It can help chill quantum computers to near absolute zero, improve certain medical images and national-security scanners, and, in theory, serve as an almost-clean fusion fuel. Together, those promises turn helium-3 into a decisive strategic commodity and a driver for an emerging moon-mining race. The United States and China emerge as the principal rivals. Both have placed lunar exploration high on their national agendas and explicitly tied it to future technological and strategic advantage.

Russia, too, has declared its intent to join the competition, while the European Union, India, and other smaller players are beginning to take their position in this contest. As the world lines up for a stake in lunar resources, the question remains. Who will get there first, and what will it mean for the future of technology, energy, and geopolitics?

Why helium-3 matters

Helium-3 is rare on Earth. Most of our supply comes indirectly from tritium decay in nuclear stockpiles, producing only modest quantities. Figures cited in industry discussions put annual yields from these sources at a few thousand to tens of thousands of liters, far short of what a fully scaled quantum industry might demand. By contrast, the Moon has quietly accumulated helium-3 for eons because it lacks a protective magnetic field; solar wind particles implant the isotope into the top layers of regolith.

Estimates vary, but some scientists believe the lunar surface could contain enormous absolute quantities, perhaps on the order of a million metric tons, though dispersed at low concentrations.

Why does that matter? For quantum computing, helium-3 is a workhorse behind the scenes. State-of-the-art dilution refrigerators exploit mixtures of helium-3 and helium-4 to cool qubits down to millikelvin temperatures where fragile quantum states can persist. As one cryogenics engineer put it, “It’s like 200 times colder inside a Blue Origin fridge than outer space,” underscoring how essential extreme cold is to reducing errors and making quantum machines useful. If quantum data centers scale up as companies and nations expect, demand for helium-3 could balloon well beyond what Earth can supply.

Beyond quantum, the isotope’s appeal is broader still. Helium-3 is a superb neutron absorber, useful for radiation detectors, and when hyperpolarized, it improves some MRI scans. The most intoxicating possibility, however, is fusion. Fusion reactions that use helium-3 produce charged particles rather than neutrons, meaning far less long-term radioactivity in reactor materials.

Theoretical comparisons are eye-popping. On paper, tens of tons of helium-3 could deliver energy for entire nations for long periods. That futuristic prize is one reason politicians and planners are paying attention, even though workable helium-3 fusion reactors remain, for now, speculative.

