By BR Research

Copyright brecorder

Beco Steel Limited (PSX: BECO) was formerly known as Ravi Textile Mills and is incorporated in Pakistan as a public limited company. BECO is an integrated steel producer with products ranging from scrap to billet to various end products including specialty steel.

Pattern of Shareholding

As of June 30, 2024, BECO has a total of 124.963 million shares outstanding which are held by 1241 shareholders. Around 53.32 percent of BECO’s shares are held by its directors and sponsors followed by general public holding 22.83 percent shares. Chaudhry Steel Re-rolling Mills (Private) Limited has a stake of 21.94 percent in the company. Financial institutions account for 1.70 percent shares of BECO. The remaining shares are held by other categories of shareholders.

Historical Performance (2020-24)

After 2016, BECO didn’t post any sales for the four successive years. However, it posted net profit in 2019 and 2020 on account of its other income. At the end of 2014, the company’s operations were resumed after over three years with the support of loans from its directors, however, in August, 2017; its operations were again suspended due to liquidity constraints, non-availability of fresh credit lines from banks and unfavorable circumstances in the yarn market (the company previously operated as a textile concern). The company had been consistently posting net losses since 2010 which had put it under extreme liquidity stress. As the company was unable to meet its financial obligations, it suffered recovery suit from the creditors which resulted in halting its operational activities for many years.

In March, 2020, 51 percent of the company’s shares along with its management control was acquired by Ch. Muhammad Shafique and Muhammad Ahmed Raza who were also the major shareholders of Chaudhary Steel Re-rolling Mills Limited and Beco Steel Re-rolling (Private) Limited respectively. The new shareholders having rich experience in the steel sector changed the company’s line of business from textile to steel. However, the company couldn’t record any sales in 2020. Administrative expense dropped by another 36.71 percent year-on-year in 2020 as the number of employees was reduced from 17 in 2019 to just 4 in 2020. Other expense ticked down by 65 percent in 2020 due to reduction in provisioning done for WPPF and no loss incurred on the sale of store, spares and loose tools in 2020. While the company made significant profit on saving accounts and also wrote back loan from the ex-director. However, high base provided by the gain on the disposal of fixed assets in 2019 resulted in a drop of 63.19 percent in other income in 2020. Operating profit dropped by 66.45 percent year-on-year in 2020 to clock in at Rs.31.658 million. Finance cost grew by 41 percent year-on-year to clock in at Rs.1.04 million in 2020 on account of interest charges on WPPF. Net profit dropped by 70.38 percent year-on-year in 2020 to clock in at Rs.30.197 million with EPS of Rs.1.21.

The company started its steel business in July 2021 on toll manufacturing basis and posted net sales of Rs.230.77 million. Cost of sales clocked in at Rs. 226.74 million which mainly comprised of raw materials consumed during the year. Gross profit was recorded at Rs. 4.03 million in 2021, resulting in GP margin of 1.75 percent. Administrative expense mounted by 99.42 percent mainly on the back of fee & subscription charges incurred during the year. The company also hired two new resources during the year resulting in a workforce of 6 employees in 2021. BECO also incurred distribution expense of Rs.1.84 million in 2021. During the year, the company considerably reduced its profit related provisioning, however allowance for ECL booked during the year resulted in 10.50 percent uptick in other expense in 2021. Other income shrank by 46.51 percent in 2021 due to high-base effect as the company wrote back directors’ loan worth Rs.25.20 million in the previous year. The write-back of directors’ loan was the main reason which had enabled BECO to record a positive bottomline in 2020. In the previous year, the company also recorded operating profit of Rs.31.658 million which shrank by 79.22 percent in 2021. OP margin clocked in at 2.85 percent in 2021. Finance cost plunged by 71.38 percent in 2021 due to lower interest charges incurred on WPPF. Net profit deteriorated by 92.30 percent to clock in at Rs.2.32 million in 2021. This translated into EPS of Rs.0.09 and NP margin of 1.01 percent in 2021.

In 2022, BECO’s topline multiplied by 2634.46 percent to clock in at Rs. 6310.32 million. During the year, the company achieved major milestones i.e. the addition of plant and machinery and start of commercial operations on its own manufacturing plant during the last two months of 2022. Before that, the company operated on toll manufacturing facility. For a massive capital investment, the company issued 99.96 million ordinary shares at a premium of Rs.20 per share for a total value of Rs.2,998.975 million in 2022. High cost of sales due to commodity super cycle in the international market coupled with Pak Rupee depreciation pushed the cost of sales up by 2552.51 percent in 2022. Yet the company was able to record 7247.39 percent higher gross profit in 2022 with GP margin jumping up to 4.70 percent. Administrative expense grew by 187.27 percent in 2022 due to staggering growth in payroll expense as the number of employees grew from 6 in 2021 to 160 in 2022. Other factors that pushed up the administrative expense were higher rent, rates and taxes as well as higher legal and professional charges incurred during the year. Distribution expense grew by 755.31 percent year-on-year in 2022 due to carriage and transport charges. Other expense also grew by 516.50 percent in 2022 due to higher provisioning done for WWF and WPPF. Conversely, other income shrank by around 99.57 percent in 2022 due to lower profit on saving account. Operating profit grew by 3246.16 percent in 2022 with OP margin climbing up to 3.50 percent. Finance cost slid by 50.90 percent year-on-year in 2022 due to lower interest incurred on WPPF. Net profit grew by 8097.54 percent in 2022 to clock in at Rs.190.52 million. This translated into EPS of Rs.4.45 and NP margin of 3 percent in 2022.

