Copyright cleveland.com

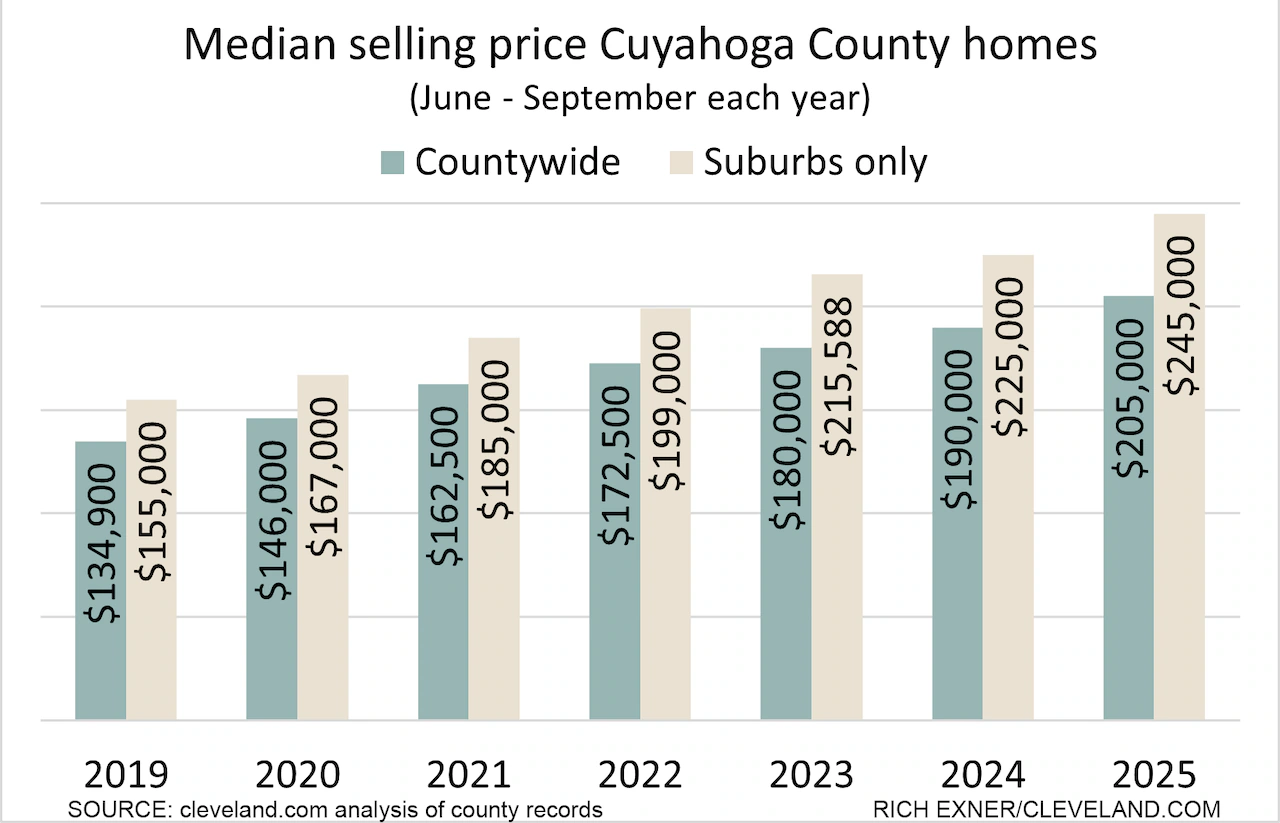

CLEVELAND, Ohio – Buying a house in Cuyahoga County may be more affordable than in many other parts of the country — but that doesn’t mean it’s cheap anymore. The online real estate brokerage Redfin recently pegged the median price for a single-family home in Ohio at $269,000, well below the national median of $435,295. It’s even less in Cuyahoga County, cleveland.com found in an analysis of recent sales data, with the suburban median coming in at $245,000. But that median — calculated from county sales records for June through September — is still up 58% from before the pandemic, when the typical home sold for $155,000 in 2019. Even over just the past year, prices climbed from $225,000, cleveland.com found in looking at the same four months of data for each year going back to 2019. In Cleveland, the citywide median this year was $100,100, up from $95,000 a year ago and $62,900 during the same four months in 2019. The Cleveland market, however, is widely varied, with nearly 200 homes going for at least $250,000 from June through September, but hundreds of others selling for under $50,000. “Overall affordability has deteriorated across the county, and that overall housing is increasingly unaffordable for many, especially as incomes are not rising in step with home price increases,” said Molly Schnoke, director of Center for Economic Development at Cleveland State’s Levin College of Public Affairs and Education. Schnoke, who earlier this year co-authored a housing study commissioned by Cuyahoga County, said housing costs are outpacing wage growth for many new homebuyers. “Contributing to this is also the dynamic of stubbornly high mortgage rates. While during the pandemic they were at 3% or less, today they hover around 6.5% - down from their peak, but still much higher than only a handful of years ago,” Schnoke said. Assuming a 20% down payment on a home priced at the current median of $245,000, Schnoke noted that the monthly payment on a 30-year mortgage at 6.25% interest would be just over $1,200, not including taxes and insurance. That compares with roughly $520 a month at 3% interest for a median-priced $155,000 home in 2019. “People are faced with buying less house for more money, if they can at all,” Schnoke said. Sharp increases have occurred across the county. Among the 20 cities where there were at least 100 sales during the four months this year to offer enough data for a fair comparison, the increases since 1999 ranged from 53% in Solon and 55% in Rocky River to highs of 86% in South Euclid and 96% in Maple Heights. In the middle were Shaker Heights and Westlake, at 62%. “We haven’t seen this type of inflation in our region for quite a while,” said Mark Vittardi, immediate past president of the Akron Cleveland Association of Realtors. ”I think it comes down to a lack of inventory. It’s not just the price point, but also the lack of options.” He said he doesn’t believe today’s buyers are stretching beyond their means, as many did before the 2007–08 housing crash. Buyers now, he noted, must qualify under much stricter mortgage rules. There has been some good news with mortgage rates edging down of late, but that could translate to rising home prices, according to a fall update on affordability from the national real estate data analytics firm ATTOM. “The drop in mortgage rates will help some buyers keep pace with the rising cost of homes,” ATTOM CEO Rob Barber said. “But the more favorable loan rates could also enable prices to keep rising and further extend this two-and-a-half-year streak we’re in of homes being less affordable to the typical resident of an area than they historically have been.” Prices by city Here are the median home prices for each city in which there were at least 70 sales each year from June through September. The cleveland.com analysis included single-family homes and condos selling for at least $10,000. Home sales involving multiple parcels and sheriff’s deeds transactions were excluded to better gauge the typical market.