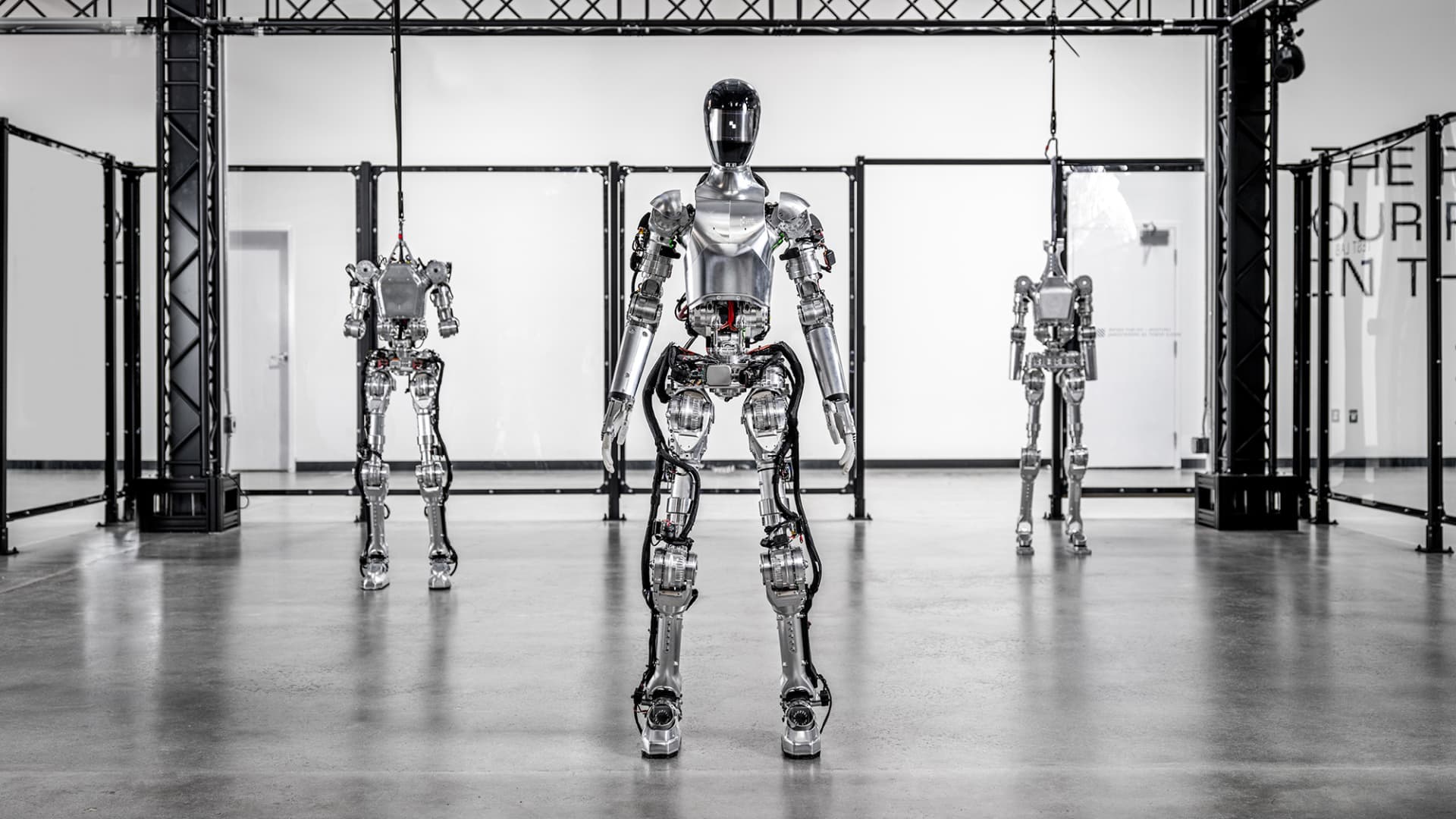

Brookfield Corporation’s partnership with humanoid robot startup Figure AI could boost the value of its portfolio companies and give it a leg up in the artificial intelligence race, according to Wall Street analysts. Figure AI on Wednesday announced a strategic partnership with Brookfield — one of the world’s largest alternative investment management firms with over $1 trillion of assets — to develop what the companies said would be the world’s largest real-world humanoid pretraining dataset. The two companies will also work to facilitate the deployment of autonomous humanoid robots across several industries. Additionally, Brookfield invested in Figure AI’s latest funding round of over $1 billion, which valued the humanoid maker at $39 billion. Morgan Stanley and RBC Capital Markets each reiterated their overweight ratings on Brookfield following the news, noting the agreement could drive productivity gains and, therefore, higher returns for investors across Brookfield’s portfolio. The company owns several publicly listed and private subsidiaries, including Brookfield Asset Management, Brookfield Renewable Partners, Brookfield Infrastructure Partners and Brookfield Business Partners. “We see scope for humanoid robots to increase operating margins of portfolio companies across the Brookfield ecosystem, which includes the asset manager, BAM, and the infrastructure, renewables, private equity, and real estate holding companies BIP, BEP, BBU, and BPG,” Morgan Stanley analyst Michael Cyprys said in a note to clients, adding that the deal “supports OW call as BN creatively looks to extract greater returns, while expanding AI capabilities.” “Deploying humanoid robots potentially improves the return profile of BAM investments and the funds from operation (FFO) of the operating companies, providing upside to distributions to investors … and could drive better performance fee earnings across the complex,” Cyprys said. Morgan Stanley’s and RBCs respective price targets of $76 and $83 on Brookfield shares imply 4.5% and 14% potential upside from Monday’s close. The stock is up 26% this year and reached an all-time high on Monday. Cyprys and RBC analyst Bart Dziarski noted that the Brookfield-Figure AI agreement could be crucial to unlocking gains across Brookfield’s massive yet undervalued real estate portfolio. That collection includes over 100,000 residential units, 500 million square feet of commercial office space and 160 million square feet of logistics space. Figure AI will also gain critical training data for its AI humanoids that will teach the robots how to move, perceive and act across spaces designed for humans. The data collection in Brookfield environments will allow the firm to see how it can deploy humanoid robots within its portfolio, analysts say. “Data collection can permeate beyond Brookfield’s real estate footprint into its other assets/operating companies across private equity, renewable, and infrastructure, of which Brookfield has leading positions in each,” Dziarski said, adding that Brookfield’s real estate business “remains heavily discounted in the stock.” BN 1Y mountain Brookfield Corporation stock performance over the past year. Looking ahead, Morgan Stanley’s Cyprys said he would not be surprised to see other alternative investment managers seek similar partnerships to the Brookfield-Figure AI deal, as they have a vast amount of assets, datasets and opportunity for better investment returns as robots get deployed. The firm forecasts the global humanoid robots will generate $5 trillion in annual revenue by 2050. “We view Brookfield as particularly well suited to lead in partnership with companies developing AI-leveraged robotics given their skew towards more industrial-adjacent and real asset industries where we see meaningful opportunity to deploy autonomous robots,” Cyprys said. Echoing Cyprys, Morgan Stanley analyst Adam Jonas in a Monday note said that Brookfield, alongside Meta and Tesla, that has a leading “agentic opportunity” in vision data that will be used for AI robot development. ( Learn the best 2026 strategies from inside the NYSE with Josh Brown and others at CNBC PRO Live. Tickets and info here . )