In 2023, BECO’s net sales dwindled by 40.54 percent to clock in at Rs.3752.11 million due to lower sales volume on the back of poor economic and political condition of the country which greatly reduced the construction and infrastructure development activities in the country. High international steel and petroleum prices due to commodity super cycle in the global market was further exacerbated by Pak Rupee depreciation and high indigenous inflation. As a consequence, BECO recorded gross loss of Rs.20.03 million in 2023. While the company streamlined its workforce from 160 employees in 2022 to 34 employees in 2023 resulting in a downtick recorded in payroll expense, whopping spike in travel & conveyance charges drove administrative expense by 17.66 percent in 2023. Distribution expense tumbled by 91.77 percent in 2023 as no carriage & transport charges were incurred coupled with a decline in the salaries of sales force. No provisioning done for WWF and WPPF resulted in 42.66 percent lower other expense in 2023. Other income grew by 83 percent in 2023 due to increased profit on saving accounts, however, wasn’t significant enough to produce any positive impact on the company’s financial performance. BECO posted operating loss of Rs.82.12 million in 2023. Finance cost escalated by 2146.46 percent due to massive interest charges incurred on WPPF on account of monetary tightening. Net loss clocked in at Rs.204.12 million in 2023. This culminated into loss per share of Rs.1.63 in 2023.

In 2024, BECO’s net sales further plummeted by 17.43 percent to clock in at Rs.3098.02 million. Inferior politico-economic conditions continued to take its toll on the sales of the company. However, decline in the international commodity prices and stability of Pak Rupee towards the end of the year enabled the company to record gross profit of Rs.223.36 million in 2024. This translated into GP margin of 7.21 percent in 2024. Administrative expense mounted by 445 percent in 2024. The main reason behind this massive rise in administrative expense was due to provision of Rs.224.174 million booked against the litigation charge raised by FBR. BECO also expanded its workforce to 46 employees in 2024, resulting in higher payroll expense. Distribution expense slid by 29 percent in 2024 as the company didn’t incur any salaries of sales force. Decline in miscellaneous charges resulted in 23 percent lower other expense recorded in 2024. Liabilities worth Rs.110.079 million written back during the year resulted in 64507.50 percent higher other income in 2024. BECO posted operating profit of Rs.46.14 million with OP margin of 1.49 percent in 2024. Finance cost surged by 59.82 percent in 2024 due to greater bank charges & commission and higher interest charges on WWF and WPPF. BECO recorded 54.66 percent thinner net loss to the tune of Rs.92.54 million in 2024. This translated into loss per share of Rs.0.74 in 2024.

Recent Performance (9MFY25)

During the nine-month period of FY25, BECO’s topline posted a staggering year-on-year growth of 118 percent to clock in at Rs.6064.36 million. In the previous years, the company navigated through a testing macroeconomic backdrop. However, improvement in the same enabled the company to realize its potential and strike important deals both within and outside the country. Cost of sales surged by 110.57 percent in 9MFY25. This resulted in 315.38 percent stronger gross profit in 9MFY25 with GP margin clocking in at 6.96 percent versus GP margin of 3.65 percent recorded in 9MFY24. Administrative expense surged by 131.87 percent during the period under review possibly on account of higher payroll and travelling & conveyance charges. Distribution expense fell by 17.16 percent during 9MFY25. Higher profit related provisioning appears to be the cause of 571.36 percent hike in other expense in 9MFY25. Conversely, other income slid by 13.97 percent during 9MFY25 seemingly due to lesser profit recognized during the year. Thinner other income might also be due to the fact that the company wrote back its liabilities in the previous year. Operating profit strengthened by 503.79 percent in 9MFY25 with OP margin clocking in at 4.60 percent versus OP margin of 1.66 percent recorded in 9MFY24. Finance cost tumbled by 77.61 percent during the period under review due to monetary easing which squeezed the interest charges on WPPF. BECO recorded net profit of Rs.202.94 million in 9MFY25, up 1872.82 percent year-on-year. This translated into EPS of Rs.1.62 in 9MFY25 versus EPS of Rs.0.08 recorded in 9MFY24. NP margin also climbed up from 0.37 percent in 9MFY24 to 3.35 percent in 9MFY25.

Future Outlook

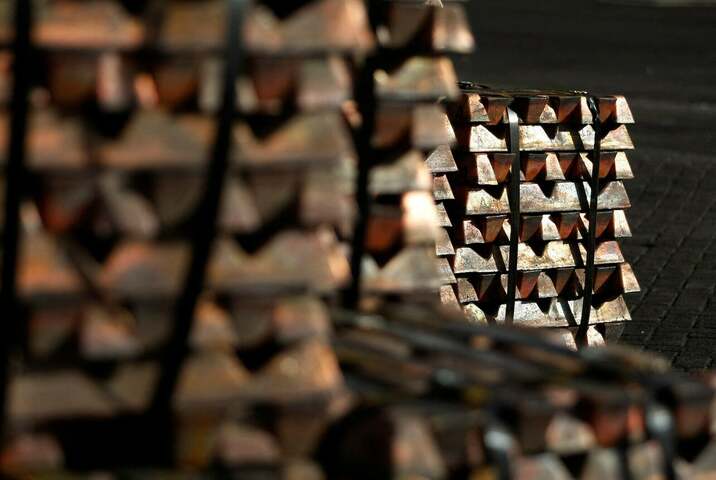

Significant increase in PSDP allocation will boost the reconstruction and rehabilitation activities in the areas affected by the Monsoon floods. This will buttress the demand of long-rolled products. Moreover, with the downward revision in international steel prices and the improvement in the value of Pak Rupee, the company would be in a better position to stock up on its inventory. BECO is also eyeing international markets to diversify its sales mix. One significant step in this direction was the shipment of first export consignment of copper ingot to Hong Kong, China.