Banks up scrutiny on education loan exposure, tighten underwriting norm post H-1B visa diktat

By Piyush Shukla

Copyright thehindubusinessline

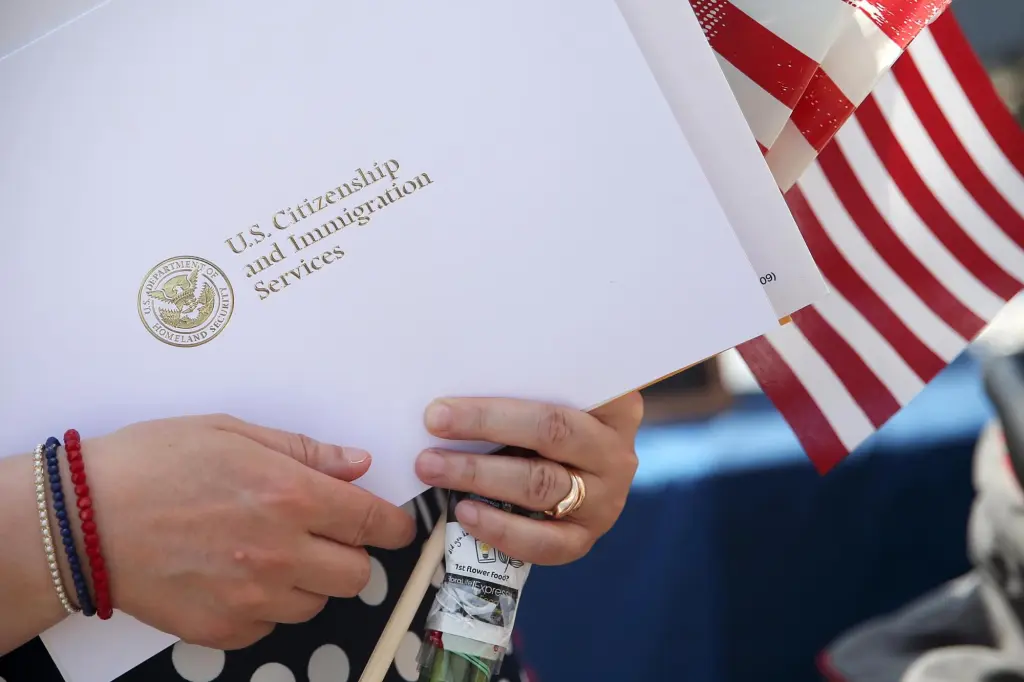

Indian banks have increased scrutiny of their education loan portfolios and are tightening underwriting standards following the US government’s move to tighten H-1B visa norms, including a proposed $100,000 fee per new applicant, sources say.

“Students who want to study abroad are hesitant in applying for a loan, considering the latest US move on the H-1B visa. While these loans are backed by some security of parents, if the family is from a marginal background, and if the students are in their second or third year of their graduation, aspiring for a H-1B Visa, and if they don’t find a job in the US, then it is a problem,” a senior private sector banker said.

“These loans are generally non-interest-bearing for some period, so banks will be careful in extending fresh education loans. It may increase the credit risk. Education-focused NBFCs would be the most impacted by the US’ move,” they said.

Banks’ education loans exposure stood at ₹1.41 lakh crore as on July 2025, up 15 per cent on a year-on-year (y-o-y) basis. The assets under management (AUM) of Credila Financial Services, India’s largest non-bank education loan financier, stood at ₹41,810 crore as on March end, while Avanse Financial Services’ AUM was at ₹18,985 crore as on FY25 end.

“We are yet to assess how many students who got education loans from us were eyeing and now won’t probably get a H-1 B visa. We will do that assessment soon,” said a senior banker at a large public sector bank.

Another banker said that lenders will now consider doing credit tightening for education loans and will also evaluate the repayment capacity of parents of the students who were eyeing the visa for shifting to the US.

Published on September 28, 2025