Engineering the harvest

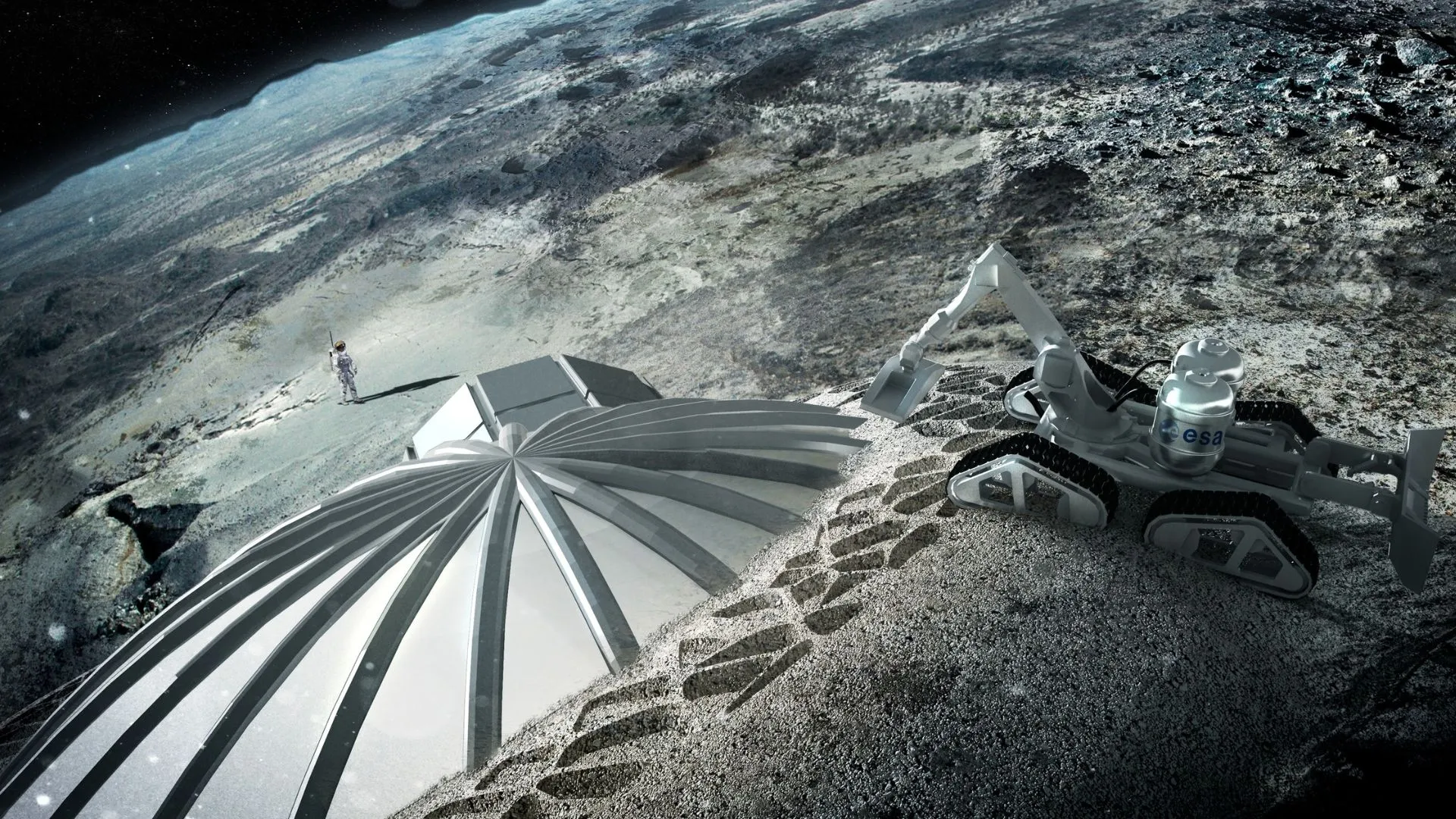

Turning lunar dust into a meaningful stream of helium-3 is not simple. The isotope is not concentrated in easy-to-access pipes or pockets. Apollo samples typically showed helium-3 concentrations measured in parts per billion. That means enormous volumes of regolith must be processed to extract useful gas. The basic industrial recipe is straightforward on paper.

Excavate surface soil, heat it at high temperatures to release trapped gases, separate helium-3 from the much more abundant helium-4 and other volatiles, and store the purified gas for transport. In practice, each step poses hard engineering problems.

Marcin Frackiewicz, president of Warsaw’s TS2 SPACE, noted these limitations in his detailed review of the field. Lunar regolith is notoriously hostile to machinery. It’s fine, glassy particles are highly abrasive and cling electrostatically, which in Apollo missions fouled seals and joints and stuck to spacesuits. In vacuum and one-sixth gravity, lubricants boil off, moving parts behave differently, and remote or autonomous operation is necessary because of the time delay between Earth and Moon, which makes real-time teleoperation impractical.

Powering heaters that drive hundreds of tons of soil through thermal processing will require large, reliable energy sources on the surface, whether solar concentrators or small reactors, and any mining concept has to balance mass, power draw, and reliability to be deliverable and maintainable by robotic systems.

Startups are building concepts that try to thread these needles. One company, Interlune, has proposed a small, mobile harvester that scoops regolith, heats it internally, and expels spent soil as it traverses the surface. The goal is a machine light enough to be landed on a single lander but capable of processing tens to hundreds of tons per hour. Interlune’s CEO has been explicit about the scale.

To produce small quantities of helium-3 that matter on Earth, you must process vast swathes of soil, “enough lunar regolith to fill a large backyard swimming pool,” to yield only a few liters. The company has moved from lab experiments into hardware partnerships, tested sub-scale systems in reduced-gravity flights, and worked with terrestrial equipment makers to shrink conventional heavy-civil machinery into space-ready form.

