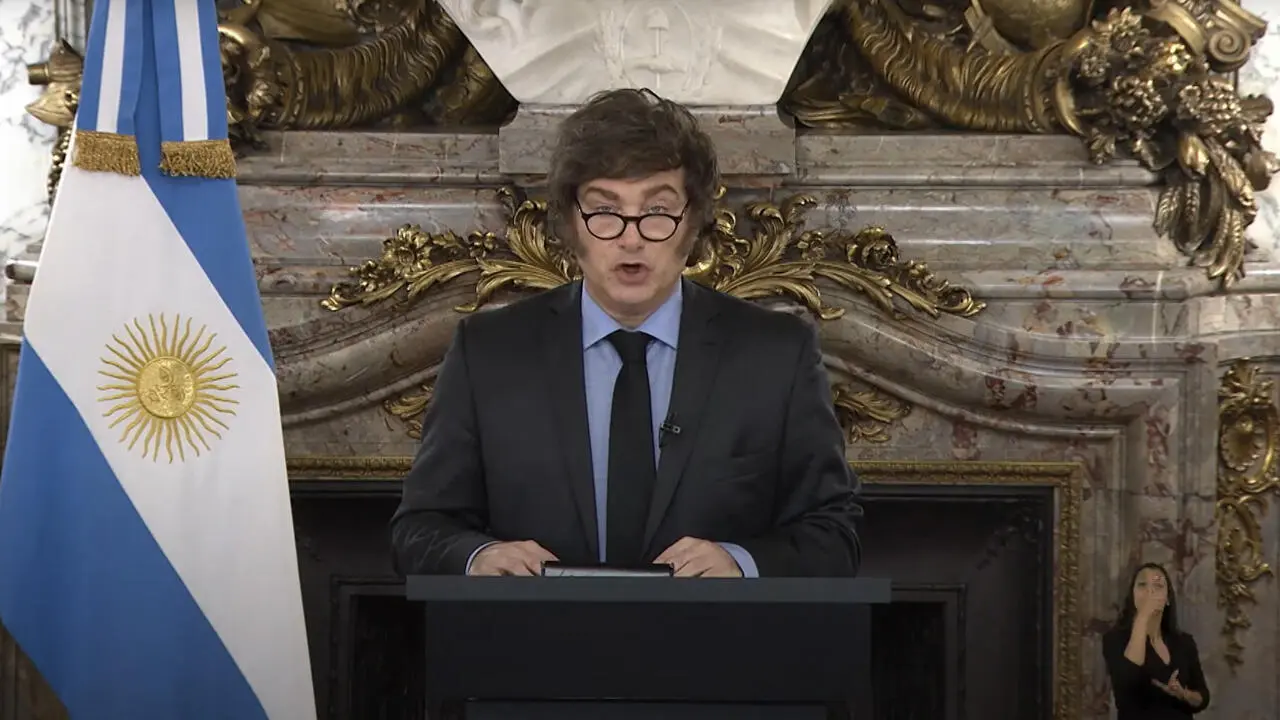

Argentina’s 2026 Budget: Milei Pivots from Austerity to New Investments in Key Social Sectors

By Florencia Belén Ruiz

Copyright riotimesonline

President Javier Milei’s latest budget plan marks a sharp change after almost two years of austerity. On September 15, the Argentine government presented a 2026 budget that pledges new money for pensions, health, and education.

These commitments follow heavy public pushback and a defeat for Milei’s party in key Buenos Aires elections. For business and outside observers, the big story is not just the new spending, but the motive and risks.

The budget allocates 85% of all federal spending to health, education, and pensions. The plan features increases beyond inflation: pensions up 5%, healthcare up 17%, education up 8%.

Official data sets next year’s inflation at 10.1% and expects the peso to average 1,423 per dollar. The government forecasts 5% GDP growth for 2026, up from a projected 5.4% expansion in 2025. It aims for a fiscal surplus or, at least, fiscal balance.

Behind these numbers lies a hard truth. Milei’s austerity succeeded in cutting runaway inflation, but also pushed up unemployment and triggered major protests. The government removed subsidies on basic services and saw living standards fall.

This new budget reads like a direct response to social and political pressure, including the ruling party’s loss in Buenos Aires and looming midterm elections.

The pivot to increased social spending follows warnings from opposition leaders and business groups who argue that deep cuts risk long-term harm to Argentina’s social fabric and investment climate.

Market reactions remain cautious. After the government’s election loss, the Buenos Aires stock index dropped and the peso weakened. Investors remain wary of both political instability and the durability of planned reforms.

Milei’s policy also forces other public sectors to absorb cuts if projected revenues fall short. The so-called “fiscal stability rule” blocks the Treasury from running up new debt, requiring immediate spending adjustments if costs or revenues hit unexpected levels.

For global observers, this is a real-life stress test of whether a hard budget line can withstand social needs and political cycles in a major Latin American economy.