Artificial intelligence has moved from niche technology to a dominant economic force. The money pouring into data centers, cutting-edge chips, and the infrastructure that supports them is now strong enough to keep both the US and the wider world expanding through 2026, we predict.

In the United States, the influence is already clear. Stripping out technology-led investment and growth earlier this year would have been close to stalling. Instead, output continues to climb even as job creation slows.

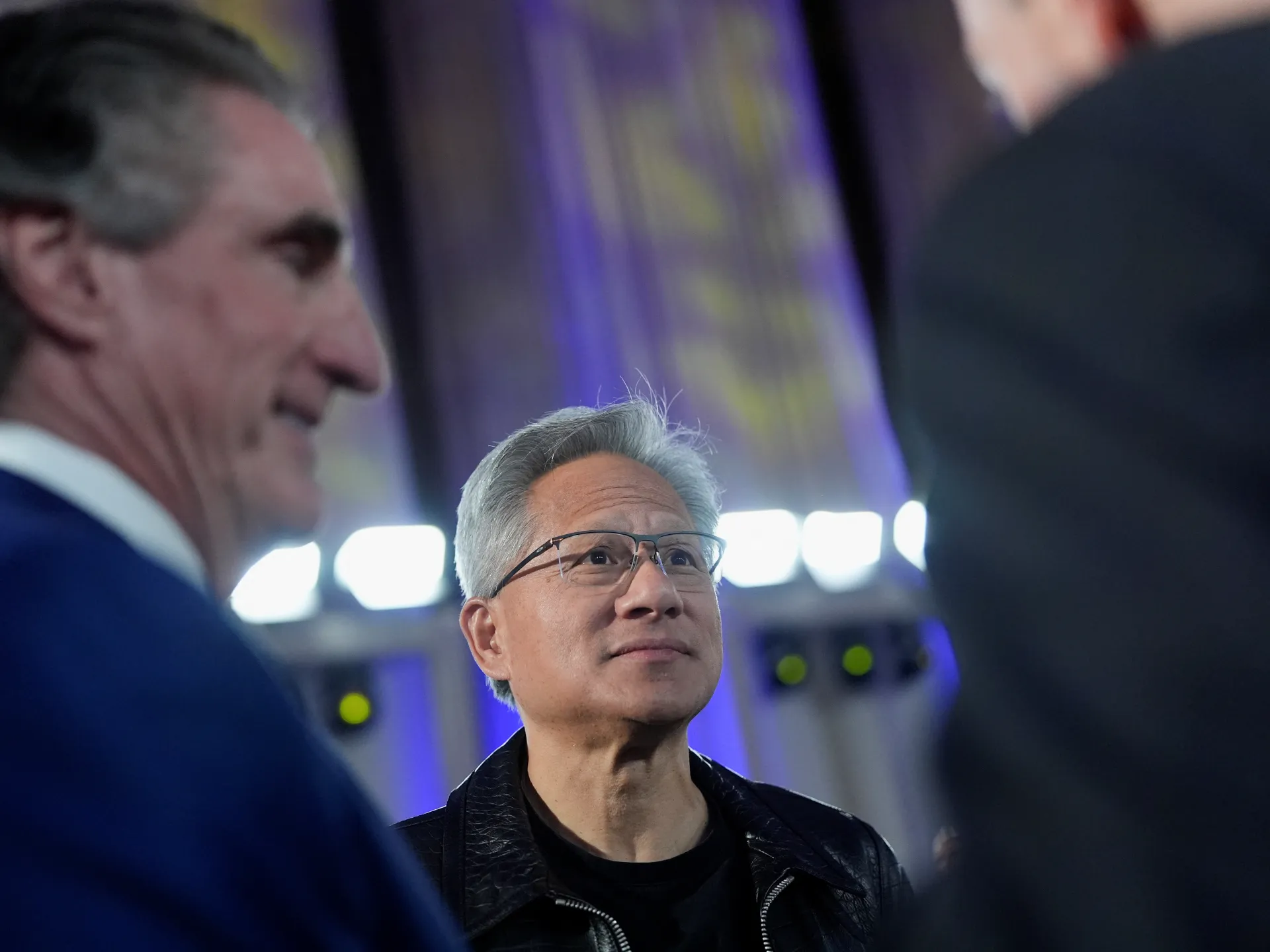

AI projects demand huge capital commitments but far fewer employees. Nvidia (NASDAQ: ), for instance, has a workforce of around 36,000 yet generates trillions in market value and drives trade flows across Asia, Europe and the US.

This capital intensity explains why the labor market can soften while the economy keeps advancing.

The surge is global. Analysts see AI infrastructure spending rising by more than 30% a year, supporting record chip exports from Taiwan and South Korea and filling order books for Europe’s ASML. Taiwan’s semiconductor shipments are up sharply, and South Korea’s exports have returned to pre-2022 levels. Utilities are reporting a parallel boom as data-center electricity demand accelerates.

No other single technology sector has had such a broad macro impact. AI is no longer a side story; it is the central engine of worldwide growth.

Competition among US tech giants to build computing power, government incentives from Washington to Tokyo, and relentless demand for machine-learning hardware are driving the investment wave. Every major economy wants a share of the build-out, ensuring another year of double-digit spending.

Governments are reinforcing the trend. In the US, the CHIPS Act and other programs are unlocking billions in subsidies for semiconductor capacity and energy infrastructure.

The European Union has committed record funding for next-generation fabrication plants, while Japan and South Korea are offering tax breaks and fast-track permits to secure their roles in the supply chain. This policy push guarantees that capital continues to flow.

The knock-on effects stretch well beyond technology. Data-center power use in the US is expected to double by 2030, driving new investment in energy grids and renewables.

The AI build-out is creating demand for metals, construction materials, and shipping services, giving global trade a lift even as traditional manufacturing struggles.

Investors who view AI as a passing fad are missing a structural shift. Currencies, equities, commodities, and bond markets are already being shaped by this surge, and that influence will only deepen in 2026. Energy supply issues and regulatory questions may eventually temper the pace, but they are unlikely to outweigh the profitability case next year.

There will be no US or global recession in 2026 if this level of AI investment continues. It is setting the direction of economies and markets, redefining how growth is generated and where capital flows.

AI is not just the biggest investment theme of next year—it’s the clearest macroeconomic driver of the decade ahead.