Copyright Benzinga

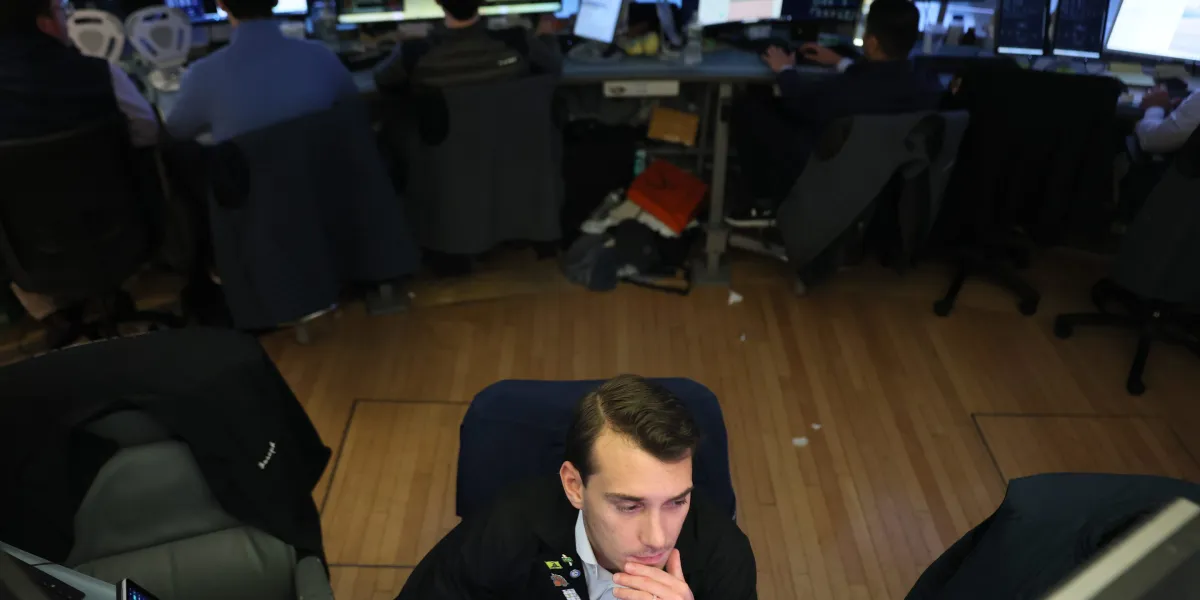

American Airlines Group Inc (NASDAQ:AAL) is on the verge of a Golden Cross, with its 50-day moving average closing in on the 200-day line — a classic technical signal often followed by bullish runs. Track AAL stock here. Chart created using Benzinga Pro Golden Cross Setup Points To Potential Breakout Traders are watching as the airline prepares to report third quarter earnings Thursday pre-market, with analysts estimating a 28-cent-per-share loss on $13.63 billion in revenue, according to Benzinga Pro. A strong earnings beat could push AAL stock past the 200-day SMA (simple moving average) and confirm the Golden Cross, potentially fueling a surge in trading activity. The stock is trading at $12.31, comfortably above its eight-day and 20-day SMAs of $12.03 and $11.73, respectively. The 50-day SMA of $12.44 is inching toward the 200-day average of $12.58. Momentum indicators are encouraging: the RSI (Relative Strength Index) is climbing to 55.6, and the MACD (Moving Average Convergence Divergence) is trending toward a bullish crossover. These technical factors suggest a breakout could be imminent if fundamentals align. Read Also: EXCLUSIVE: EHang’s CFO Just Gave Away The Future — And It’s Bigger Than Anyone Expected Billionaire Hedge Funds Hold Steady AAL's setup is further underscored by significant hedge fund holdings from the second quarter. Israel Englander's Millennium Management held 4.59 million shares (~$51.45 million), Ken Griffin's Citadel Advisors owned 4.22 million (~$47.33 million), and Paul Tudor Jones' Tudor Investment maintained 353,540 shares (~$3.97 million). While not new purchases, these stakes show that smart money is already invested as the stock approaches a key technical juncture. Earnings And Market Context Analysts expect modest losses due to rising fuel costs and post-pandemic travel fluctuations. Still, with a market cap of $8.13 billion and P/E ratio of 14.7, AAL stock remains an attractive speculative play. A combination of solid earnings and a confirmed Golden Cross could attract renewed attention from both institutional and retail traders. As American Airlines heads into its third-quarter report, the stock's near-term technical setup and existing hedge fund holdings make it a key name to watch. If earnings exceed expectations, the Golden Cross could ignite a rally — potentially rewarding the billionaire investors already on board. Read Next: Joby, Archer, Vertical: Meet The Airline-Backed Fleet That Could Replace Your Uber Photo: Shutterstock