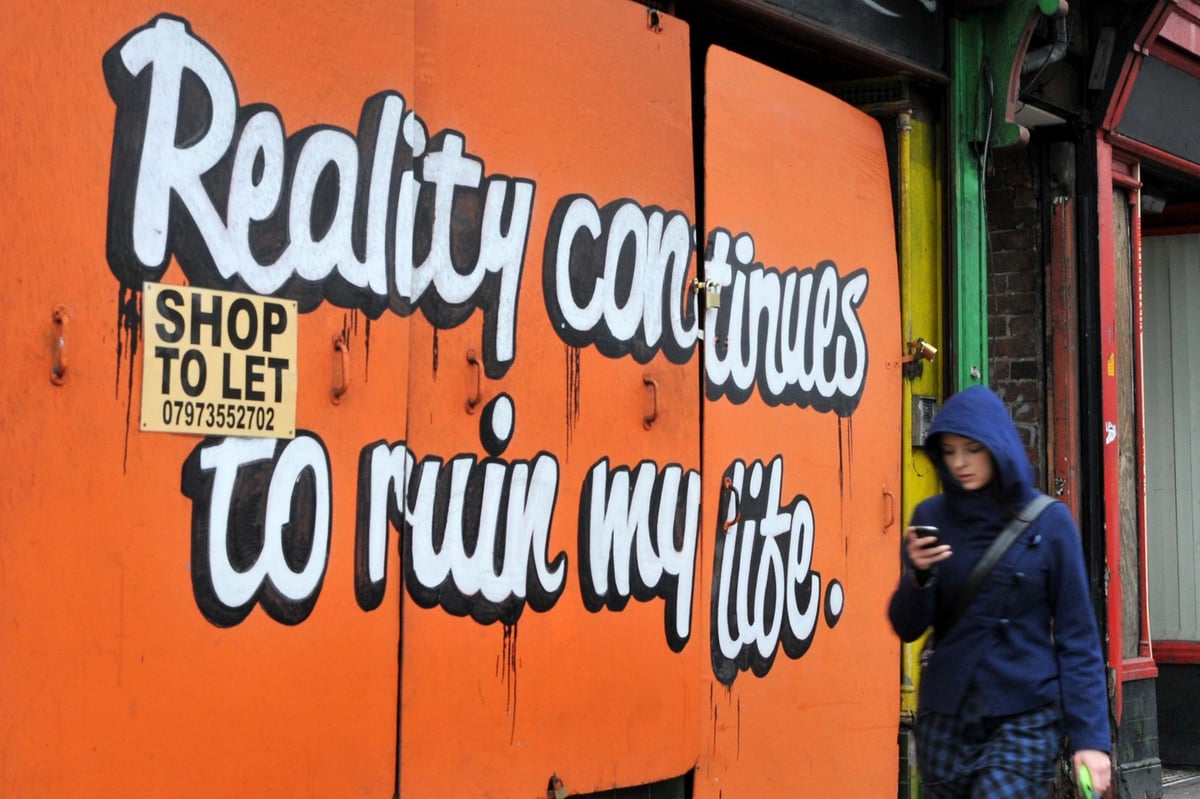

Copyright birminghammail

Commissioners overseeing Birmingham City Council have strongly hit back at claims that the authority's bankruptcy was 'not necessary' and its financial woes 'exaggerated'. Lead commissioner Tony McArdle and finance commissioner Chris Tambini said it was a 'false narrative' for academics to claim the council had been in 'reasonable' financial health when senior officers raised the alarm in 2023. They described the analysis as 'ill informed' and 'distracting' at a critical time. The government sent in the commissioners to take over the council's affairs two years ago. It has been under intervention ever since. READ MORE: Demand for public inquiry into Birmingham bankruptcy as academics claim 'figures don't add up' The pair took the unusual step of issuing a public statement in response to local and national headlines proclaiming the council's bankruptcy was unnecessary, based on an analysis by accounting expert Dr James Crackley and others. Earlier this month Dr Brackley published his claims that the council's financial position and the risk of equal pay claims had been 'miscalculated' by hundreds of millions of pounds and its finances were actually in a reasonable, manageable state when it 'went bust'. A Section 114 'distress' notice issued by its finance chief had caused a snowball effect, triggering intervention, job losses, massive service cuts and council tax rises. But the figures the council used to justify its distress were 'miscalculated' and 'misleading', claimed Brackley. His analysis was supported by 23 accountancy professors and academics, who together joined him in calling for an independent public inquiry into the affair. The two commissioners spoke to BirminghamLive to make their case, after first publishing a statement online in response to the analysis. Mr Tambini, who had been a council finance director for a decade prior to his appointment as commissioner, described the financial situation at the council when he arrived on the scene in October 2023 as 'desperate'. He said there was no plan in place to address equal pay, nor were any negotiations under way to resolve the problem long term, despite thousands of active claims. While it now appeared the negotiated final settlement on equal pay claims would be significantly less than the original estimate of 'up to £760m', there was no guarantee at the time that those costs would not have kept building up into the future. "If I had been Section 151 officer at the time I would have issued that notice," he said...."I can fully understand why the notice was issued. The biggest liability (equal pay) was still there and was still growing." He said previous, unaudited budgets had not properly accounted for those risks up to 2023. The second major issue was the size of the 'budget gap' facing the council - the difference between its income and outgoings. By October 2023 the gap was £87m, and growing - but for the following year it was estimated to have risen to £375m. "And again there were absolutely no plans to address that," he said. Even six months later, with commissioners breathing down their necks, the council only identified £150 million of savings and cuts, he said. "The actual position was much worse. "So I'd say it was the right call at the time and also the right call with hindsight. Saying that the council's finances were actually sound is not accurate." Asked who the public should believe - the academics and those councillors suspicious of the actions of officers and auditors, or the commissioners, external auditors and council officials - Tambini said: "I'd say of course the council and commissioners." The council is currently preparing a very detailed response to every point made in the James Brackley analysis and their findings will be discussed at a future Audit Committee, he added. Mr Tambini said he had exchanged views with Dr Brackley before about the council's