Copyright forbes

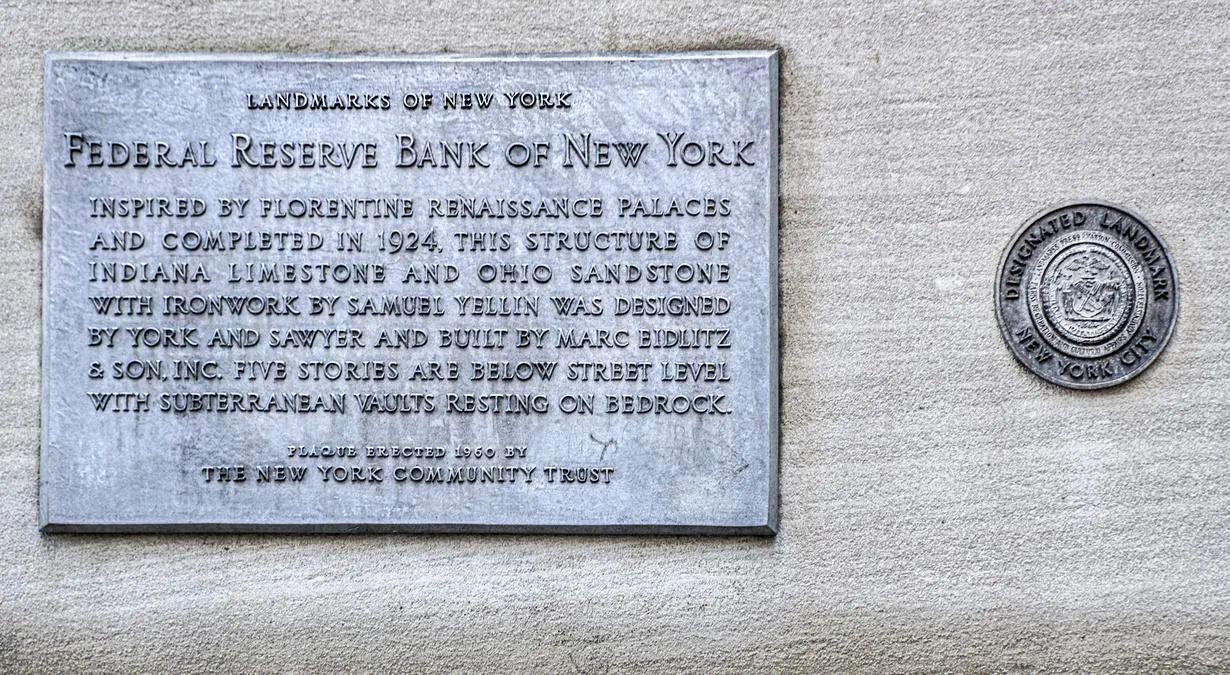

One of the greatest challenges currently facing the United States is the massive amount of credit card debt that American families are facing. According to the Federal Reserve Bank of New York 2025 Report, credit card balances are now $1.21 trillion in aggregate. The Fed report continues on that total household debt increased by $185 billion to hit $18.39 trillion in the second quarter, and student loan balances edged up by $7 billion and stood at $1.64 trillion, In addition, consumers haven’t changed their behavior much in the last five years but are suffering the downside effects of spending with much higher interest rates on those credit cards. The Trump Administration has also capped the amount of student loans a person can carry, which will certainly push more families to pay for college on personal credit cards. Exterior historical plaque, Federal Reserve Bank of New York, New York City, New York, USA. (Photo by: Plexi Images/GHI/UCG/Universal Images Group via Getty Images) UCG/Universal Images Group via Getty Images Normally, this is a story about how greedy financial services companies or mismanaged fintech’s are pushing Americans to add credit cards they don’t need or can’t afford. There is some of that, as the Federal Reserve also notes that credit card delinquency is also up to 7% of card users. But we are also seeing some entrepreneurs looking at this as an opportunity. Rob Russini is the founder of Lending Match, which was launched in 2025 to improve transparency within consumer lending and help consumers take advantage of solutions that they may not have knew existed. The company is registered to work in 30 US states and licensed by the Nationwide Multistate Licensing System (NMLS). Lending Match is bringing a marketplace approach to over extended credit card debt holders by providing consumers with the ability to apply for one consumer loan through over 30 top lenders (that service ranging credit scores) with no impact to the consumer credit score at application. Consumers will see results instantly and be able to compare rates and terms from various providers. Instead of consumers going to each lender one-by-one, consumers can reach all partner lenders with one application. MORE FOR YOU According to Russini, “Lending Match is a one-stop-shop for consumers shopping for unsecured loans. We provide not only the solutions consumers are looking for, but also the transparency and the simplicity throughout the entire consumer buying experience, from the initial application to the final financial decision.” Can AI be used to help consumers with their credit card debt? Lending Match Artificial intelligence also has the potential to help consumers manage their credit card debt. Breakthroughs in risk assessment, better personalized customer service through AI bots and the creation of customized products will make it easier for consumers to access the correct credit card for their needs. It will also help with credit line management and customer monitoring. In addition, investments in cyber security will also reduce fraud and identify theft. Another startup, Ava, announced a venture-backed round to build products that help consumers to improve their credit profile. According to the startup, Americans could save up to $1000 monthly with better credit bureau scores and data. Rather than trying to make money off fees and interest payments, Ava strives to help millions of Americans build better “credit health” so that they do not fall behind, and ultimately, create more wealth to invest. One area where fintech entrepreneurs like Lending Match are racing ahead is the partnerships they have developed with large fintech’s, like SoFi and Avant. Most banks and traditional card companies tend to use traditional sources of capital. In the United States, this has resulted in several communities being left behind, including entrepreneurs, immigrants, people of color and rural small businesses. Fintech’s are sourcing capital for these communities in different places, and globally, that is increasingly crypto currency. These partnerships offer greater potential capital availability for borrowers. The American economy is in an uncertain place, with some concerned about recession, while others wonder about the effects of tariffs during the Christmas shopping season, and whether that will lead to greater credit card debt. While nobody hopes for this outcome, it’s not surprising that there are entrepreneurs prepared for this outcome with new products and services. Editorial StandardsReprints & Permissions