By Contributor,Trevor Clawson

Copyright forbes

Christoph Klink says funding constraints can be a “competitive weapon” for European companies

The narrative runs something like this. Individually and collectively, Europe’s innovation ecosystems are generating increasing numbers of startup companies, many of them working in sectors that will drive and define economic prosperity in the years ahead. Problems arise, however, when those companies hit the growth phase. At that point, capital becomes harder to find and those that do raise the sums required find that European VCs tend to be risk-averse when it comes to writing large checks. Consequently, the funding comes from global – and for that read U.S. and Asian – sources. That can result in businesses relocating out of Europe, taking much of their value with them. It’s a scenario that keeps policymakers across the continent awake at night.

A new report, published today by global, early-stage venture capital firm Antler, challenges that prevailing narrative, at least up to a point.

Released to coincide with Antler’s European Founder Conference, the report notes that 14 companies founded in and after 2020 have already achieved unicorn status, and on average, they have taken just two years to hit the billion-dollar valuation marker. Two-thirds of those companies – dubbed rocketships by Antler – have been backed mainly by European rather than global VCs, suggesting that investors on the continent are finding the confidence to make big financial commitments.

But does this mark a major step forward for Europe’s innovation economy? Ahead of the report’s publication, I spoke to its author and Antler partner, Christoph Klink. I began by asking him if European VCs have become more willing to support businesses at the growth stage.

“When you look at the rocketship companies, two-thirds of their investors are European,” says Klink. “So there are clearly European investors that get it and are prepared to move fast.”

MORE FOR YOU

An Execution Mindset

However, that doesn’t mean that Europe’s VC firms are matching the sums that their U.S. or global counterparts are prepared to commit. “The amount of funding you will be able to attract in Silicon Valley is still larger than they are in Europe. That leads to European founders adopting an execution-first mindset.”

In practice, he argues, European founders use a relative scarcity of capital as a “competitive threat.” They won’t necessarily be able to raise more money than their U.S. counterparts, so instead they focus on bringing their products to market quickly and capital-efficiently.

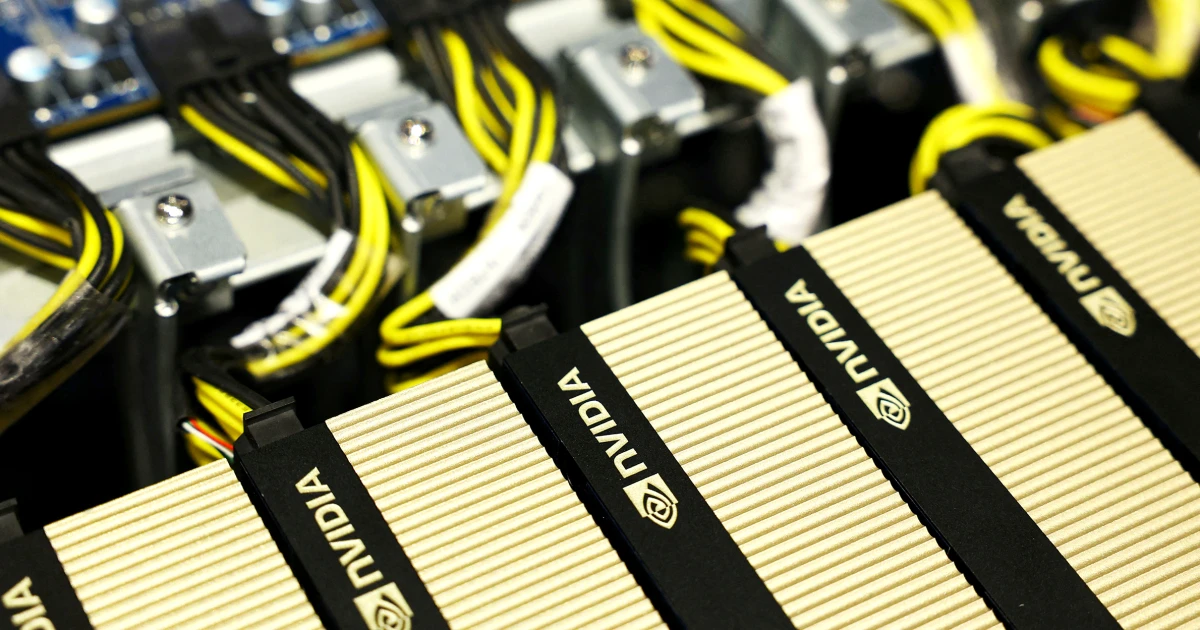

Artificial Intelligence has pretty much leveled the playing field,” Klink adds. “All of a sudden, with AI tooling, you can build better products in a shorter amount of time. So, European companies can compete with businesses that are much better funded. They are forced to be more capital efficient.

Less Dilution

Through an investor prism, there is something of a virtuous circle here. “The less capital a company raises on the journey to becoming successful and large, the lower the amount of dilution is for early investors,” says Klink. The same is true for founders, who will hold onto a larger percentage of their companies’ shares.

Investors may be more inclined to invest in the later stages, having seen examples of European companies scaling – as Klink puts it – at an insanely high speed. Meanwhile, there is inspiration for the next generation of founders.

So where is the money going? At this point, Klink describes trends in the ecosystem very much from Antler’s perspective. As he sees it, AI is crucial, either because a company is developing AI solutions or because its product development is being supercharged by the technology. In terms of sectors, Klink cites Defence Tech as an increasingly important industry offering significant growth opportunities. Enterprise Software is also a strong sector. Companies singled out by the report as rocketships include Helsing (defence), Loveable (enterprise software), Mistral (AI) and ElevenLabs (also AI).

None of this means that Europe’s policymakers can rest more easily, safe in the knowledge that the continent’s ecosystem is increasingly robust. Klink stresses that while there are palpable success stories, the continent needs more of them.

“We have all the ingredients to build and scale companies. We have the skills, capital and generally the political support. But does that mean we succeed often enough? Probably not.”

And there are challenges. Europe is not a totally a single market. There are still a great many national rules and regulations governing how businesses operate in specific markets. Share ownership and incorporation rules also vary from country to country. Equally important, while European businesses are benefiting from the speed-to-market that AI faciliates, so are their competitors elsewhere. There is still plenty for policymakers to be concerned about.

Editorial StandardsReprints & Permissions