Separation and purification are another critical hurdle. Even if a harvester can outgas regolith reliably, separating minute traces of helium-3 from helium-4 and other gases at low mass fractions requires sophisticated cryogenic or membrane systems. Some teams have demonstrated initial proof-of-concept separations on Earth, but making those systems robust for the lunar environment is a different challenge. Storage and safe transport back to Earth, presuming governments and markets decide that bringing helium-3 home is economical, adds further complexity.

Where we are now

Interest and investment have moved quickly from speculation to planned demonstrations. Governments and agencies are underwriting technology development and buying small initial quantities, partly to nudge the market and spur technical readiness. In mid-2025, the U.S. Department of Energy announced a historic procurement of three liters of lunar helium-3, the first government purchase of an extraterrestrial resource, intended to seed early supply chains and signal strategic interest.

Private buyers like Maybell Quantum and Microsoft have also struck tentative arrangements in the quantum and cryogenics industries. Firms that build dilution refrigerators and quantum infrastructure are lining up long-term supply deals if lunar production proves viable.

At the same time, Marcin’s report mentions that reconnaissance missions are being prepared to map where helium-3 is concentrated and test in-situ resource techniques. Multispectral sensors designed to detect subtle soil signatures, rovers carrying mobile cameras and experiments, and plans to piggyback scientific payloads on commercial landers are all part of near-term efforts to move from models and samples toward a working mining plan.

The limits of feasibility remain real. A U.S. Geological Survey assessment described lunar helium-3 as an “inferred unrecoverable resource” when judged against near-term economic and technical constraints; extracting it at scale within a few decades is not guaranteed. Some analysts argue that other lunar resources like water ice may offer clearer early payoffs for deep-space logistics and fuel production.

The first lunar pilot plants will likely be justified more as proof of concept and strategic positioning than as immediate profit centers. The hope among proponents is that a successful demonstration, combined with falling launch costs and improved autonomy, will unlock later economies of scale.

A new geopolitical scramble

Like all other high-stakes human endeavors, the helium-3 story is not just technical. It’s geopolitical. Spacefaring nations see strategic value in being first to secure access to potentially game-changing resources. The legal groundwork is fragmented. The 1967 Outer Space Treaty forbids sovereign claims over celestial bodies. Still, it does not explicitly ban resource extraction, and subsequent national laws and international agreements have tried to define how commercial rights might work.

The United States passed a law in 2015 recognizing private property rights for extracted space resources, and the Artemis Accords of 2020, an American-led set of principles for cooperative exploration, further clarified that resource extraction could proceed under agreed norms. Not every major player has signed those accords (notably China and Russia); however, other nations have signaled alternative approaches to resource governance and cooperation.

The prospect of China using lunar mining to gain a decisive lead in quantum technology or clean energy has already raised concern among American analysts. For Washington, supporting private ventures like Interlune and laying out frameworks such as the Artemis Accords reflects a desire to set the rules early and secure allies under a U.S.-led vision of space commerce. For Beijing, lunar missions such as the Chang’e program have been framed as national achievements, with officials openly describing helium-3 as a resource that could fuel China’s future energy needs for thousands of years.

Other powers are watching closely. Despite setbacks in its Luna program, Russia has aligned itself with China on plans for a joint lunar research station in the 2030s, signaling that it sees resource utilization, including helium-3, as a long-term goal. The European Union, meanwhile, has supported studies on helium-3 extraction and backed technology demonstrations, but its role remains more exploratory and cooperative than competitive. India’s successful Chandrayaan-3 landing at the lunar south pole in 2023 also positions it as a potential partner or independent player in the resource race, though on a smaller scale.

This patchwork of laws, the demonstrable technological hurdles, and the symbolic value of lunar firsts combine to create an environment of competition that could resemble past resource rushes. If one nation or corporate bloc establishes reliable helium-3 supply chains, it could gain market leverage in quantum infrastructure and, down the line, in fusion fuel. Observers compare the modern rare-earth story, where concentrated production in China now shapes the entire global supply chains and works wonders in spreading geopolitical influence. The prospect of a similar asymmetry on the Moon is one reason governments are moving now.