and August is a clear signal that existing foreign investors are generating high, quick returns but are not reinvesting them into Pakistan’s long-term productive capacity,” he stated. “This poses a major challenge to our balance of payments and our ability to attract sustainable foreign capital.” This trend, led by China, the UK, and the Netherlands, suggests a diminished long-term confidence from some of the nation’s key investors.

The ongoing floods have delivered a catastrophic blow to both the agricultural and industrial sectors. Reports indicate that up to 60% of the rice crop and 35% of the cotton crop have been destroyed in Punjab alone. This devastation not only threatens food security but also creates a significant supply-side shock, which is expected to cause a spike in domestic food prices and reignite inflation.

Hussain also noted the cascading impact on the industrial sector. “The destruction of our cotton crop will create a ripple effect throughout the textile industry, our top foreign exchange earner. Meanwhile, for the first time in decades, industrial hubs like Sialkot have also been impacted, with several workshops ‘marooned’,” he said.

We must implement a comprehensive policy to incentivize the reinvestment of repatriated profits within Pakistan. Targeted tax breaks and streamlined regulations could encourage foreign companies to reinvest their earnings back into our productive capacity,” he urged.

He emphasized the need to aggressively pursue diplomatic initiatives to diversify trade partners, referencing recent outreach to ASEAN member states and efforts to strengthen commerce links with Bangladesh. The recurring nature of natural disasters requires a long-term strategy for climate resilience. Hussain stressed the need to prioritize investment in climate-resilient infrastructure and diversified agricultural practices to break the cycle of economic stagnation caused by extreme weather events.

“Our economic future hinges on our ability to translate short-term financial optimism into long-term, sustainable growth. This requires a coordinated effort from the government, the business community, and international partners to address these fundamental challenges head-on,” concluded Mian Zahid Hussain.

Copyright Business Recorder, 2025