finances after previous concerns were flagged. He acknowledged the pair had disagreed on 'most fundamental issues' around the city council's finances. But he said: "We're now in touching distance of getting the council out of the most critical part of the intervention, particularly around the finances...we really do hope next year's budget will be a balanced budget without the use of any asset sales or anything like that. "So the concerns that commissioners have around this analysis is that it is a distraction, and it allows some elements to think that we don't need to do what we're doing. That has a real impact, and could cause big issues for Birmingham . That's why we're concerned." Mr McArdle, who replaced Max 'the Axe' Caller earlier this year as the council's lead fixer, said: "I'm not sure how any interpretation of the undeniable scale of difficulties at Birmingham that seeks to suggest 'well, it wasn't really that bad two years ago, perhaps all this wasn't necessary' is at all helpful. The fact of the matter is, as has played out, Birmingham was in a dire position. "You've reported yourself on many issues - like Perry Barr (housing scandal), equal pay liabilities over many years, what's happened with the Oracle implementation and so on. "BirminghamLive readers are having to pay the bill for all of that stuff. Our work here is about stopping those difficult, poor decisions being made, and that hemorrhaging of money across all these things...so that the council can be put back on a sustainable footing." He added: "An argument about who knew what, when, in September two years ago, and whether they should have done something differently, is all well and good, but it doesn't pay off any of those bills." He also pointed out that Birmingham City Council had not gone into government intervention solely because a S114 notice was issued. That happened only after the Government found evidence about the dire context for the financial distress and issues around governance, scrutiny and financial mismanagement. In a joint statement they also said: "There have been many solutions put forward to Birmingham's financial woes. Some argue for the use of reserves, but you can only spend these once and you do need them for their proper purpose. In any event, as at the end of March, available reserves were £177m, a figure still wholly inadequate to meet the likely liabilities and known deficits. "Others say the council should borrow...this does need to be paid back, with interest, and this never seems to get the attention it requires in much of the ill-informed analysis. For the largest council in Europe to behave like a bad debtor shifting loans between maxed out credit cards is neither legal nor feasible. "There is no magic fix to Birmingham's woes. They have been a long time in the making, and whilst good progress has been made by the new leadership recently, there remains a lot to do." Dr James Brackley, formerly of Sheffield University's Audit Reform Lab and now based in Glasgow, has listed a series of reasons why he believed the council had inaccurately overstated its financial woes when the first of two Section 114 Notices were issued in September 2023. Read the full story of Birmingham's 'bankruptcy' and why the numbers don't seem to add up on Inside Birmingham with Jane Haynes Comparing the original notices and official statements from around that time with the delayed annual accounts for that year, published this summer, he found a series of major discrepancies. These were: His analysis concluded that only an independent public inquiry will be able to properly probe the circumstances surrounding the chaotic events of late 2023. In response to the commissioners' written reply to his analysis, Dr Brackley said he stood by his findings and challenged the commissioners to agree to a public inquiry. He said he found it 'extraordinary and deeply worrying' that the key planks of his analysis had yet to be addressed.