Copyright Business Insider

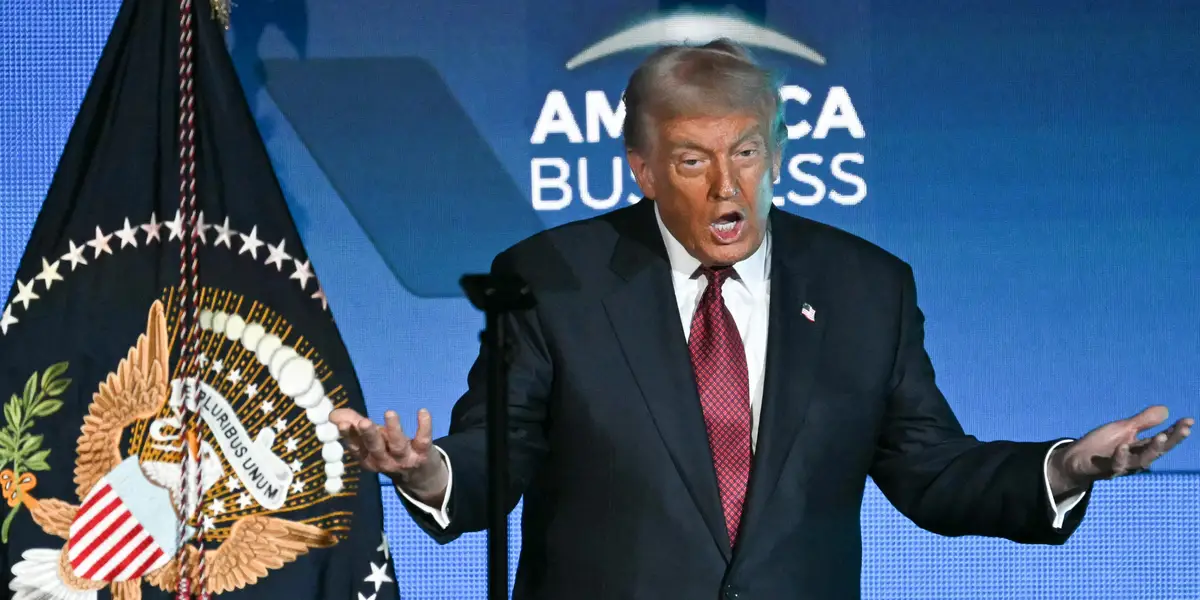

What's the opposite of "Liberation Day"? The market might soon find out. About seven months after the worst market meltdown since the pandemic brought on by the unveiling of Donald Trump's tariffs, investors are eyeing the possibility that the Supreme Court could wind back the clock. Stocks got a bump on Wednesday on reports that justices seemed skeptical that Trump has the power to unilaterally impose sweeping tariffs. After an earlier dip on continued selling in tech, major indexes rose in afternoon trading, with the Dow Jones Industrial Average up 300 points and the S&P 500 up nearly 1%. It could be just a taste of what's to come for markets if the Supreme Court ultimately decides against Trump's ability to wage his trade war with zero input from lawmakers. The case carries severe economic and political implications, prompting strong responses from Supreme Court justices regarding Trump's use of the International Emergency Economic Powers Act to sidestep congressional approval and impose steep global tariffs. A reversal would likely be a major boon for the market. Businesses, both big and small, would be spared a painful import tax that has been weighing on outlooks for profitability all year. The move would also likely dispel the specter of higher inflation, something that's kept the Fed hesitant as it plots the path of monetary policy. Cory Johnson, chief market strategist at Epistrophy Capital Research, broke down why the skeptical view from the Supreme Court is a boon for the stock market. "You could still build, but you paid extra for every watt and wafer," he said. "The justices' skepticism suggests they might finally unplug that surcharge, and in a market where speed and cost are everything, that's as close as policy comes to a performance upgrade." The reshoring of manufacturing in the age of Trump's tariffs is a headache for even the largest companies, and was widely expected to inject major volatility into the outlook for costs and profitability. Companies like Apple, with sprawling global supply chains, have no easy way to bring factory jobs back to the US to avoid tariffs. Related stories Business Insider tells the innovative stories you want to know Business Insider tells the innovative stories you want to know Daniel Bustamante, CIO of Bustamante Capital Management, told Business Insider that his hedge fund sees the possible removal of the tariff issue as bullish for stocks. "We're looking at this as a positive for the market if they rule against them here, and I think you're seeing the markets start to price that in with some better flows in certain sectors," he said. Tariff-exposed Consumer brands like Stanley Black & Decker, and RH, as well as automakers GM and Ford all jumped on the news the tariffs could be rolled back. A bet on the prediction site Polymarket, regarding whether the court would rule in favor of the tariffs, had dropped to 27% on Tuesday afternoon, from 45% at the end of October. Bustamante added that his team is optimistic that the positive market momentum will continue in the coming days and possibly weeks, depending on further developments and sentiment around the likelihood of how the court could rule. In the meantime, Glenmede vice president, Michael Reynolds, thinks investors should be mindful of one big tariff-related question: can the Supreme Court mandate the refund of tariffs previously collected? "By the time a ruling is handed down (possibly early 2026), there may be a total of $100B+ in tariffs collected under emergency powers," he noted. "If those must be refunded, that may effectively feel like another layer of corporate stimulus on top of tailwinds from The One Big Beautiful Bill Act and ongoing Federal Reserve easing."